Coinbase former CTO Balaji Srinivasan said the US Dollar (USD) is not too big to fail and expects Bitcoin (BTC) to replace it as the global reserve currency.

Srinivasan pointed out that unlike in the past when investors have flocked to dollar-denominated assets during a time of stress, this is a different time. He noted that historical data shows that people exit devaluing currencies, which is where USD falls into.

“Dalio has a different definition of historical reserve currencies. He says it’s the US dollar, then before that the British pound, then before that the Dutch guilder. But the point remains that reserve currency status doesn’t last,” Balaji added.

He noted that this is the difference between 2008 and 2023 as USD no longer held its strong position. Balaji also suggested that the Chinese RMB could even replace the USD as the world reserve currency.

This continues his earlier views that Bitcoin could reach $1 million in 90 days as the US financial system suffers from hyperinflation. Meanwhile, many believe Balaji’s predicted changes take generations to happen, not 90 days.

US Dollar is Weakening

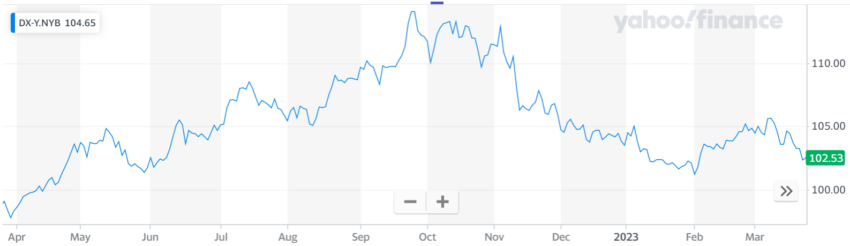

While not everyone believes BTC will replace USD, there are clear signs that the US dollar is weakening against other cryptocurrencies. The US Dollar Index is down 8.9% in the last 6 months and has lost 1.34% of its value in the past year.

The USDX measures the value of the USD relative to a basket of other major fiat currencies, and its decline over the past 6 months suggests that the dollar is losing value. This decline is due to the fear of recession due to the Fed’s interest rate hike and the recent collapse of major U.S. banks.

Bitcoin Gains Strength

Meanwhile, Bitcoin has been gaining strength in recent months. The cryptocurrency is up 46.18% in the last 6 months and has increased by 65.54% on the year-to-date metrics, according to BeInCrypto data.

Interestingly, most of the BTC gains in recent weeks are attributed to trading in the US. Its performance has led some to push for higher Bitcoin prices and faster adoption. But experts believe that any growth in Bitcoin price is unlikely to reach levels predicted by believers in hyperbitcoinization.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.