Solana (SOL) initiated an upward movement on Sept 7. It is approaching a very important resistance between $39.20 and $41.40. If it reclaims it, the rate of increase could accelerate further.

SOL has been falling underneath a descending resistance line since reaching an all-time high price of $259.90 in Nov. The downward movement led to a low of $25.86 in June.

The price has been increasing since and managed to break out from the line in the beginning of Aug. Afterward, it returned to validate it as support and created a double bottom pattern in the process. Besides being a bullish pattern, the double bottom was combined with bullish divergence in the RSI (green line).

Bullish pattern

So, there are three signs that support the beginning of an upward movement for SOL:

- The price has broken out from a descending resistance line

- The weekly RSI has generated bullish divergence

- The price has created a double bottom pattern

As a result, an upward movement towards the closest resistance areas at $85 and potentially $115 is likely.

Moreover, on Sept 7, the number of new non-fungible tokens (NFTs) on Solana reached a new all-time high of 312,000, further adding to the bullish sentiment.

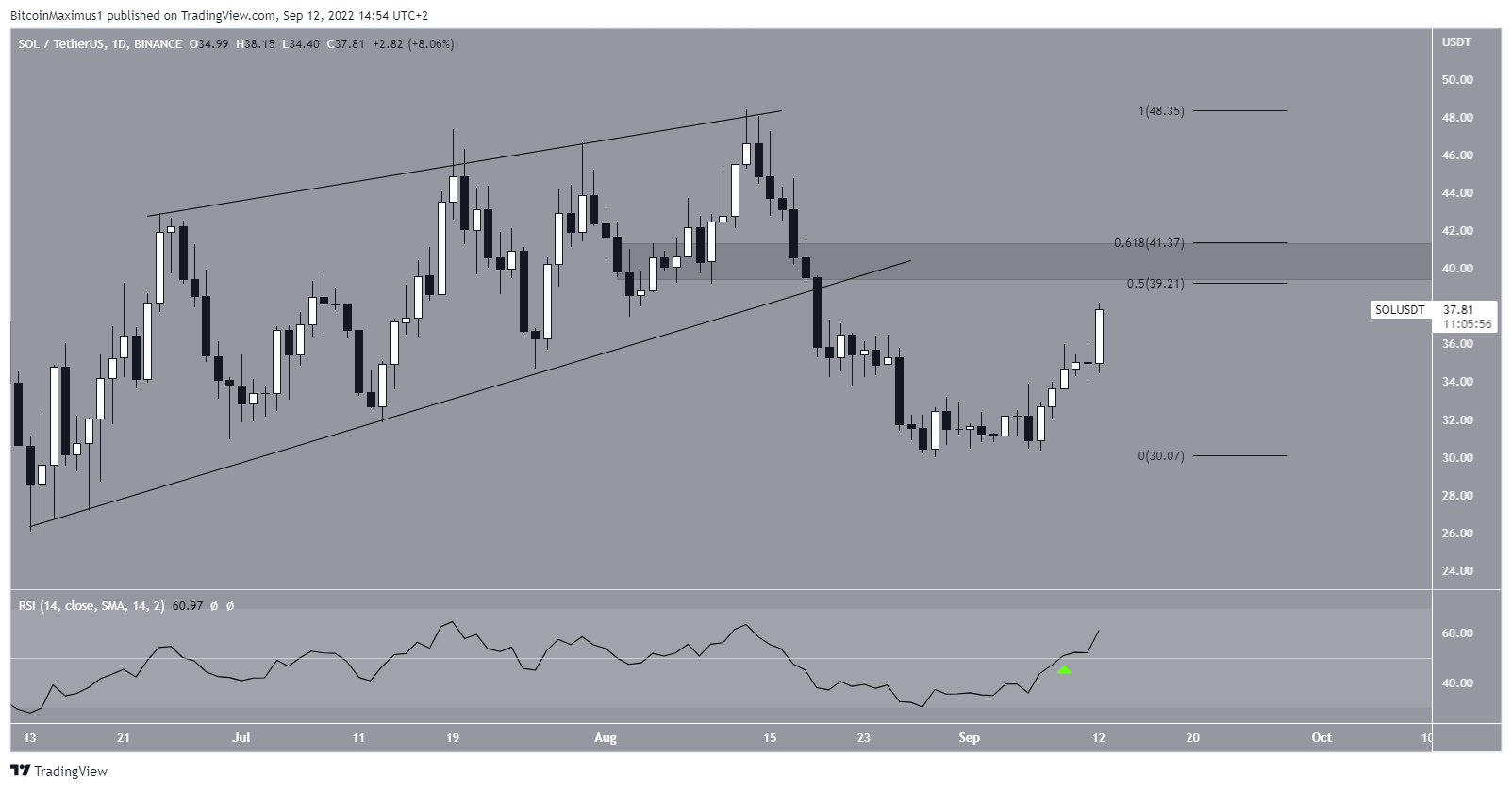

Breakdown and retest

The daily chart shows that SOL broke down from an ascending wedge on Aug 19. This led to a low of $30 10 days later.

Afterward, the price began an upward movement that accelerated on Sept 12. This was also combined with a daily RSI breakout above 50 (green icon).

If the upward movement continues, the next closest resistance area would be between $39.20 and $41.40. The area is created by the 0.5-0.618 Fib retracement resistance levels.

In order for the movement predicted in the weekly timeframe to occur, SOL has to reclaim this area and validate it as support afterward.

Future SOL movement

Due to the shape of the wedge, it is possible that the initial increase was part of a leading diagonal five-wave upward movement. If so, the price is now correcting inside an A-B-C corrective structure. In this case, SOL will get rejected by the 0.618 Fib retracement resistance level before falling.

However, it would mean that a long-term bottom has already been reached.

A reclaim of the $39.20 to $41.40 range would suggest that even the short-term bottom has already been reached, and the price will increase towards new highs.

For Be[in]Crypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.