Imagine engaging in a trust dependent relationship with a well-known cryptocurrency investment company that has all the bells and whistles of a successful investment firm. They’ve got an impressive trading portfolio, and the promise of a substantial investment return through the use of a sophisticated cryptocurrency arbitration trading bot to ensure a higher payout.

But what isn’t readily known to its investors is that this impressive company is a complete scam. From their website to their advertisements — the entire framework of their business model is an alleged elaborate Ponzi scheme designed to pilfer as much money as possible from many of its investors before making a claim that their arbitration bot malfunctioned due to a bug that generated a computing error, causing it to empty its holdings incorrectly, supposedly distributing profits higher than the actual profit. In totality, this would be considered an exit scam.

“A billion-dollar crypto Ponzi scheme”

This is apparently the case regarding ArbiStar, a Spain-based crypto investment firm, which allegedly stole nearly $1 billion in investment money from 120,000 clients, according to Tulip Research, a forensic fraud investigative research firm specializing in analyzing blockchain for fraudulent activities who describes the company as a billion-dollar crypto Ponzi scheme.

This so-called bot malfunction allegedly affected 30,000 investors whose return simply vanished into thin air under the guise of “heavy losses.” Apparently, these losses were part of an elaborately choreographed scheme, like a slight of hand.

The company even said they would freeze the accounts of the affected parties in an effort to halt further losses, claiming that the money would supposedly be returned with negative balances. They would even go so far as to stop receiving investments, giving off the illusion that ArbiStar would ensue damage control options in an effort to save as many of their loyal clients as possible.

According to ArbiStar, the computing error caused by the bot supposedly created a liquidity hole amounting to 28% of their total funds. However, some have already denounced ArbiStar CEO Santi Fuentes for misappropriation of their funds.

But what really happened to all that money? Some of it allegedly found its way on the dark web, in an infamous black market known as Hydra, the largest dark web black market in Russia.

But the story doesn’t end there. In fact, this is only the beginning.

The shady history of Santi Fuentes

ArbiStar is a cryptocurrency trading investment company situated in Spain and is led by Santi Fuentes. The company uses multi-level marketing (MLM), also known as network marketing, referral marketing, and pyramid selling.

Many respected and successful companies build their business model on using MLM strategies to get where they are today. Mary Kay and Avon are just a couple names that come to mind. However, in the wrong hands this model can be abused, hence the popular term “pyramid scheme.” For this reason it can be hard to distinguish between a legitimate company and pyramid schemes giving off the appearance of a respectable establishment.

If referral marketing is how the company expands in the conventional sense, it is interesting to note that ArbiStar sells no retailable products or services of any kind. People who become affiliates of the ArbiStar brand are only able to advertise ArbiStar affiliate membership itself, hence, the appropriateness of the term “ponzi” — a flagrant form of investment racket that uses the money collected from new members to pay existing stakeholders.

While operating a pyramid might raise eyebrows for the dubious practice, what really raises a red flag is that ArbiStar has reportedly provided no proof of having registered its company with the National Securities Market Commission, which is Spain’s securities regulator.

As reported, Fuentes hasn’t registered with any for that matter, which begs the question, what is ArbiStar really operating behind the scenes if Fuentes doesn’t want the company to be subjected to regulatory securities laws?

In regards to Fuente’s corporate bio on the ArbiStar website, he claims that he is “one of the most experienced people in the world of referral marketing. He has led teams of thousands of people with great success.”

On the contrary, some of the companies Fuentes was associated with in the past allegedly had less than admirable reputations. However, Fuentes does address these circumstances in another section of his corporate bio, which reads:

“He has also known as team leader the failure of some projects where companies were not transparent and cheated their sales teams. For this reason he is the ideal person to lead ArbiStar 2.0.”

The statement is indirectly indicative that the company’s previous business model was unsuccessful.

What is also interesting to point out is that Fuentes went from selling medicinal coffee to becoming an investor with little in the way to indicate that he had any experience in investing.

A pattern of serial securities and pyramid fraud

Previously, before getting involved in Ponzi schemes, Fuentes was an Organo Gold distributor in 2013, which is a Chinese medicinal infusion of coffee and health products with Ganoderma mushroom.

Before heading ArbiStar, Fuentes was a top investor in Global Unity back in 2014, which itself was linked to the WCM777 Ponzi scheme based in California, started by Chinese national Ming Xu.

Xu’s financial empire fell like a house of cards under an investigation by the United States Securities Exchange Commission and was promptly halted. However, not before he had already collected $65 million dollars, and skimmed $28 million from gullible investors, which he deposited into various bank accounts in the US, then diverted it to Hong Kong and Shanghai Banking Corporation, who ended up playing a part in the laundering process, even after it had been warned that the WCM777 was operating fraudulently.

Even with Xu, the WCM777 and affiliates going down for violating the Securities Exchange Act and getting hit with stiff fines, this apparently did nothing to deter Fuentes from pursuing similar ventures surrounded by an atmosphere of fraud.

After the fall of Global Unity, in 2015, Fuentes managed to climb his way back up as a top investor for another investment company known as MoneyBox TV, which turned out to be yet another Ponzi scheme.

Similar to ArbiStar — which was yet to come — they based their business model on MLM with referral commission, which appears to be a running theme here. The company was situated in Italy, and was run by CEO Simone Di Sabato, who also had a history of being involved in otherwise questionable business practices himself.

Then, ArbiStar is born shortly after. As highlighted above, their arbiter bot crashes, as investor money seemingly disappears while ArbiStar seems to conduct damage control. What happened next might seem surprising. But this is how ArbiStar 2.0 came about, revamping their efforts in “developing automated trading crypto bots.”

ArbiStar and a dark web giant

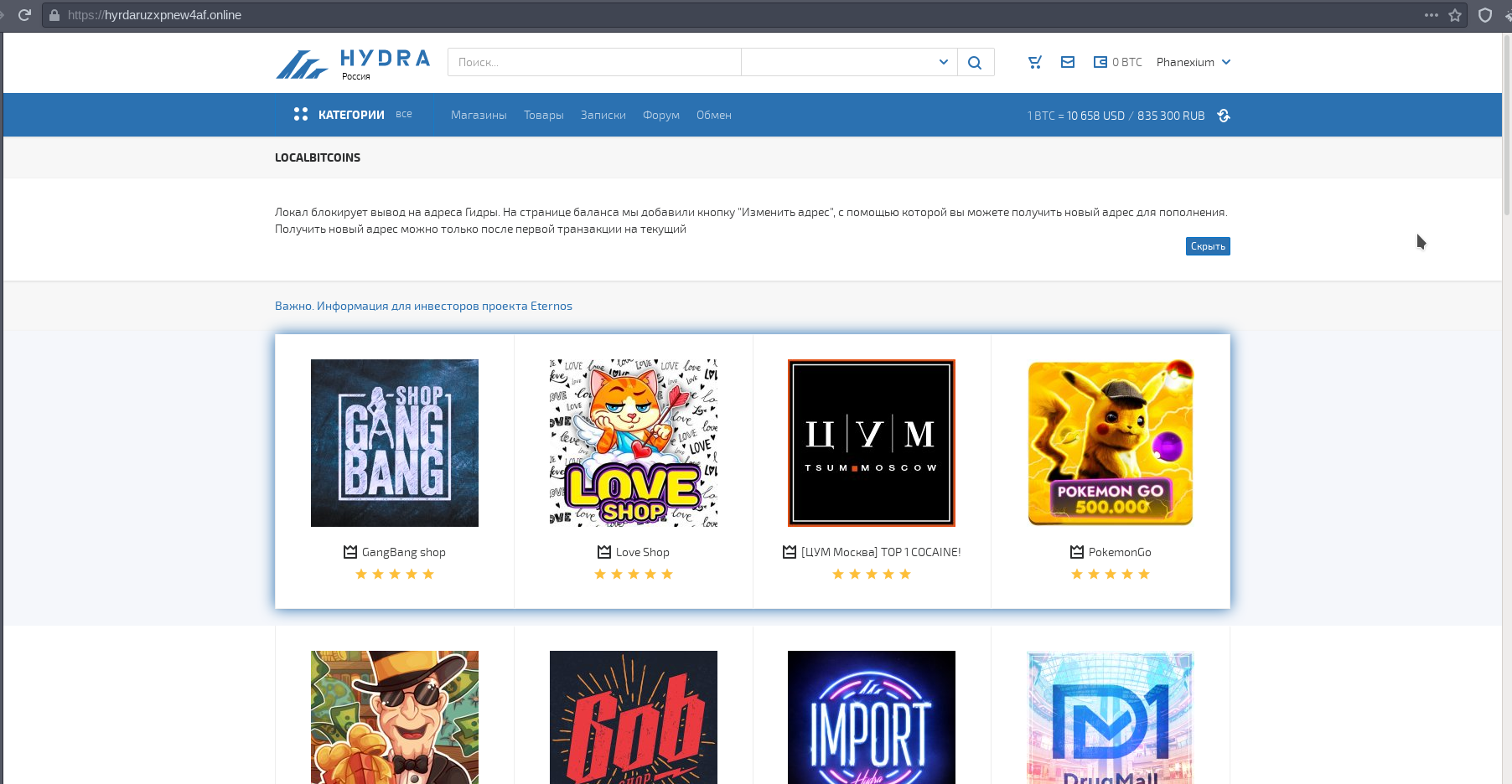

Within the reaches of the dark web lies a giant buried within underground servers in Russia known as the Hydra Market. Tulip Research tied ArbiStar to Hydra.

This darknet market (DNM) is the largest black market in the country and had its debut in January 2015 when it launched the platform with a strong focus on providing an underground platform for anonymous users to purchase drugs, but also includes hacking services, forged documents, stolen data dumps and other illicit goods. This move took place nearly two years after the Federal Bureau of Investigation shut down the infamous Silk Road DNM.

A Hydra Market interface screenshot.

The prolific Hydra DNM claims to have 3 million registered accounts on its network and processes over 100,000 daily crypto transactions. Additionally, this DNM has 400,000 recurring customers, according to an analysis published last year by the investigative news outlet, Proekt.

In comparison, the biggest DNM in the West was AlphaBay, which was believed to have 400,000 registered users at the height of its success. Its operations were shut down in 2017 by US authorities and international law enforcement officials.

As reported by Hydra’s website last year — which is tucked away on the Tor network and can only be accessed through an IP anonymizer — their aim is to expand its illegal drug operations around the world, which specifically includes countries in the West by seeking to raise $145 million in investment money through a token sale. This operation was set to launch in December 2016.

The marketplace encouraged customers to purchase a bundle of 100 tokens priced at $100 each — which can be purchased directly from their website for Bitcoin (BTC) — which would allow a buyer to the rights to 0.003% of the rights of the company, as well all profits generated by Hydra, although they are silent in regard to which blockchain the tokens would be associated with.

According to a memorandum published by Hydra, “It will start a new era in the West. The scale of expansion is hard to imagine.”

Hydra has had to postpone this endeavor due to the pandemic, which reinforces the impression that the operation has all the underpinnings of an exit scam as well.

The message revealing the postponement of the project launch due to the pandemic.

However, it is curious to note that Hydra appears to have a proactive position regarding the postponement, with a friendly message to their user base:

“All who bought the tokens have their money returned to their accounts in full. Thank you for being with us. We will let you know when we will return to the project.”

However, information regarding the success of this fundraising operation is rather ambiguous and vague. Whether or not it has been successful in attracting investors is largely unknown, at this time.

Suspicious transaction allegedly links ArbiStar to Hydra

After assessing a transaction made by ArbiStar, Tulip Research discovered a suspicious transaction conceivably linking ArbiStar to the Hydra market. On Sept. 16, 2020, Tulip Research reported on their Twitter feed:

“The address from where ArbiStar paid 274 users on 03/23/2019, received the Bitcoins from an address that, in the same transaction, also sent BTC to 18 accounts linked to Hydra Market: the most famous Russian black market on the darknet.”

Tulip research discovered that the address that ArbiStar had paid a total of 274 users back in March 2019 had also accepted the transaction of 11,917 BTC that also distributed satoshis to 18 different accounts that were connected to the Hydra DNM.

While this connection may appear insubstantial, in the weight of ArbiStar’s relevant history, especially the man behind it, it is not possible to ignore the trail of breadcrumbs he has left behind, in which others have pieced together.

For example, Tulip Research also discovered that ArbiStar was using BTCPayServer for the past year by taking advantage of a feature called PayJoin. PayJoin is a pay-to-end-point, allowing for more private peer-to-peer transactions and adding an element of obfuscation in comparison to traditional transaction methods, in an effort to conceal the money trail.

The forensic researchers were able to track various movements made by the company with the incoming transactions before its implementation. By applying heuristic methods, separate addresses can be related and thus distinguished as belonging to a single organization.

What’s interesting, in a recent interview, Fuentes placed the responsibility for the purported bot error on the development team, which ostensibly no longer works for ArbiStar since the date the company detected that “they did not do their job well.” Fuentes explained:

“The bot is not defective, but the communication between its operations and what is shown on the client’s screens. From the moment the mismatch was detected, we blocked the outflow of payments (withdraws). Since August 1, there has been no promotion or advertising of the Community Bot on social networks.”

Fuentes pointed out that the amount of money in dispute has nothing to do with the amount said in the media. He further revealed that the company’s plan is to reimburse everyone affected within a 12 months period, so that the victims of the so called bot error recover their contributions and obtain profits with the company’s products.

When asked whether ArbiStar has a license to receive money from investors, Fuentes stated that it is not necessary since the company deals with cryptocurrency, which, according to the law, is not considered money.

However, with all the compounding factors and history of relevant conduct, at hand, it is still yet to be determined exactly why ArbiStar continues to persist unchecked by securities regulators or what it’s precise relationship is with the titanic Russian dark web market, Hydra.