The Bank of Canada announced on Monday that it is seeking feedback from the public on the digital Canadian dollar CBDC and the features that could incorporate.

This #HaveYourSay initiative invites the public to share their opinions through comments. Public consultations will remain open until June 19.

SponsoredBank of Canada Releases Advert for CBDC

The top bank recently released a video advertisement encouraging public participation in the central bank digital currency (CBDC). In the video, the Bank states that it is currently exploring the feasibility of introducing a digital Canadian dollar. It also touched upon how it would operate.

It notes, “We’re getting ready in case one day Parliament and the Government of Canada ask us to issue one.”

The top banking institution elaborated that it is investigating the possibility of a CBDC due to decreased cash usage in favor of alternative payment methods. The Bank aims to stay current with this shift in trends.

In a statement, Carolyn Rogers, Senior Deputy Governor at the Bank of Canada, emphasized the importance of ensuring everyone can participate in Canada’s economy.

According to the Bank of Canada’s official definition, the digital Canadian dollar would not be classified as a cryptocurrency since the apex bank would back it. Furthermore, the Bank has cautioned that there is a possibility that foreign countries’ CBDCs or cryptocurrencies may gain widespread usage in Canada in the future. This, in turn, may hurt the central position of the Canadian dollar in the economy, ultimately affecting the stability of its financial system.

Therefore, with regard to the digital dollar, it notes, “A digital Canadian dollar could help protect our economy by ensuring Canadians always have an official, safe and stable digital payment option in the Canadian dollar. “

SponsoredMeanwhile, the Bank of Canada has expressed confidence that a digital Canadian dollar would complement cash instead of replacing it.

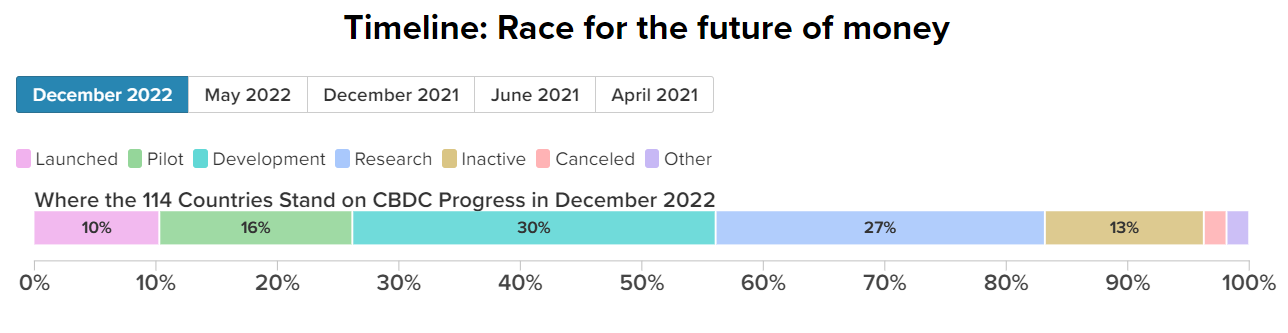

According to the Atlantic Council, more than 114 nations are now considering the implementation of a CBDC. Since May 2020, when only 35 nations were considering CBDCs, more countries have become interested in this idea. In 2023, more than 20 nations—including Australia, Thailand, Brazil, and India—are anticipated to make substantial progress toward piloting a CBDC.

Growth Comes with Political Debate

In a report published by Juniper Research, it is predicted that the value of CBDCs will experience a significant increase. The analysis indicates that by 2030, the current value of $100 million will soar to $213 billion.

According to the report, the adoption of CBDCs is expected to be propelled by governments. Especially if they utilize them to enhance financial inclusion and increase their authority over digital payments. The implementation of CBDCs is predicted to improve access to digital payments. This is especially so in emerging economies, where mobile penetration rates surpass banking penetration rates. The study also revealed that, by 2030, 92% of the overall value transacted via CBDCs will be for domestic payments.

The paper says that the sector is still in its infancy. And the pilot projects could extend its extraordinary growth of over 260,000% in the coming years.

However, the U.S. remains mostly divided on the prospect of introducing a digital currency. The debate comes despite the predicted surge in CBDC use. Florida Governor Ron DeSantis recently proposed changing the state’s uniform commercial code to forbid using fed-backed CBDCs.

In fact, in Canada as well, Conservative Leader Pierre Poilievre made a similar statement last year. He declared that he would discontinue any proposals for a digital currency if he were to become the Prime Minister.