Avalanche (AVAX) price has been in a downtrend for the last two months, currently trading at $27. The altcoin has lost key support floors, which has caused whale investors to lose patience.

Despite the ongoing pressure, there may still be hope for AVAX to recover and bounce back in the near future.

Avalanche Is Under Pressure

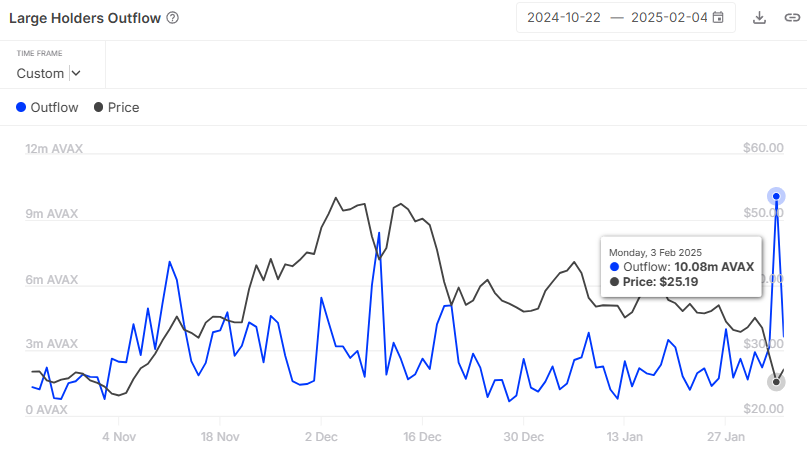

The current market sentiment for AVAX is under pressure as whale outflows reach a three-month high. As the price dropped by 23% this week, large holders have moved to sell off their holdings.

About 10.08 million AVAX over $272 million were sold in a single day 48 hours ago. This shift in investor behavior suggests a lack of confidence in a short-term recovery, with whales opting to minimize their losses rather than hold onto their positions.

This trend highlights the growing skepticism among influential investors. The whale sell-off has been a strong indicator of the bearish outlook, which is affecting AVAX’s price action. Large wallet holders are likely to focus on protecting their capital as the market remains volatile, reflecting caution among the broader investor base.

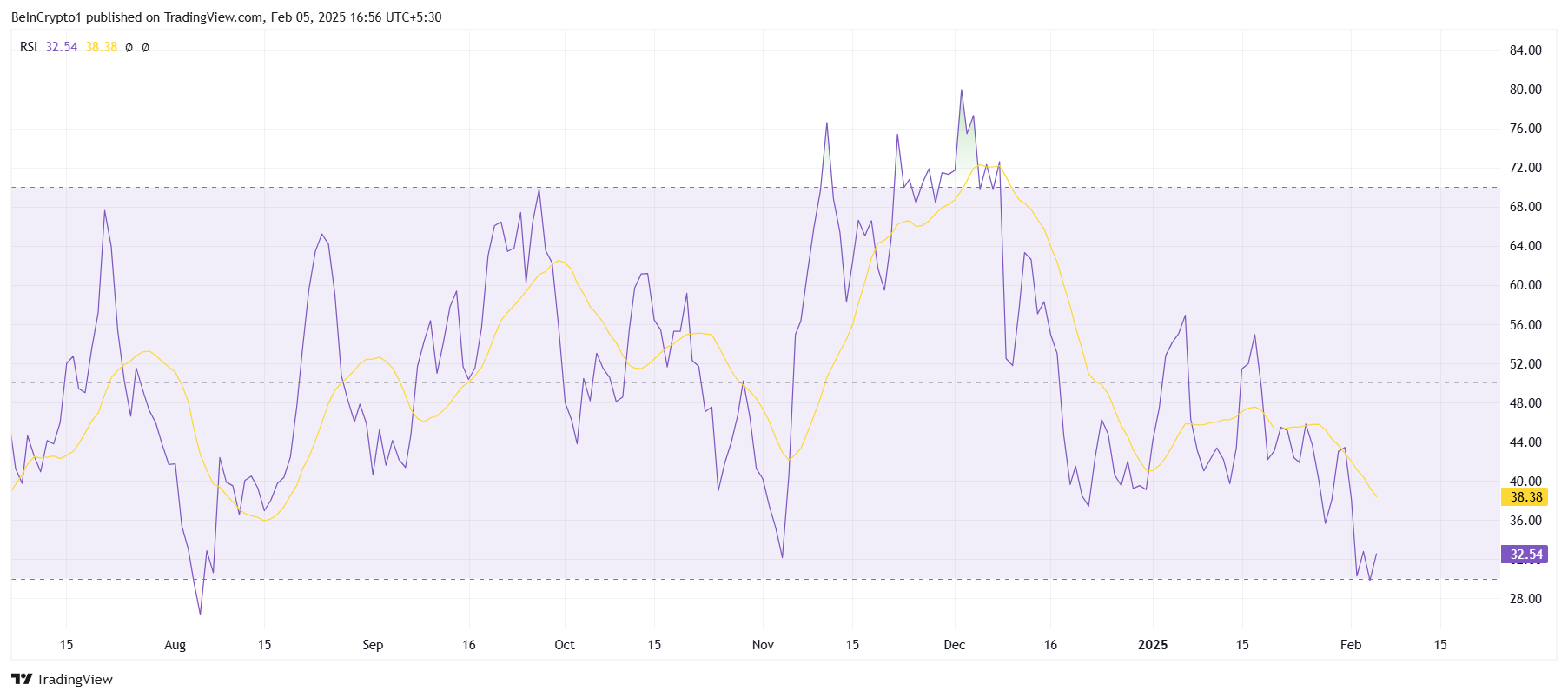

The overall momentum for AVAX is showing signs of nearing a saturation point in its bearish trend. The Relative Strength Index (RSI), a key technical indicator, is hovering dangerously close to dipping below 30.0, signaling that AVAX is inching into the oversold zone. Historically, once an asset hits the oversold region, it has often led to a price reversal as bearish momentum starts to exhaust itself.

This close proximity to the oversold zone could be an opportunity for a potential rebound. As more investors are likely to enter the market at low prices, AVAX may begin to see some support from bargain hunters, contributing to a possible recovery. However, this remains uncertain, and the market conditions will need to stabilize for a meaningful turnaround.

AVAX Price Prediction: Taking A Few Steps Back

AVAX’s price is currently sitting at $27 after losing the support level of $31 last weekend. The altcoin has struggled with a downtrend for the past two months, and a lack of buying momentum has only added to the bearish pressure. However, the current price is holding above the critical $27 support, which may present an opportunity for recovery.

While a continued drawdown is unlikely, given the saturated bearish momentum, AVAX is still at risk of falling to $22 if investor sentiment worsens and further sell-offs occur. The bearish pressure could persist in the short term, making it crucial for the altcoin to reclaim key support levels to avoid further losses.

On the other hand, reclaiming the $27 support could give AVAX a chance to recover towards $31. A break above this level would invalidate the bearish outlook, signaling that a reversal could be underway. If AVAX can breach the $31 barrier, it could recover some of its recent losses and set the stage for a more significant rally.