ASTER, the native token of decentralized perpetuals exchange Aster, has struggled to maintain momentum after reaching its all-time high of $2.43 on September 24.

Since then, the altcoin has shed 25% of its value, and technical indicators point to the risk of further downsides.

Weak Demand Puts ASTER Price at Risk of Further Losses

On-chain signals show sustained weakness in buy-side demand, increasing the risk of the cryptocurrency facing deeper losses if market sentiment does not improve.

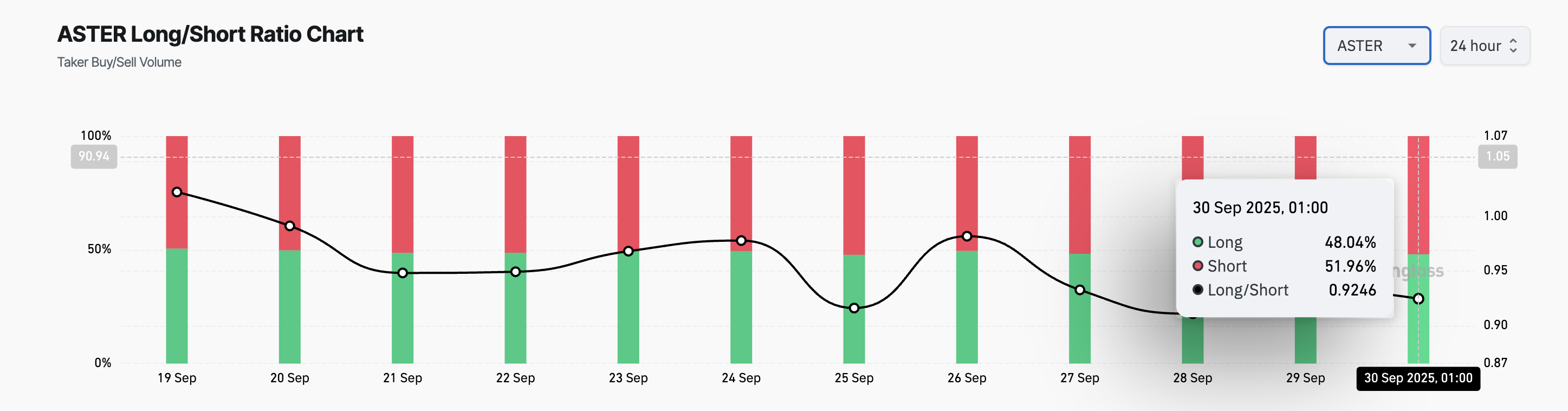

The altcoin’s long/short ratio has fallen steadily over the past few days, highlighting the growing negative bias among futures traders. As of this writing, ASTER’s long/short ratio is 0.92 and remains in a downtrend.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

The long/short ratio measures the proportion of traders holding long positions (bets that an asset’s price will rise) against those holding short positions (bets that the price will fall).

A ratio above one indicates that more traders expect upward momentum, reflecting a bullish sentiment in the derivatives market. Conversely, a ratio below one signals that most participants are betting on further downside.

ASTER’s long/short ratio confirms that shorts are dominating the market, with more traders positioning themselves for price declines than for a recovery. This could result in a further loss of confidence, which may push the altcoin’s value further downward.

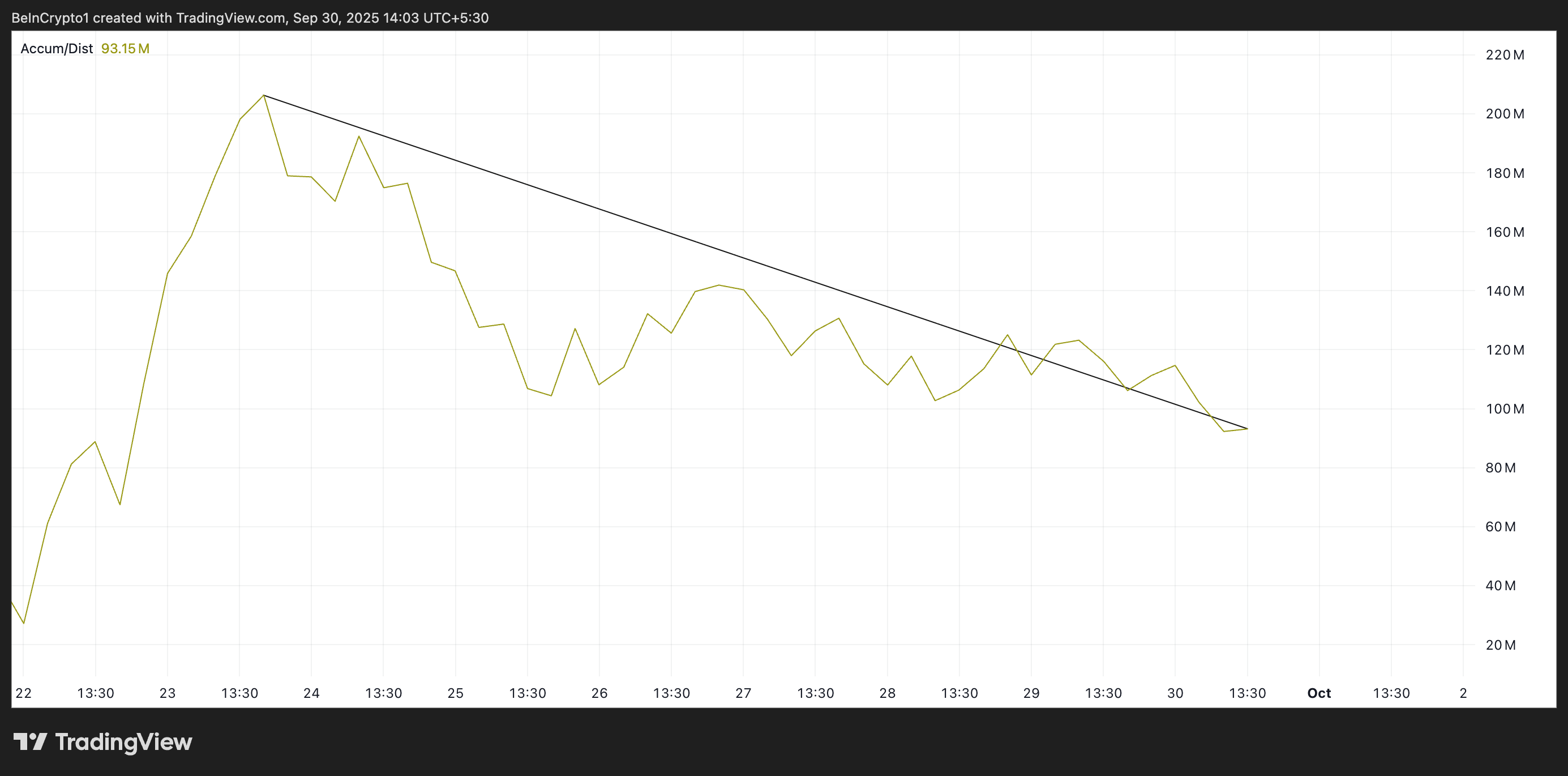

Further, on the four-hour chart, the token’s declining Accumulation/Distribution (A/D) Line confirms the waning buying interest.

This indicator tracks the relationship between an asset’s price and trading volume, highlighting whether traders are leaning toward accumulation or distribution.

When it falls like this, it means investors have limited interest in holding the asset at higher price levels, putting ASTER at risk.

ASTER Price Teeters Near Crucial Floor

At press time, ASTER trades at $1.8198, hovering right about the support floor at $1.7119. If demand weakens further, this price level could give way, opening the door to a deeper dip toward $1.4882.

On the other hand, if new demand enters the market, it could push its price past the $2.0303 resistance and toward $2.1650. A breach above this level could push ASTER’s price to revisit its all-time high of $2.436.