Short sellers have had a tough start to the weekend following over $915 million in liquidations over the past 24 hours.

Following a strong start to the weekend for the cryptocurrency market, bitcoin has finally managed to climb back over $60,000. The increase in price may have many smiling. However short sellers have taken a major knock as liquidations continue to pile up.

Bitcoin and ethereum causing pain for bears

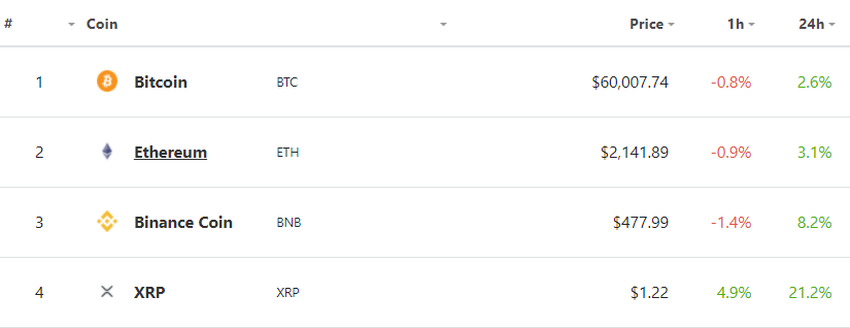

Market strength on Saturday saw the top four cryptocurrencies all gain handsomely in price. Consequently the majority of liquidations over the course of the last 24 hours came from bitcoin, ethereum, binance coin, and XRP.

Bitcoin jumped 2.6% on the day, with XRP surging by more than 20%.

While bullish momentum has continued over the course of the last few weeks. Short sellers have been trying to time the top of the run through the use of margin trading. However Saturday was not to be as the price increases across the top four caused huge losses.

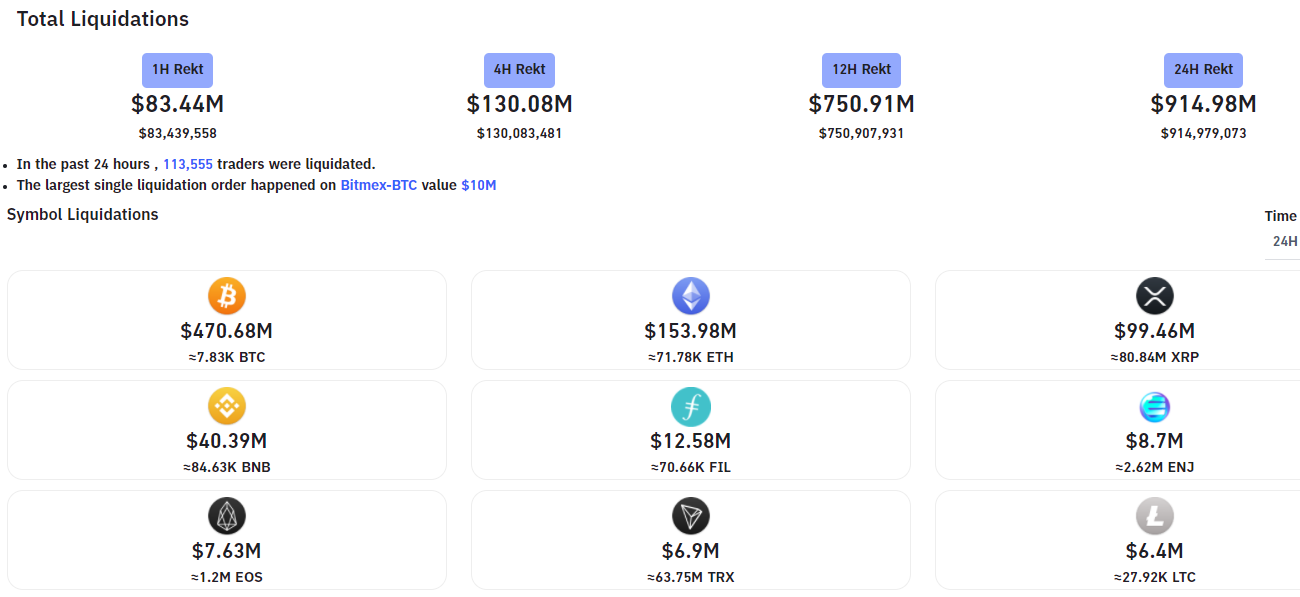

According to Bybt, over $915 million in liquidations have occured in the space of 24 hours. With over 113,000 traders being liquidated. The largest liquidation saw a Bitcoin whale on BitMex lose $10 million.

Bitcoin liquidations accounted for just over half of the total. With ethereum claiming over $153 million in liquidations. Followed by XRP with just under $100 million. Binance Coin saw $40 million in losses.

A big week for liquidations

The big day of liquidations comes just three days after Bitcoin dropped nearly 5% to touch $55,600. A whopping $1.7 billion in liquidations followed as bulls took a beating. However it appears traders have not learned their lesson as the extended liquidations across the market continue.

The majority of liquidations appear to come from short sellers, making up over $600 million of the total. Binance exchange accounted for 47% of the liquidations, with Bybit liquidating over 20% of the total.