Bitcoin’s bull cycle is approaching its final stage after 997 days since the cycle bottom on November 21, 2022.

This suggests the peak could occur within 70 days, likely between October 15 and November 15, 2025.

Bitcoin Cycle Peak in October–November 2025

In a recent observation of Bitcoin’s historical cycles, analyst CryptoBirb shared some notable insights.

Historical data presented by this analyst outlines the length of past bull cycles: 2010–2011 (~350 days); 2011–2013 (~746 days); 2015–2017 (~1,068 days); 2018–2021 (~1,061 days). If history repeats, the current cycle is projected to last around 1,060–1,100 days.

As of now, counting from the previous cycle bottom on November 21, 2022, Bitcoin’s bull run has lasted 997 days and is nearing its final phase. The peak could appear within the next 70 days if history follows the same pattern.

“Peak odds also highest in next 3 months, with the sweet spot between Oct 15 & Nov 15, 2025,” CryptoBirb noted.

Timing the cycle peak based on Bitcoin halving events yields a similar projection. The 2012 halving to the 2013 peak took about 366 days; from 2016 to 2017, about 526 days; and from 2020 to 2021, about 548 days. Based on this, the period from the 2024 halving to the next peak could be around 518–580 days.

“This one puts next peak between Oct 19 & Nov 20, 2025 (518–580 days),” CryptoBirb added.

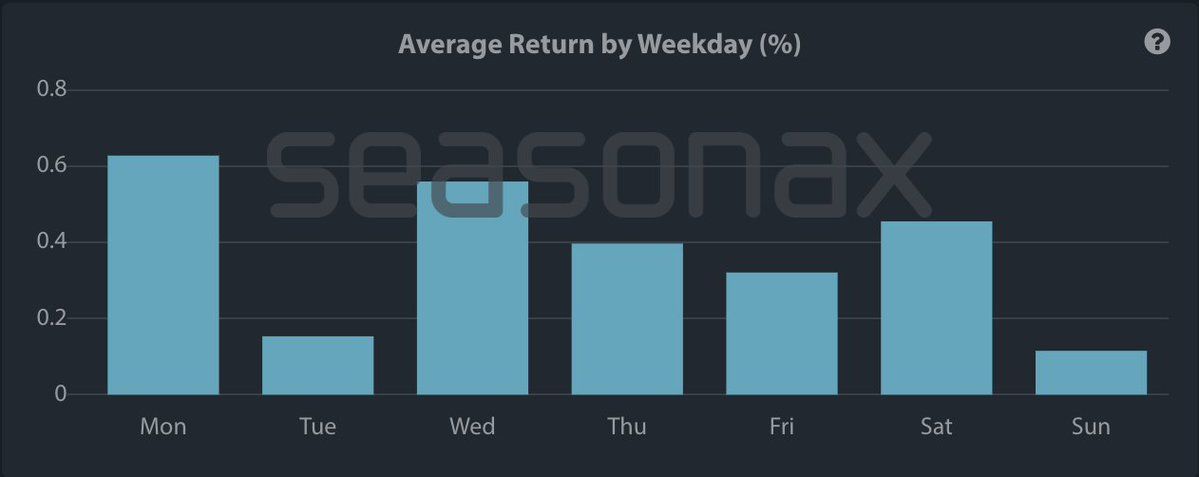

To further support this view, CryptoBirb pointed out that in past cycles, October and November have often been Bitcoin’s strongest growth months, particularly on key dates like Monday (October 20, October 27) and Wednesday (October 22, October 29). Among these, October 22 is the most likely window for a price breakout.

The overlap between the four-year cycle of the U.S. presidential election and Bitcoin’s supply halving further strengthens the hypothesis that the cycle peak will fall between mid-October and mid-November 2025. This pattern has repeatedly been observed when political factors, combined with supply scarcity, fuel strong bull runs.

“Next ATH odds strongly cluster Oct 15–Nov 15, 2025 — where history, math, and market momentum align. My guess is we won’t be too far off 4th week of October,” CryptoBirb said.

This aligns with the view of Alphractal’s CEO, who believes that the Bitcoin cycle remains intact and is highly likely to peak in October, but cautions investors to brace for heightened volatility before the top is reached.

Bear Market in 2026

From a market psychology perspective, the pre-peak phase often sees extreme euphoria, surging trading volumes, and peak search interest for Bitcoin-related keywords. This phase can also feature sharp short-term corrections to “shake out” weak hands before prices increase.

Bitcoin has already been experiencing strong upward momentum alongside recent corrective pullbacks.

Following the peak, historical trends indicate that bear markets typically last between 370 and 410 days, with an average decline of about –66%. If this scenario repeats, a downtrend could begin in 2026, ushering in a deep correction phase before the next accumulation period begins.

This is why many analysts recommend an exit strategy before the market reverses. Some investors have already planned to cash out of crypto before December to fully secure their profits.

However, as BeInCrypto previously reported, some experts believe the Bitcoin cycle is “dead.” Forecasting risk is harder now, as a potential institutional panic could redefine future bear markets.