Arbitrum (ARB) price is vulnerable to a correction despite broader market cues being positive owing to the failed breach of a key resistance level.

The investors hold the power to prevent a decline, provided they refrain from profit-taking, which is very likely.

Arbitrum Investors Could Cause a Drop

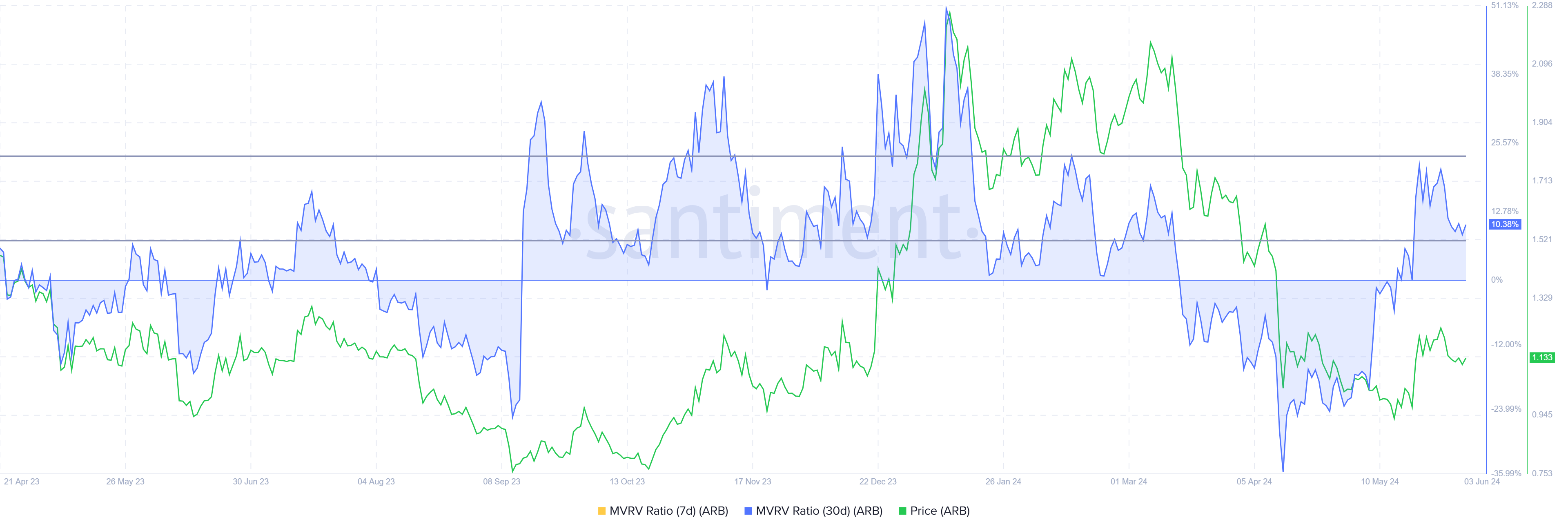

ARB holders tend to influence Arbitrum’s price direction, which could be the case in the coming days. This is because the conditions are very favorable for selling at their hands, looking at the Market Value to Realized Value (MVRV) ratio.

The MVRV ratio assesses investor profit or loss. Arbitrum’s 30-day MVRV is 10%, signaling profit and potentially prompting selling. Historically, ARB corrections occur within the 7% and 23% MVRV range, labeling it as a danger zone.

Thus, ARB holders could opt to take profits.

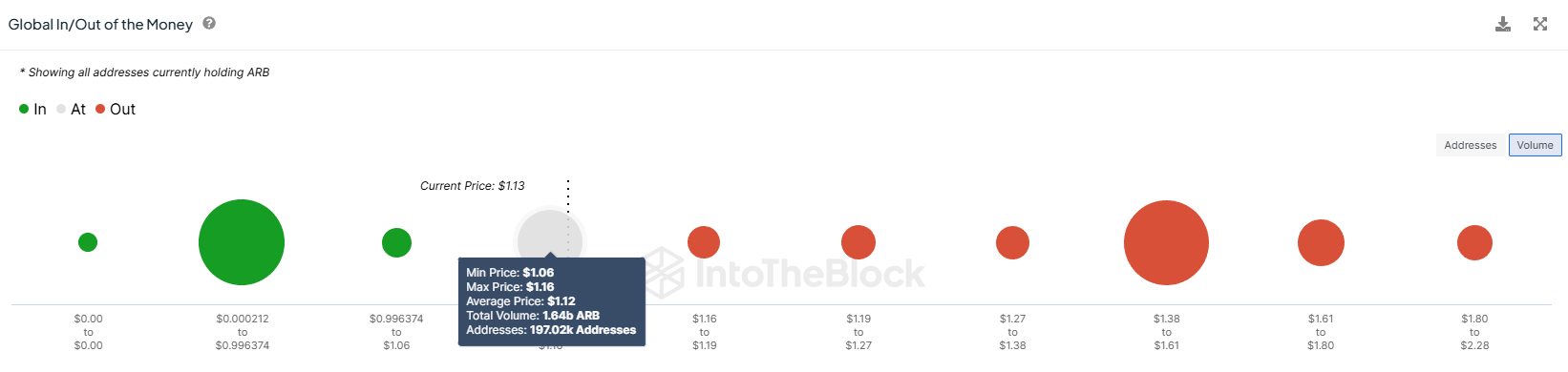

Another compelling reason is that 1.64 billion ARB are about to turn profitable. According to the Global In/Out of the Money (GIOM) indicator, this supply worth more than $1.8 billion is on the verge of yielding gains to its investors.

Read More: 5 Best Arbitrum (ARB) Wallets in 2024

This supply was bought for between $1.06 and $1.16, and Arbitrum’s current price, $1.13, does not seem very far from when it will become profitable.

Consequently, ARB investors will likely move to secure their gains by selling before the price corrects, inherently causing a dip.

ARB Price Prediction: Falling to Previous Lows

Arbitrum’s price, trading at $1.13, failed to surpass the resistance at $1.26. The altcoin bounced off the support at $1.10, which has been tested before. Staying above it supports recovery, while a slip below it points to bearishness.

Given the aforementioned factors suggest a decline, it may not be surprising if ARB falls below the support of $1.10. Further selling could push it down to $0.97, resulting in Arbitrum’s price losing the support of $1.00.

Read More: Arbitrum (ARB) Price Prediction 2024/2025/2035

However, ARB could initiate a recovery if the bounce-off invokes bullishness and selling remains minimal. This would enable a climb back up to $1.26, and breaching it would invalidate the bearish thesis, sending Arbitrum’s price to $1.30.