The prices of both Basic Attention Token (BAT) and Stellar (XLM) have broken out from important resistance levels. While BAT is currently moving upwards, XLM might retrace a little further before potentially reversing its trend.

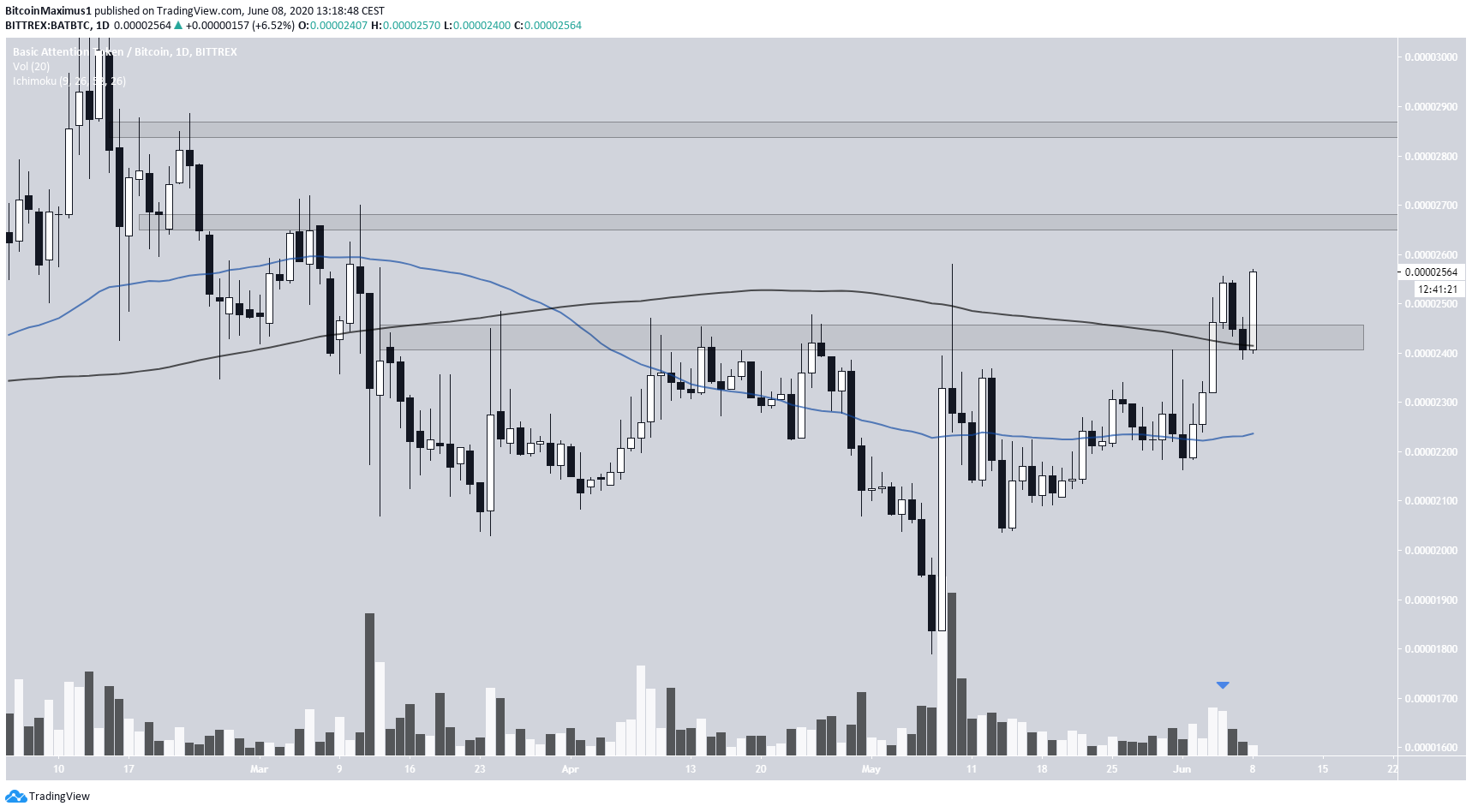

Basic Attention Token (BAT)

The weekly chart shows that BAT has broken out from a descending wedge that had been in place since October 2019. The price has reached a weekly close above the resistance line and has been moving upwards ever since.

The most important resistance area is found at 3100 satoshis, the top of the descending wedge.

The daily chart provides an even more bullish outlook. The price has moved above the 2440 resistance area, something it had been struggling to do since March. The closest resistance levels are found at 2670 and 2850 satoshis, respectively, and the price is likely to reach them in the short-term.

In addition, during the breakout, the price also moved above the 200-day MA, which had been providing resistance for the past two months. The 50-day MA is moving upwards, possibly setting up a bullish cross between the two indicators.

Therefore, the BAT price is expected to continue its rally upwards towards the two short-term resistance levels and possibly the long-term one at 3100 satoshis.

Well-known trader @Pentosh1 agrees with this assessment. He tweeted earlier today, pointing out that the price has flipped both a critical resistance area and a moving average (MA), paving the way for higher rates.

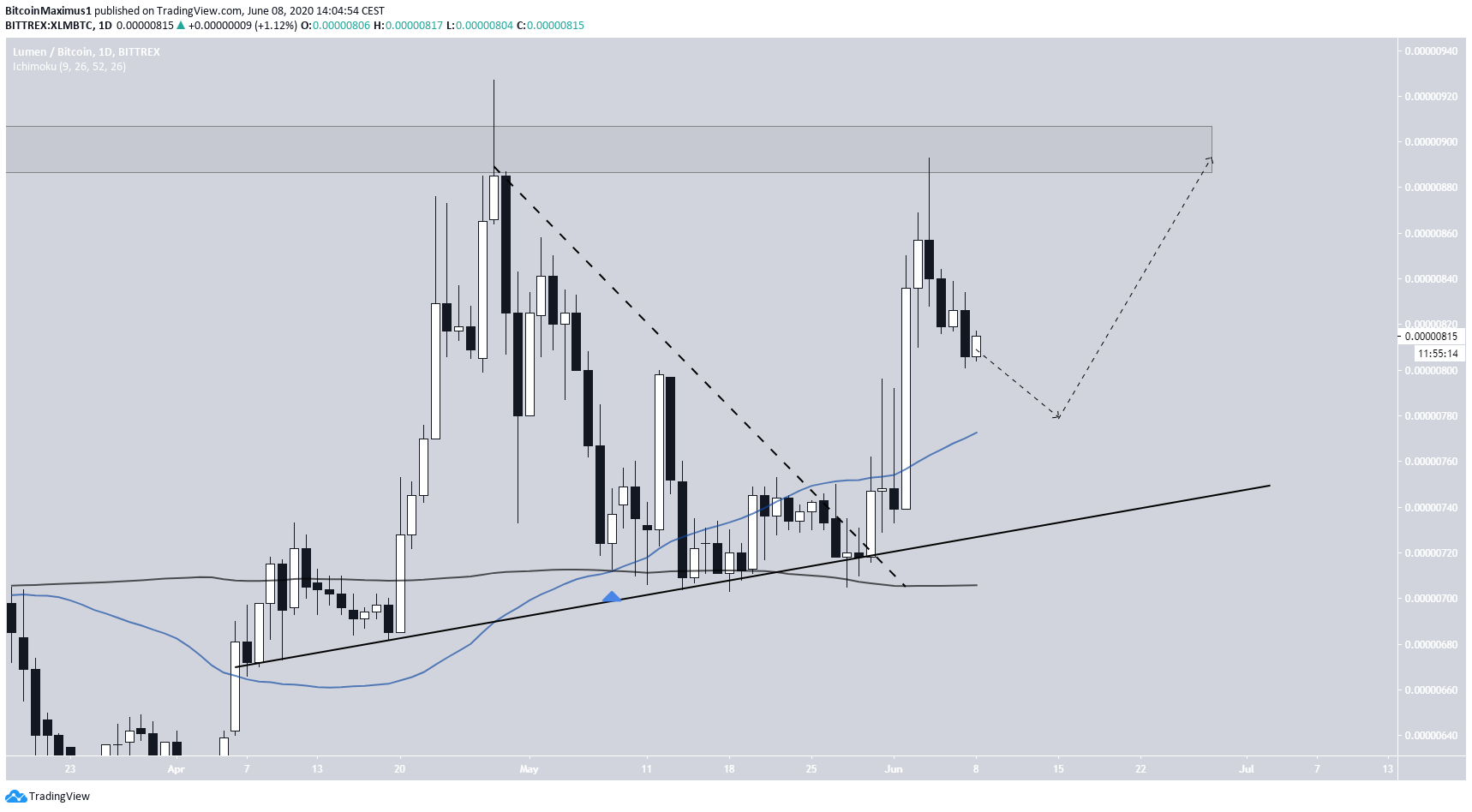

Stellar (XLM)

The XLM price has also broken out from a long-term descending resistance line. Also, it has moved above both the 50 and 200-day moving averages, which previously made a bullish cross.

However, once the price reached the 900 satoshi area, it was rejected (June 4) and has since declined. The price is in the process of retracing, before possibly making another attempt at breaking out.

XLM is following an ascending support line, which is currently at 740 satoshis. This is the lowest level XLM can retrace and still be considered bullish.

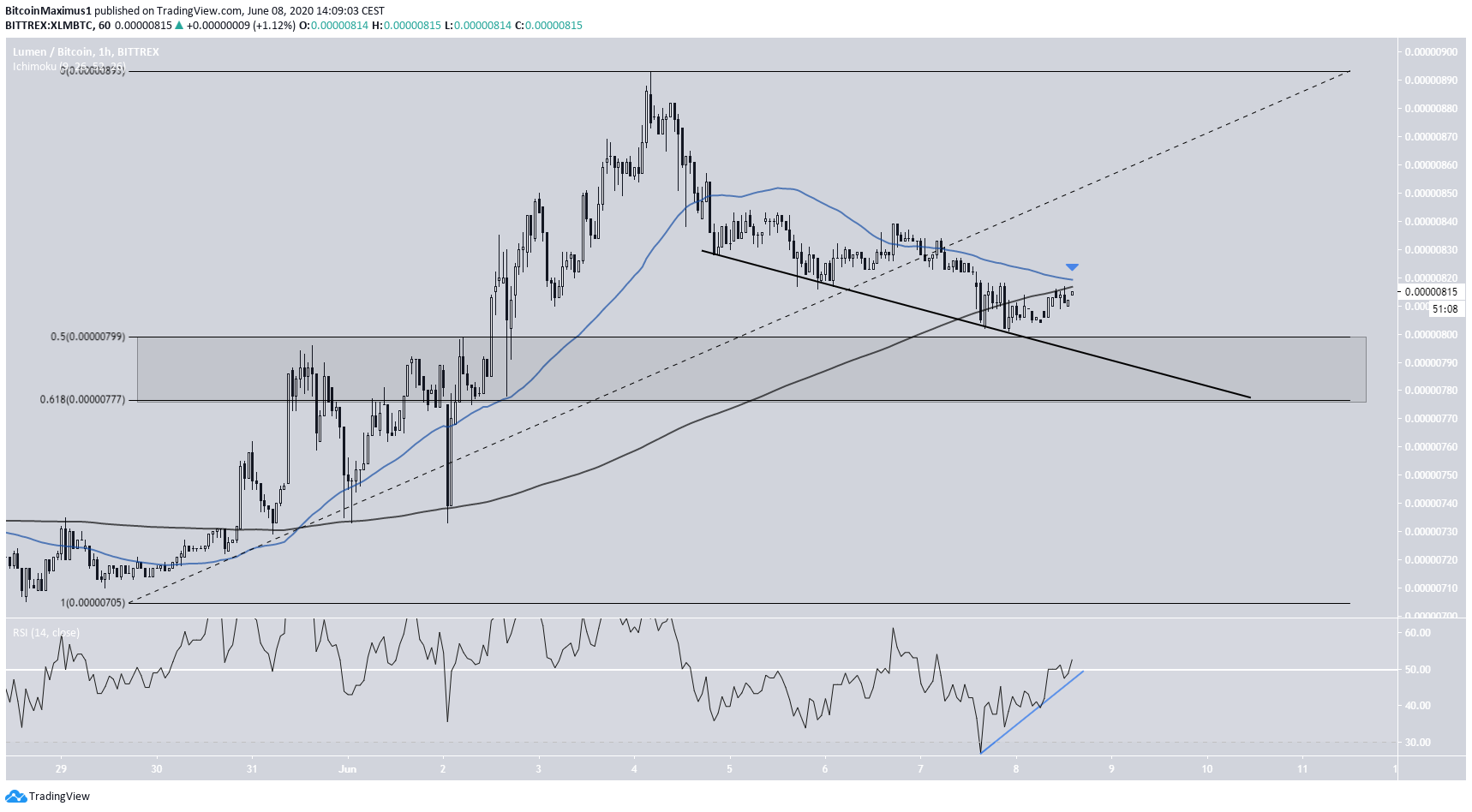

The short-term chart is, however, showing mixed signals. The 50 and 200-hour MA’s are in the process of making a bearish cross. Meanwhile, the RSI has developed bullish divergence.

The price is following a descending support line and is expected to slow its rate of decline since technical indicators do not give a clear direction of the trend.

The likeliest reversal area is found between 777-799 satoshis, the 0.5-0.618 fib levels of the entire upward move.

Therefore, the XLM price is expected to continue selling off until it reaches the reversal area outlined above, and then possibly make another attempt at breaking out.