The Bitcoin Cash (BCH) price has failed to sustain its upward movement even though it cleared a crucial long-term resistance area.

The readings from short-term time frames are not sufficient in determining the direction of the trend. So, the direction of the next move will be crucial in determining what the trend is.

Bitcoin Cash Price Fails to Pump After Breakout

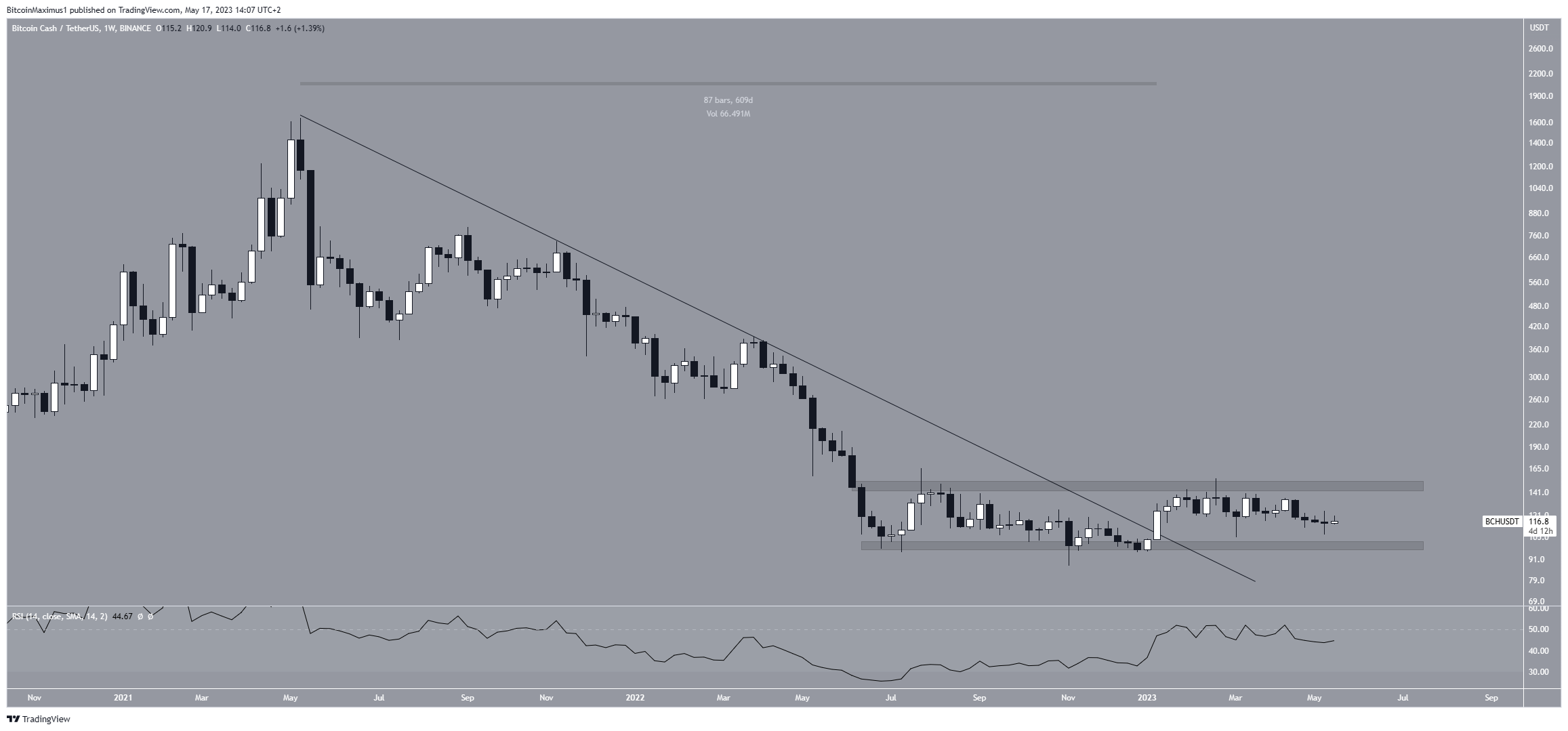

The BCH price had fallen under a descending resistance line since July 2021. The decrease led to a low of $87 in November 2022.

The price bounced afterward and has increased since. At the beginning of 2023, it broke out from the resistance line after 609 days. Breakouts from such long-term structures often lead to pronounced upward movements.

However, this was not the case for BCH. The price barely pumped after the breakout, culminating with a high of $155 on Feb. 20.

Additionally, it has fallen since and is now trading close to its breakout level.

Moreover, the weekly Relative Strength Index (RSI) does not provide any decisive clues as to what the trend’s direction is.

Traders utilize the RSI as a momentum indicator to assess whether a market is overbought or oversold, and to determine whether to accumulate or sell an asset.

If the RSI reading is above 50 and the trend is upward, bulls still have an advantage, but if the reading is below 50, the opposite is true.

The indicator is moving upwards but trades slightly below 50. This is a sign of an undetermined trend.

The closest horizontal support and resistance levels are at $100 and $150, respectively.

BCH Price Prediction: What Does the Future Hold?

The technical analysis from the daily time frame does not help to determine the direction of the trend. The price action shows both bullish and bearish signs.

During the time in which the BCH price followed a descending resistance line, it fell twice below the $115 horizontal support area. However, it is not certain if the price reclaimed the area or is in the process of validating it as resistance.

Furthermore, the daily RSI is freely moving above and below 50. This often occurs when the trend’s direction is undetermined.

Therefore, the long-term BCH price prediction will likely be determined by whether the price breaks out or down from the $150 range.

The former can cause an increase toward $200, while the latter could cause a drop to $70.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.