The Bitcoin Cash (BCH) price has broken out from a long-term descending resistance line and has validated it as support afterwards.

BCH should continue increasing towards $850 and possibly $1,150, with the rate of increase likely to accelerate once it closes above $530.

Long-Term Breakout

BCH had been following a descending resistance line since Aug. 2018. After three unsuccessful breakout attempts, it finally moved above it in Jan. 2021.

Afterward, it returned to validate the line as support (shown with the green arrow) and has been increasing since. Technical indicators are bullish, despite the RSI showing decreasing momentum.

If BCH continues moving upwards, the next closest resistance area would be at $1,161, the 0.618 Fib retracement level of the most recent downward move, which is also a horizontal resistance area.

Current Movement

Cryptocurrency trader @Cryptowhitewalk outlined a BCH chart, stating that he is currently adding to his bags due to a breakout from a short-term descending resistance line.

The daily chart shows that despite the ongoing rally, BCH faces resistance at $530, which is the 0.618 Fib retracement level of the most recent downward move.

Nevertheless, technical indicators are decisively bullish, evident by the bullish crosses in both the MACD histogram and Stochastic Oscillator.

Once it clears the first $530 resistance area, there is minor resistance at $630, created by the Feb. 10 highs. After this, there is virtually no resistance all the way to the previously outlined $1,160 area.

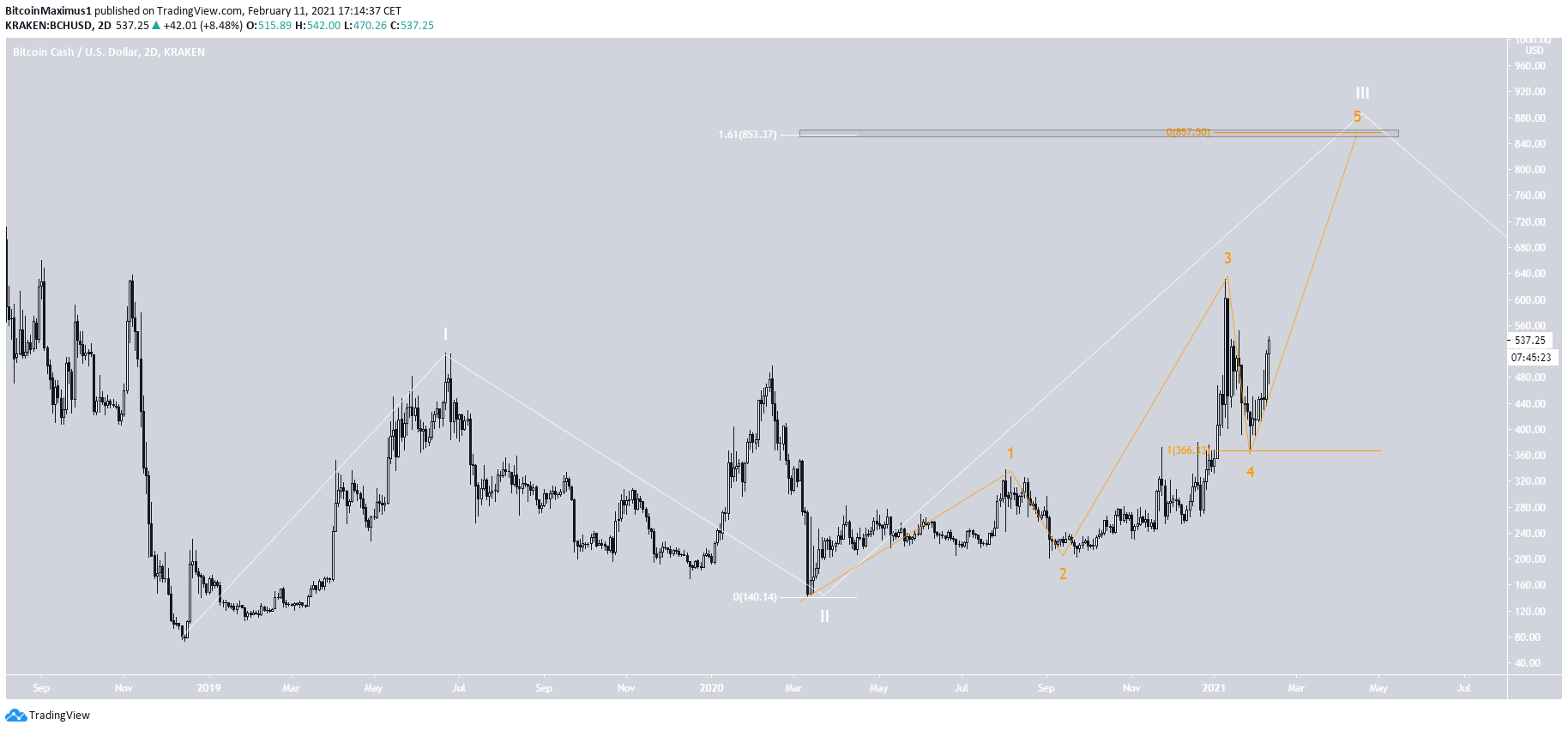

Wave Count

The wave count suggests that BCH is in wave three (white) of a long-term bullish impulse that began all the way in Dec. 2018. The sub-wave count is given in orange, indicating that it has just begun sub-wave five.

The most likely target for the top of this move is located between $853-$857, found by the 1.61 length of wave one (white) and the projection of the length of sub-waves 1-3 to the bottom of sub-wave 4 (orange).

BCH/BTC

The BCH/BTC chart is not as bullish as its USD counterpart. BCH/BTC has been steadily decreasing since Mar. 2019, and reached an all-time low price of ₿0.010 on Feb. 8.

Technical indicators show some bullish reversal signs, most notable in the bullish divergence in the RSI and bullish cross in the Stochastic Oscillator.

However, until it manages to reclaim the ₿0.026 resistance area and break out from the potential descending resistance line (dashed), the trend is still bearish.

Conclusion

To conclude, BCH/USD should move upwards towards $1,161, with the rate of the increase likely to accelerate once it clears the $530 resistance area.

Despite showing bullish reversal signs, the BCH/BTC trend isn’t bullish until it has reclaimed the ₿0.026 handle.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.