Rich Dad Poor Dad author Robert Kiyosaki recently predicted that the U.S. dollar would crash by January 2023 as investors become shaken by the volatility of the pound and euro. This could potentially create a great scenario for a low entry for a Bitcoin investment.

Kiyosaki speculated in a tweet, “Will [the] U.S. dollar follow [the] English Pound Sterling? I believe it will.”

Buying opportunity for BTC

In another tweet, Kiyosaki called it a buying opportunity for Bitcoin. He said, “If FED continues raising interest rates U.S. $ will get stronger causing gold, silver & Bitcoin prices to go lower. BUY more. When FED pivots and drops interest rates as England just did you will smile while others cry. Take care.”

Notably, the author of the financial literacy book has discussed BTC since 2018. The author claimed that Bitcoin was the people’s money in August of the same year and described the dollar as a type of farce or fraud.

Meanwhile, as the crypto markets continue to maintain a global market cap under $1 trillion, Kiyosaki stated last month that the price of Bitcoin will explode in the foreseeable future. At the time of press, BTC was trading in a 24-hour range of $18,930 and $19,300 on CoinGecko.

Despite the weak price action, Messari recently noted in its research that people from the U.K. and E.U. have been selling their pounds and euros for Bitcoin as their national currencies’ values plummet.

Crypto signals bearish but analysts are optimistic

In the face of larger macroeconomic unrest, DCG CEO Barry Silbert also declared that the world’s largest cryptocurrency would emerge as the new safe haven asset.

However, Be[In]Crypto recently cited reports that the number of crypto billionaires on The Forbes 400 list of the wealthiest people in the U.S. dropped from seven in 2021 to four this year amid the crypto market downfall.

Their combined wealth also fell similarly, from $55.1 billion to $27.3 billion, per the report. Despite that, Bitcoin analyst and trader ‘PlanB’ pushes the idea of buying the dip while pointing out how frequently Bitcoin has been declared “dead.”

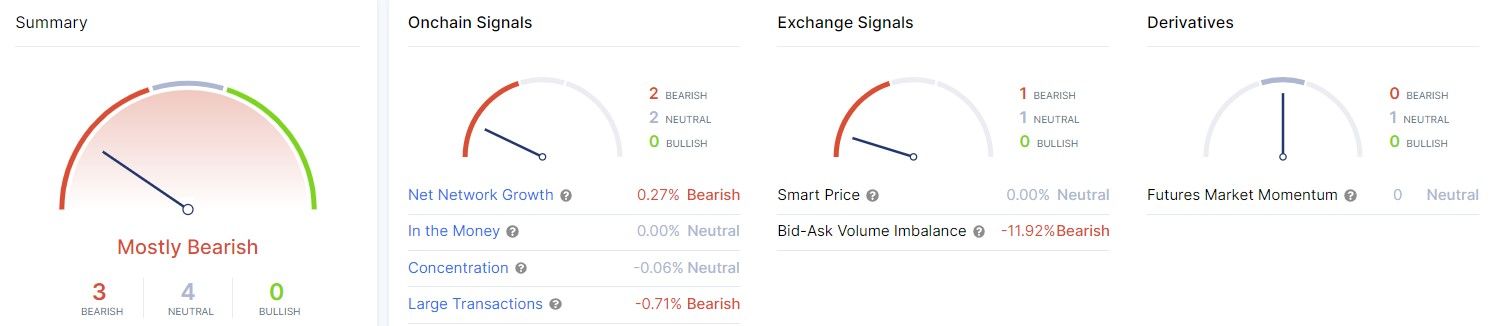

At current price levels, 48% of investors are at a loss while 4% are breaking even, as per research by IntoTheBlock. 63% of the holders of the king coin remain long-term investors despite on-chain and exchange signals remaining mostly bearish at the time of writing.