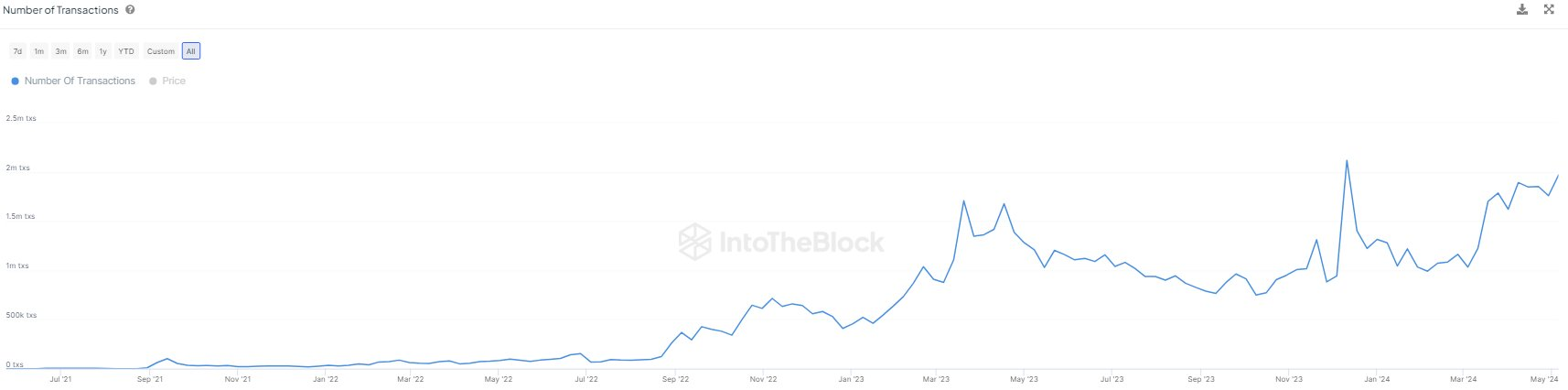

Arbitrum, a leading Ethereum layer-2 scaling solution, surged to over 2 million daily transactions, marking a substantial growth from its earlier average of around 1 million transactions in early March.

This increase not only highlights Arbitrum’s growing adoption but also indicates a robust expansion in activity within the decentralized applications (dApps) space.

Daily Transactions Climb as Arbitrum Price Bottoms

The price of Arbitrum (ARB) has seen a significant pullback from its recent 2024 peak of $2.40. The price currently stands at $1.02. Representing a 65% decline in price from its recent peak.

However, it appears the network is gaining traction, as recent data from IntoTheBlock shows that the number of transactions on Arbitrum has begun to climb back towards two million daily transactions as of yesterday.

Simultaneously, Arbitrum announced Injective’s new Layer-3 network in EVM, which utilizes Arbitrum’s advanced Orbit toolkit. This development is poised to bridge further the ecosystems of Ethereum, Cosmos, and Solana, amplifying the capabilities of blockchain interoperability and functionality.

The inEVM network, empowered by Arbitrum’s technology, allows seamless integration with the Ethereum Virtual Machine (EVM). This integration facilitates developers in crafting customizable chains, thus broadening the spectrum of decentralized application development and deployment across varied blockchain environments.

Amidst these technological advancements, financial analysts are focusing on the market positioning of Arbitrum’s token, ARB. A notable cryptocurrency analyst on X, @misterrcrypto, recently suggested that ARB has reached its market bottom, signaling potential upcoming positive shifts in its valuation.

This perspective aligns with the increased utility and transaction volume on the Arbitrum network, which typically fosters bullish sentiment among investors.

The convergence of these developments—record transaction volumes on Arbitrum and strategic expansions through Injective’s inEVM—presents a compelling narrative of growth and innovation within the crypto market.

ARB Price Prediction: The Bottom is in

According to recent trading data, ARB is charting a path that could see its price break important technical thresholds. A glance at the ARB’s daily trading chart reveals a descending trendline that has been active since early this year.

The token currently trades at approximately $1.02, with a notable resistance level at $1.20. If ARB can break through this barrier, the next critical level to watch would be just above $1.50.

Additionally, the Relative Strength Index (RSI), a key indicator used to determine the momentum of price movements, stands at 36, suggesting that ARB is nearing oversold territory. This could signal a bottom soon for the ARB Price. The trading volume shows active participation, indicating sustained interest in ARB among traders.

Breaking above the $1.20 resistance could signal a strong upward momentum for ARB, potentially reaching higher valuation benchmarks set in earlier trading periods.

Finally, the $1 support line remains a pivotal zone for ARB. Should the price break and hold below this price on the daily? ARB could be set for more selling pressure.