Over the weekend, Balancer Labs initiated its first rounds of voting to address liquidity mining. The move is the DeFi protocol’s first steps towards full community-driven decentralized governance.

Following in the footsteps of Compound Finance, Balancer Labs launched its own governance token and liquidity mining incentive at the end of May, with the first ‘harvest’ of BAL tokens occurring in late June. Token prices and total value locked on the platform shot skywards as expected.

Balancer Liquidity Mining Proposals Approved

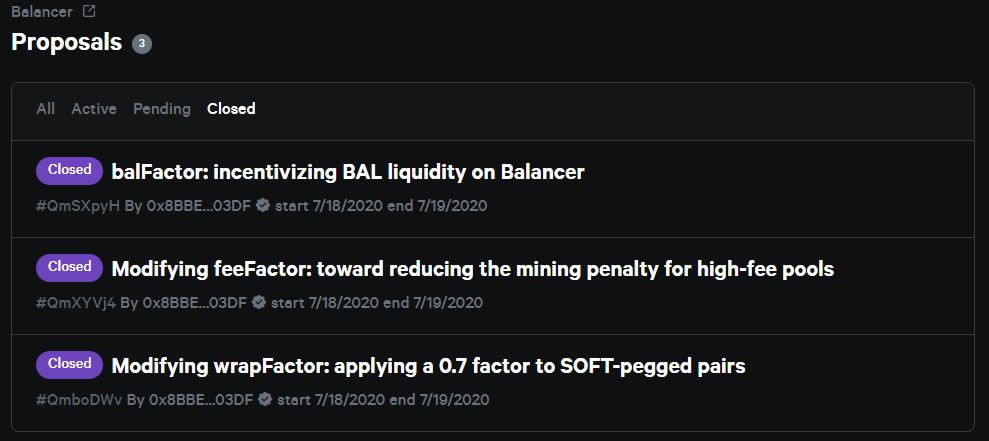

This weekend Balancer held the first round of voting for its new governance proposals, with all three submissions getting approval from stakeholders. Balancer Labs tweeted more details on the voting;

All three proposals have been approved by the vast majority of voters. A more detailed outcome of the voting will be published later this week.

The automated liquidity and asset management protocols allocate 145,000 BAL each week to those who provide liquidity to the platform. The token distribution is proportional to the amount of liquidity each address contributed relative to the total liquidity on Balancer. Several factors are taken into consideration in order to come up with a formula to manage the distribution.

Three proposals regarding this calculation were voted on over the weekend when Balancer launched its minimum governance tool. This takes a snapshot of each account’s BAL balance to approve or reject proposals while allowing the token holders to sign a transaction rather than pay transaction fees to vote.

The first proposal was something called ‘balFactor’ which incentivizes holders to use their BAL tokens for liquidity rather than simply cashing out. The idea was to apply a 1.5x multiplier to BAL that is provided as liquidity for ‘useful’ pairs including ETH, DAI, USDC, and wBTC. There was also a ‘capFactor’ of $50 million to correct down eventual excessive-adjusted liquidity for each capped token. The proposal explained;

The $50M cap is more of a safety measure, in place just for the unlikely scenario where the balFactor results in huge and unnecessary BAL liquidity coupled with an unreasonable BAL price spike. Such a scenario is automatically neutered by the cap.

Voting was unanimously in favor with 99.95% of the token balance, or 88 votes for, and 4 against.

The second proposal was to modify the ‘feeFactor’ by reducing the mining penalty for high-fee pools. A formula was proposed to calculate pool fees with a coefficient of 0.25 instead of its current value of 0.5. This would effectively incentivize a shift toward more profitable fees for liquidity providers. This proposal also received almost 100% of the votes in its favor which equated to 247k BAL tokens.

Thirdly, there was a proposal to apply a ‘wrapFactor’ of 0.7 to the liquidity of every pair of soft-pegged tokens in an effort to attract more useful liquidity to the protocol. Soft pegged pairs are highly correlated and are in pools that track the same asset, such as USDC and mUSD. These pairs have low liquidity and trading volume so a higher multiplier was agreed upon following the deliberation. The proposal elaborated;

Many community members have expressed their concerns about this type of liquidity being unfairly highly compensated by the current mining distribution rules with their less useful liquidity. Some believe the wrapFactor for the soft-pegged pairs should be as low as 0.3. Others believe it should not apply at all.

Voting for this proposal was slightly more divisive, tallying 63 votes for and 17 against, with the majority of 281.4k BAL tokens sitting in the ‘approval’ camp.

The changes are due to go live on July 20, following the successful passing of all three proposals. With the weekend voting Balancer has taken its first steps towards decentralized governance while improving its liquidity mining system.

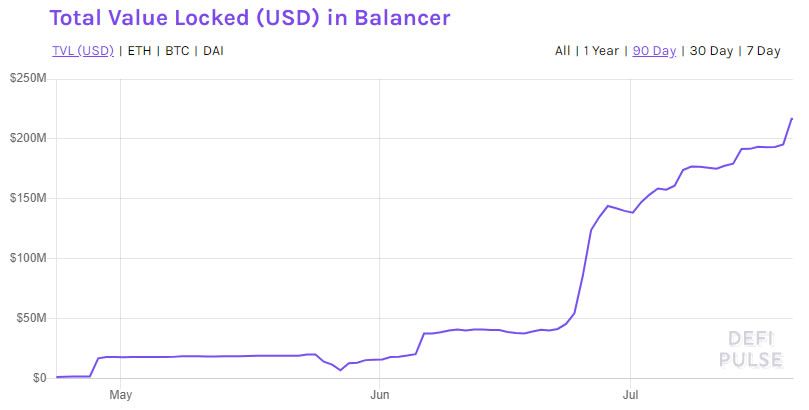

Balancer TVL at ATH, Maker Dethrones Compound

Balancer is currently ranked fifth place in the total value locked (TVL) charts according to DeFi Pulse. This marks another all-time high of $217 million, an increase of 430% since the same time last month.

The Ethereum-based automated market-maker has been one of the best performing DeFi platforms this year. BAL token price was around $10.30 at the time of writing according to Uniswap. It has retreated almost 40% from its peak in late June but is still a long way above its seed price of $0.60.

In a related development, MakerDAO has regained its top spot by dethroning Compound Finance. Maker currently has a market share of around 23% according to DeFi Pulse. TVL on the platform is currently $654 million, up 47% since the beginning of the month.

Compound has slipped down to the second spot on the TVL charts with $637 million. COMP tokens are currently trading around $160 whereas Maker is hovering around the $455 level. The platform has also successfully demonstrated its new model of decentralized governance with voting on five proposals since the beginning of July.

Maker took a hit in terms of earnings over the last quarter as it was forced to drop the Dai Savings Rate (DSR) down to zero in order to maintain the asset’s dollar peg. This has paved the way for a more diverse DeFi ecosystem with the likes of Compound, Kyber, and dYdX increasing their market shares.

DeFi Value Keeps Climbing

Total value locked for the entire DeFi ecosystem has hit another all-time high today at $2.83 billion. Aave and Curve Finance have been the two top movers in terms of liquidity injections with gains of 34% and 55% over the past 24 hours respectively.

Since the same time last month, DeFi has grown by 93% in terms of TVL, and since the beginning of the year, it has made a whopping 315% growth. Cryptocurrency markets are still sideways and there has been minimal action from the major players over the weekend. Total market capitalization is still hovering around the $270 billion level following two months of relatively low volatility.