Arbitrum’s (ARB) price has rallied above a key resistance level amid the rally in the general cryptocurrency market in the past 24 hours.

Trading at $1.15 at press time, the token’s 17% price growth in the past 24 hours mirrors the 8% spike in the global cryptocurrency market capitalization during that period.

Arbitrum Sees Spike in Bullish Activity

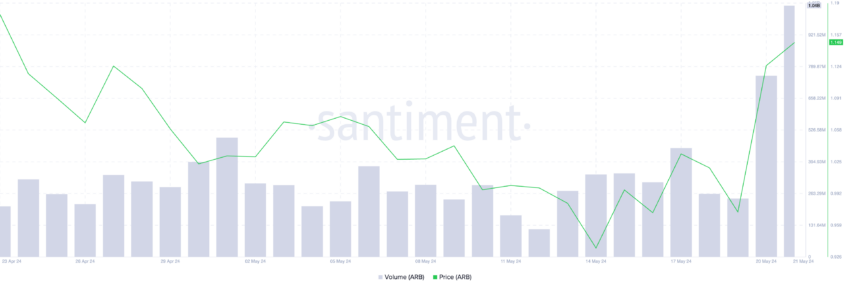

Due to the increased activity around ARB in the past 24 hours, the token’s trading volume has seen a significant uptick. Totaling $1.04 billion at press time, the token’s trading volume is currently at its single-day highest level since March 21.

When an asset’s price rises alongside its trading volume, it is considered a bullish signal. It suggests that more traders are interested in buying the asset, increasing the price.

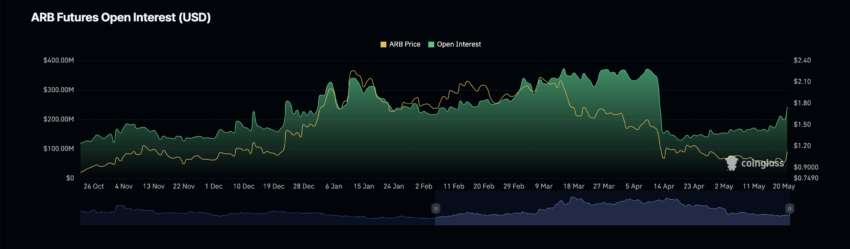

The surge in market interest in ARB has been depicted in its rising futures open interest. Thus, at $243 million, the token’s futures open interest has increased by 19% in the past 24 hours.

Read More: Optimism vs. Arbitrum: Ethereum Layer-2 Rollups Compared

ARB’s futures open interest tracks the total number of its futures contracts or positions that have not been closed or settled. When it rises this way, it suggests an uptick in market activity as more market participants move in to open new positions.

ARB Price Prediction: Why the Bulls Must Not Relent

In addition to rallying above resistance at $1.13, ARB’s price now sits above its 20-day Exponential Moving Average (EMA) and its 50-day Small Moving Average (SMA).

Conversely, when an asset’s price rallies past these key moving averages, it is viewed as a bullish signal because it suggests that the asset’s recent and medium-term price movements are positive. Traders view it as a signal that the asset in question is experiencing an upward momentum.

Confirming the upswing in demand for the altcoin, ARB’s Relative Strength Index (RSI) was 57.12, which was an uptrend. Furthermore, at this value, the momentum indicator suggested a preference for ARB accumulation over its distribution.

ARB’s price may touch $1.17 if this accumulation momentum is sustained.

Read More: Arbitrum (ARB) Price Prediction 2024/2025/2035

However, if the buyers become exhausted, bears may regain control. This would allow them to push ARB’s price below resistance and force it to trade at $1.09.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.