Bitcoin markets have had a rare welcome boost this week following the Grayscale court victory, but the pump was minor, and the crypto climate remains cool. Analysts are currently looking at the remainder of this year as an extended accumulation period.

Hope and excitement over the recent crypto industry legal victory may be premature as markets remain in a long-term state of consolidation.

Bitcoin Accumulation Continues

On Aug. 29, Bitcoin prices jumped $2,000 following the Grayscale court victory against the SEC. However, the asset has not even reached previous support-turned-resistance levels at $29,000 and has already started to retreat.

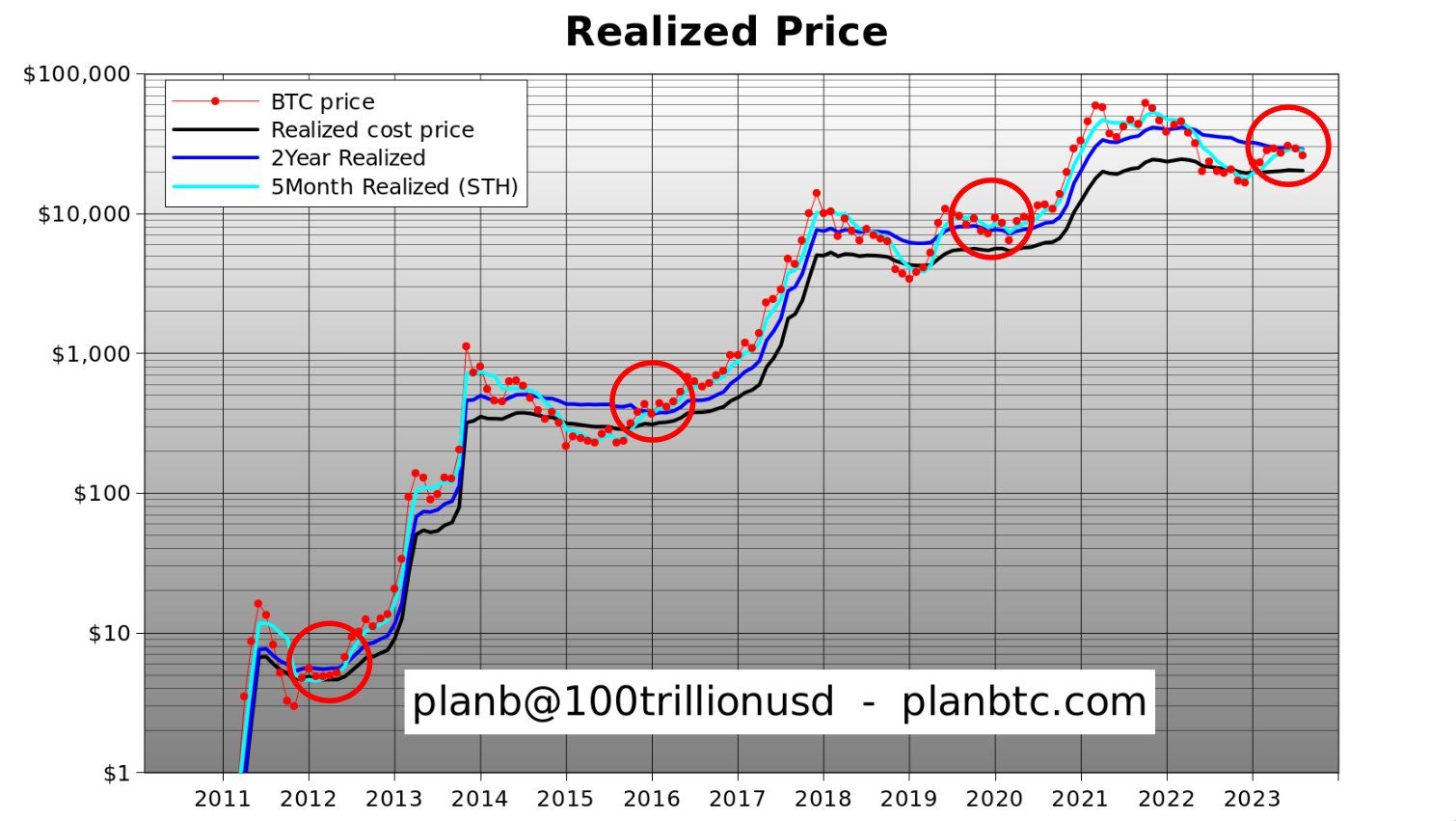

Analyst and stock-to-flow creator ‘PlanB,’ said that market patterns were repeating those from previous cycles. Bitcoin is hovering around its two-year realized price as it has done in the previous three cycles before the halving.

The realized price or realized cap is the value of all coins in circulation at the price they last moved. It could also be considered an approximation of what the entire market paid for their BTC.

“Bitcoin’s traditional dance around 2Y realized price (dark blue), a couple of months before a halving, and before the start of stage-2 bull market. Patience.”

Furthermore, the six-month period before a halving has always been slow, especially in August and September.

Fellow analyst “IncomeSharks” echoed the sentiment stating, “We should have all winter to accumulate BTC before 2024.” He added,

“Ideally, a local bottom forms in October. Winter is rarely kind to Crypto but usually makes for amazing entries.”

Another pullback has been predicted, followed by a couple of months consolidating around the $25,000 to $26,000 area to see out the year.

CryptoQuant analysts reported that the recent BTC rally was driven by derivatives exchanges, not spot exchanges. This suggests that there has been very little retail action or buying of BTC on spot markets in response to the news.

BTC Price Outlook

Furthermore, we can see the notion in BTC spot prices that have already started to retreat after they pumped to $28K in late Tuesday trading.

Bitcoin has already retreated 2% since that high and was trading at $27,427 at the time of writing.

Moreover, the asset is still down 6% over the past fortnight despite one of the most positive legal outcomes of the year.

It appears that ‘crypto winter’ is still very much in play.