The Bitcoin (BTC) price is likely to complete wave four of a five-wave bullish impulse. After the correction is complete, a significant price rally is expected, moving towards the targets given below.

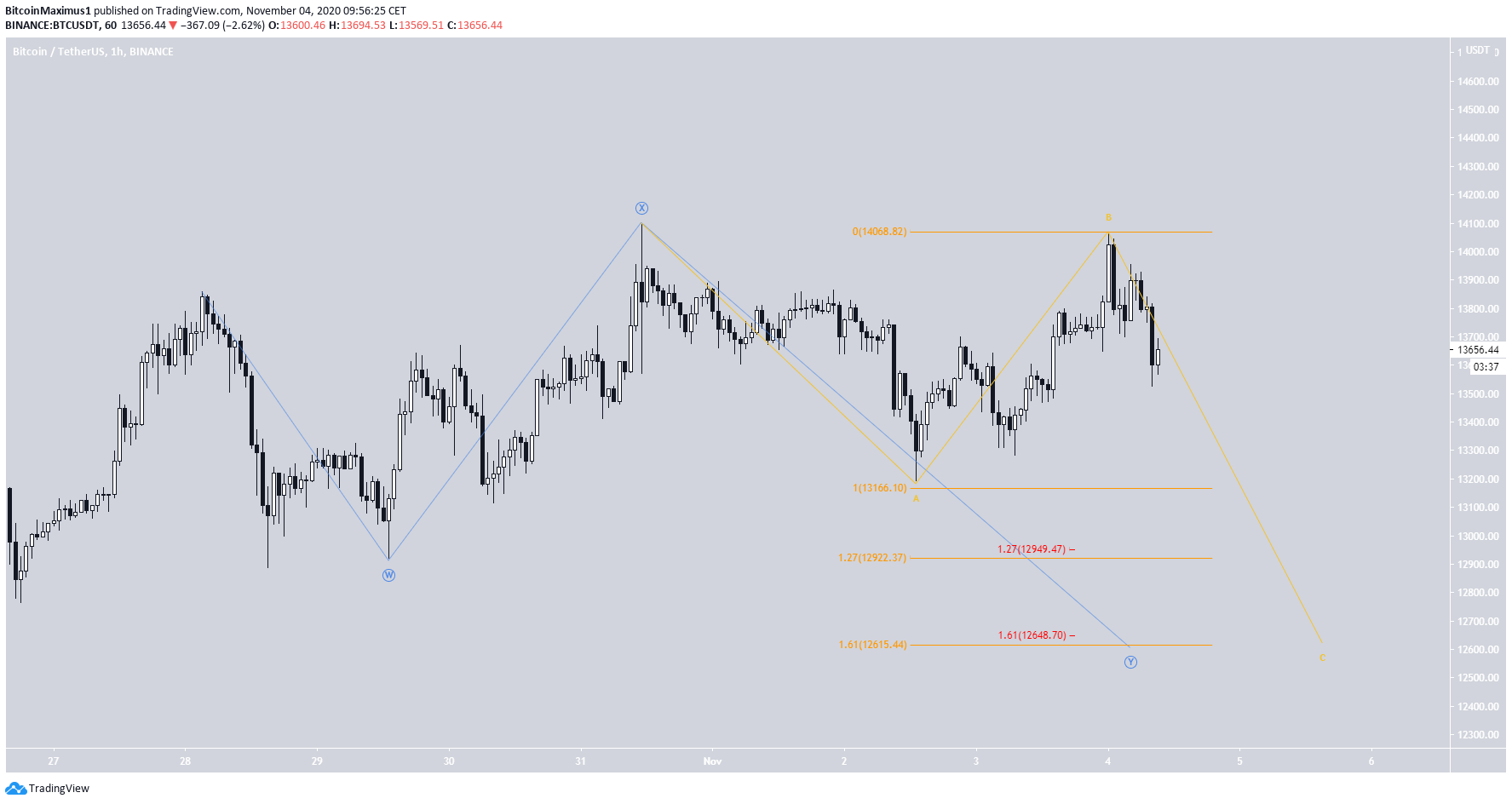

Complex Correction

The most likely count is that BTC is completing a complex W-X-Y correction (shown in blue below), currently trading in the Y wave. The Y wave is taking place in a flat A-B-C (orange), currently in the C wave. The three most likely targets for the C wave to end would be at $13,166, $12,922 and $12,615: the 1, 1.27, and 1.61 Fib levels (orange fib) of wave A. Using an external retracement on wave B gives us targets of $12,949 and $12,648 (red fib), coinciding with the latter two targets. Therefore, the two most likely targets would be where there is a confluence of fib levels, between $12,900 – $12,950 and $12,600 – $12,650.

Bitcoin Triangle

Cryptocurrency trader @CryptoTony_ outlined a possible wave count for BTC, in which the price is completing wave four inside a symmetrical triangle and will soon break out.

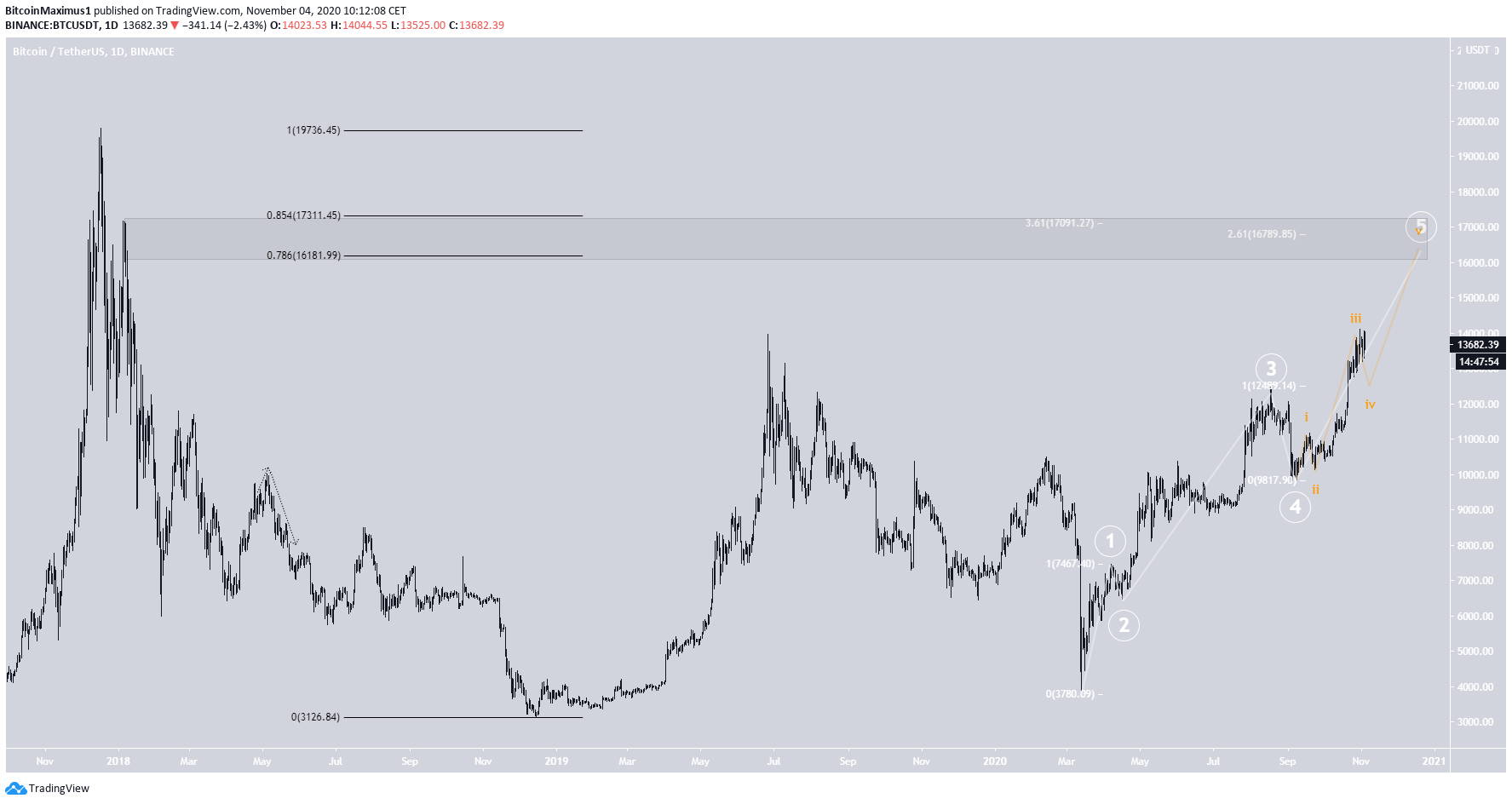

Bitcoin’s Future Move

As for the future movement, it’s likely that the previous correction is a part of a longer-term wave 4 (orange, highlighted), in an impulse that began on Sept 7. After the move is complete, wave five would likely end between $16,100 and $16,1300. These targets are found by using the Fib extensions of waves one and three.

Conclusion

To conclude, the Bitcoin price is likely to complete its correction below $13,000, before beginning an upward move that would take the price above $16,000. For BeInCrypto’s previous Bitcoin analysis, click here! Disclaimer: Cryptocurrency trading carries a high level of risk and may not be suitable for all investors. The views expressed in this article do not reflect those of BeInCrypto.Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Valdrin Tahiri

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

READ FULL BIO

Sponsored

Sponsored