Arbitrum, a prominent Layer-2 network built on Ethereum, experienced a decline in its native cryptocurrency ARB compared to other leading Layer-2 assets in the past day. This dip comes amid anticipation surrounding two significant events expected to influence its price.

Ahead of the events, SpotOnchain detected two whales offloading approximately 3 million tokens for $6 million.

Ethereum Dencun Upgrade

On March 13, Ethereum is poised for its next significant advancement, the Dencun upgrade. This promises a paradigm shift towards reduced costs for Layer 2 blockchain networks.

Market observers have emphasized the significance of this upgrade, highlighting its potential to empower Layer-2 networks like Arbitrum to compete favorably against Layer-1 chains such as Solana.

“If successful, the upgrade will guarantee cost-efficiency and speed, and as such Dencun holds the potential to onboard even more digital asset entrepreneurs in addition to the thousands of protocols currently running on top of Ethereum,” crypto firm Nexo wrote.

Read more: Optimism vs. Arbitrum: Ethereum Layer-2 Rollups Compared

Indeed, Arbitrum has expressed readiness for this crucial upgrade with the activation of ArbOS 20 Atlas, which introduces the Dencun upgrade to Arbitrum chains on Arbitrum Sepolia. Arbitrum Sepolia is a testnet chain mirroring Arbitrum One mainnet features.

This activation illustrates the network’s preparedness to implement Ethereum’s latest upgrade. According to DeFillama data, the total value of assets locked on the Arbitrum network is $3.6 billion, making it the largest Ethereum-based layer2 network.

$2 Billion Arbitrum Unlock

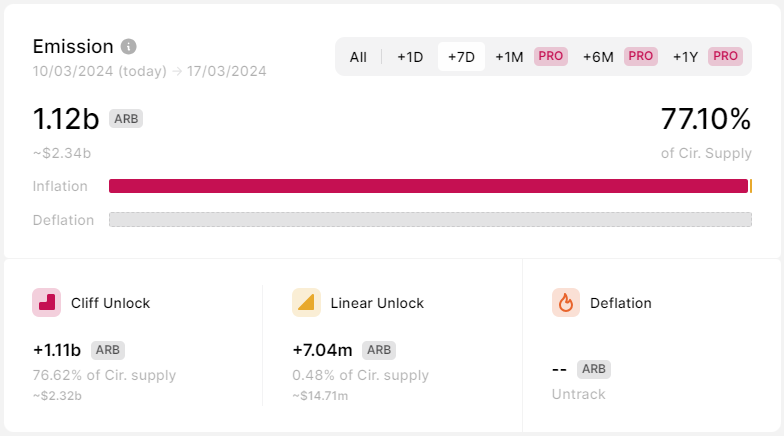

Three days after the Dencun upgrade, Arbitrum will have a major token unlock event that will double its circulating supply.

Token Unlocks data reveals the release of 1.1 billion ARB tokens, constituting 77% of the circulating supply and currently valued at $2.38 billion. The team and advisors will collectively share 673.5 million ARB, valued at approximately $1.44 billion. Meanwhile, investors expect 438.25 million ARB, amounting to $937.86 million.

This event carries significant weight for Arbitrum and could influence investor sentiment. Typically, investors view token unlocks as a bearish event that may exert additional selling pressure on the market.

Read more: Arbitrum (ARB) Price Prediction 2024 / 2025 / 2035

Indeed, Arbitrum’s ARB was the weakest performer among the top five L2 tokens, witnessing a decrease of over 2% over the reporting period. Meanwhile, the sector as a whole showcased an average gain of 3.8% during the same timeframe.