Bloomberg’s senior ETF analyst Eric Balchunas has stated that while BlackRock’s iShares Bitcoin Trust ETF (IBIT) has done well since its launch last year, it faces several challenges going forward.

This assessment comes amid recent signs of turbulence in the broader Bitcoin (BTC) exchange-traded fund (ETF) market.

Upcoming Challenges for IBIT Bitcoin ETF

Balchunas pointed to a crucial factor that could hinder IBIT’s continued growth: Bitcoin’s tendency to decline when stocks fall. This correlation presents a unique challenge for the Bitcoin ETF, as it could struggle to gain significant adoption compared to more traditional ETFs.

“IBIT did reach $50 billion in first year (it took VOO six years to hit that mark) so definitely one to watch but it would take a ton more adoption (flows), and you probably need a break in correlation with stocks,” Balchunas added.

Despite concerns about Bitcoin’s market volatility, recent 13F filings reveal a growing interest in IBIT. A 13F filing is a quarterly report mandated by the US Securities and Exchange Commission (SEC) for institutional investment managers overseeing more than $100 million in assets.

It offers transparency into major players’ investment activities. All filings must be made public within 45 days of the quarter’s end. Therefore, the deadline for Q4 2024 was February 14, 2025.

Balchunas mentioned that IBIT had attracted 1,100 holders through 13F filings. The previous record for a first-year ETF was around 350 holders.

“For context, NUKZ, a pretty successful nuclear theme ETF launched same day as IBIT has 29 holders. Most newbies have under 10,” he said.

Notably, IBIT remains the largest Bitcoin ETF, holding 2.98% of the total supply. It has continued to attract substantial investments from major players, with the latest being Abu Dhabi’s Mubadala Sovereign Wealth Fund. Last week, Mubadala invested $436 million into BlackRock’s ETF, becoming the seventh-largest holder.

From a broader perspective, institutional adoption of Bitcoin ETFs has seen a remarkable growth. The assets under management tripled in Q4, reaching $38 billion.

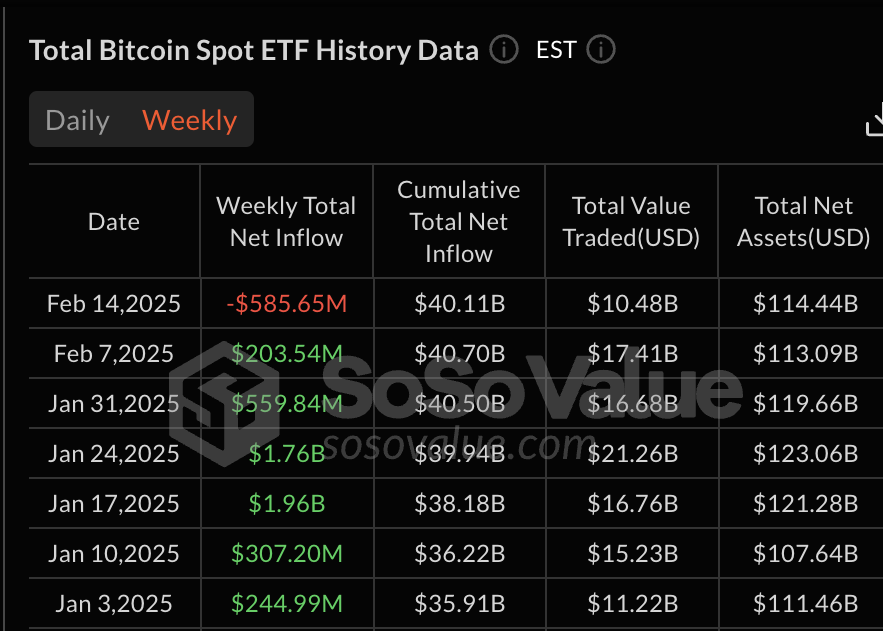

Yet, recent data shows that the momentum has slowed in 2025. Bitcoin ETFs saw their first week of net outflows last week. The weekly total net outflow reached over $585 million. Furthermore, the trend seems to be continuing.

On February 18, Bitcoin ETFs experienced $129 million in outflows. As BeInCrypto highlighted earlier, this could be due to investor caution following Jerome Powell’s rejection of rate cuts and ongoing concerns over high inflation.