The total crypto market capitalization has reached a new high in October, surpassing $4 trillion. Bitcoin and top altcoins are attracting most of the liquidity, which means their potential liquidation volumes are rising significantly.

This article highlights the potential risks facing leading altcoins that could trigger large-scale liquidations for overleveraged short-term traders in the second week of October.

1. Ethereum (ETH)

At the start of October, Messari reported that institutional investors (DATs) now hold a larger percentage of the ETH supply than BTC. This confirms that the accumulation demand for ETH remains strong.

“Growing ETF flows, ETH staking ETF approvals, and expanding global liquidity are prime catalysts for ETH’s next leg up in its step function,” Rick, Analyst at Messari, predicted.

Short-term traders have become more confident in their long positions, expecting ETH to reach new highs this month. This explains why the total liquidation volume for long positions has recently exceeded that of shorts.

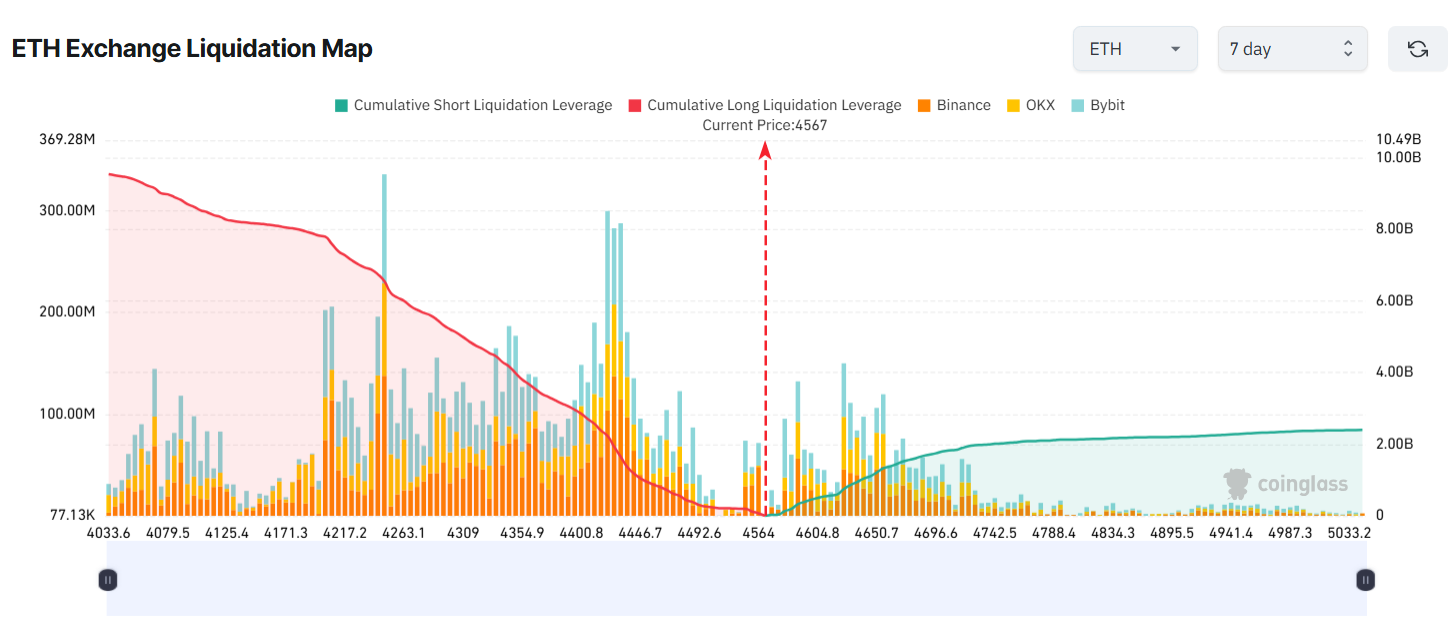

According to Coinglass, if ETH drops to $4,030 this week, over $9 billion in long positions could be liquidated. Conversely, if ETH climbs above $5,000, about $2 billion in short positions may be wiped out.

However, there are warning signs that long traders may be ignoring:

- First, about 97% of all ETH addresses are currently in profit. Historically, when this ratio exceeds 95%, it often signals a potential market top as investors begin taking profits.

- Second, on-chain data shows that some long-term ETH whales have started selling. On October 5, Trend Research deposited 77,491 ETH (worth $354.5 million) into Binance for sale. Lookonchain also reported another ETH whale becoming active after four years to move coins onto exchanges.

If selling pressure continues to build this week, mass liquidations of long positions could follow.

2. XRP

In October, the SEC will review multiple XRP ETF applications from major financial institutions, such as Franklin Templeton, Hashdex, Grayscale, ProShare, and Bitwise.

“Some of the biggest names in the industry are involved, with fund sizes ranging from $200M to $1.5T. If even one of these gets approved, it could bring a huge wave of institutional money into XRP,” Analyst Crypto King predicted.

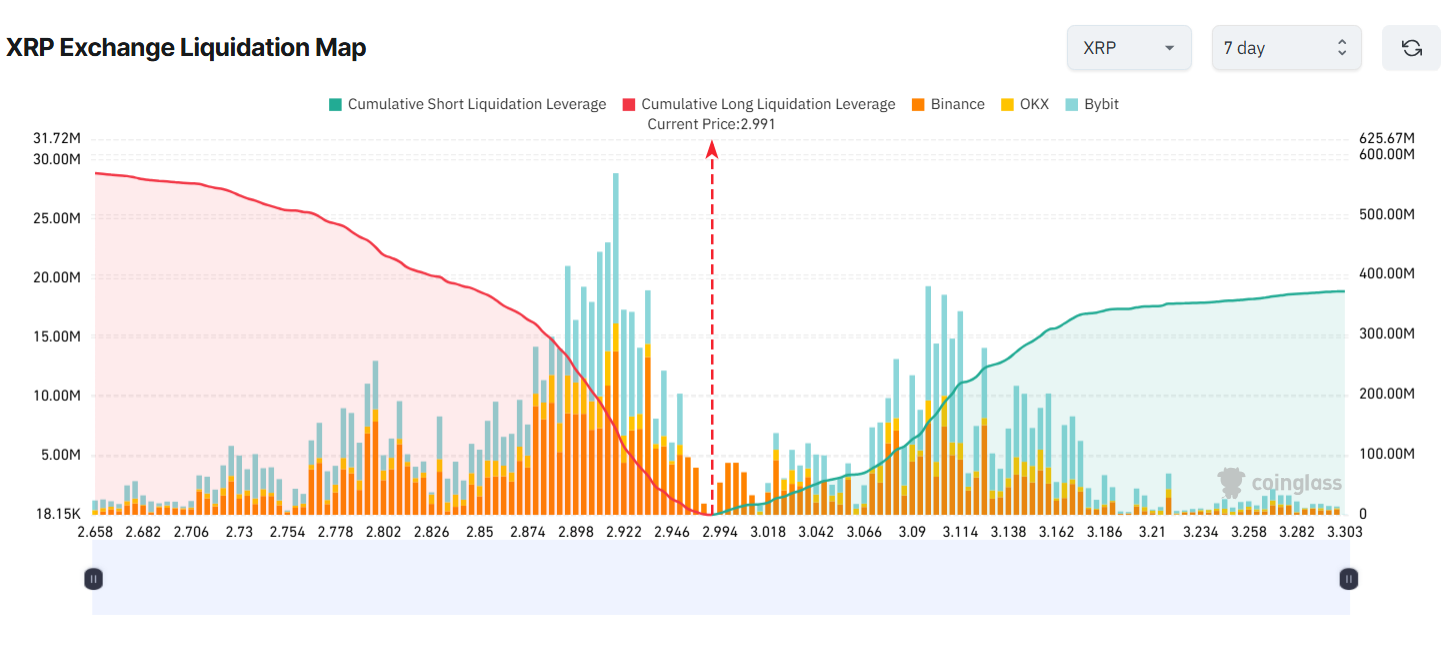

This optimism has driven traders to bet heavily on a bullish continuation for XRP. The liquidation heatmap shows a clear imbalance, with long positions dominating.

If XRP falls to $2.65 this week, approximately $560 million in longs could be liquidated. Conversely, if it rises to $3.3, around $370 million in shorts could be wiped out.

However, several warning signs have surfaced for long traders of XRP:

- The XRP balance on exchanges has risen sharply at the start of October, with about 320 million XRP being deposited.

- XRP whales have been selling aggressively, bringing their holdings down to the lowest level in nearly three years.

These are strong signs of profit-taking activity, posing significant liquidation risks for overleveraged long positions.

3. Binance Coin (BNB)

BNB has continued setting new highs in October, trading above $1,200. Traders appear to be caught in a FOMO rally, piling into bullish positions for short-term gains.

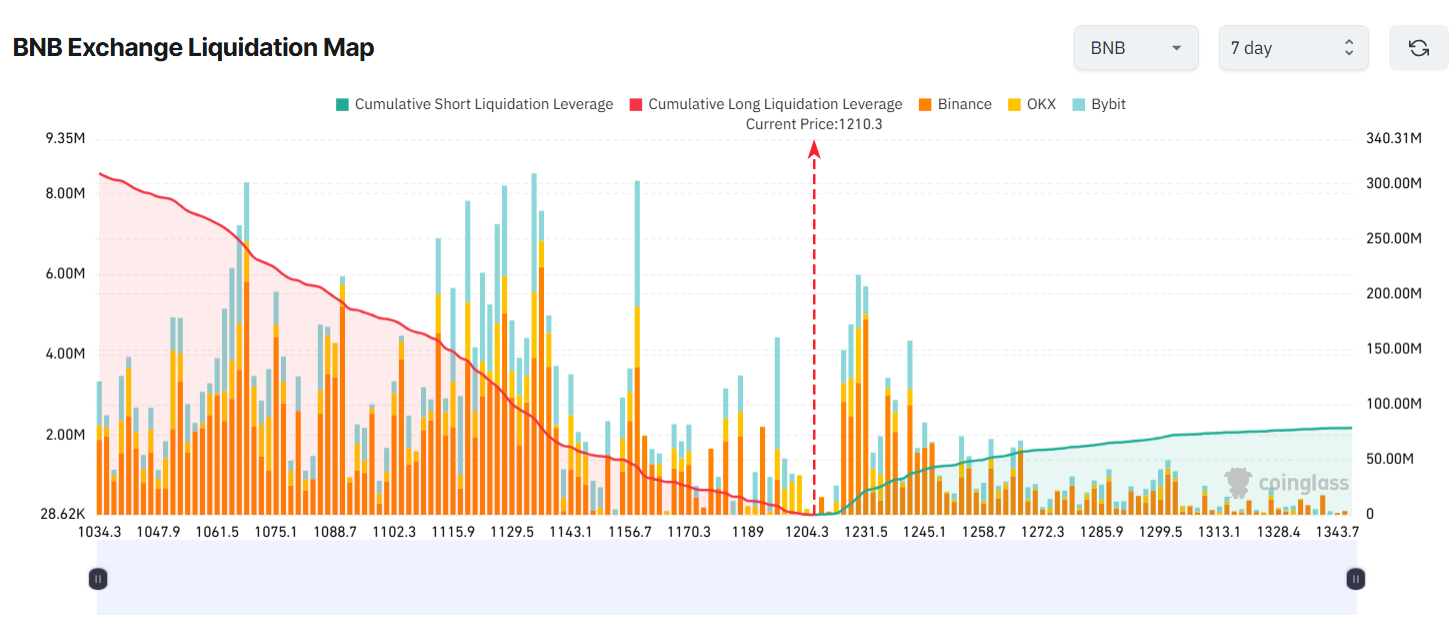

The 7-day liquidation map indicates that if BNB drops to $1,034, total long liquidations could exceed $300 million. Conversely, if it climbs to $1,340, short liquidations would total around $80 million.

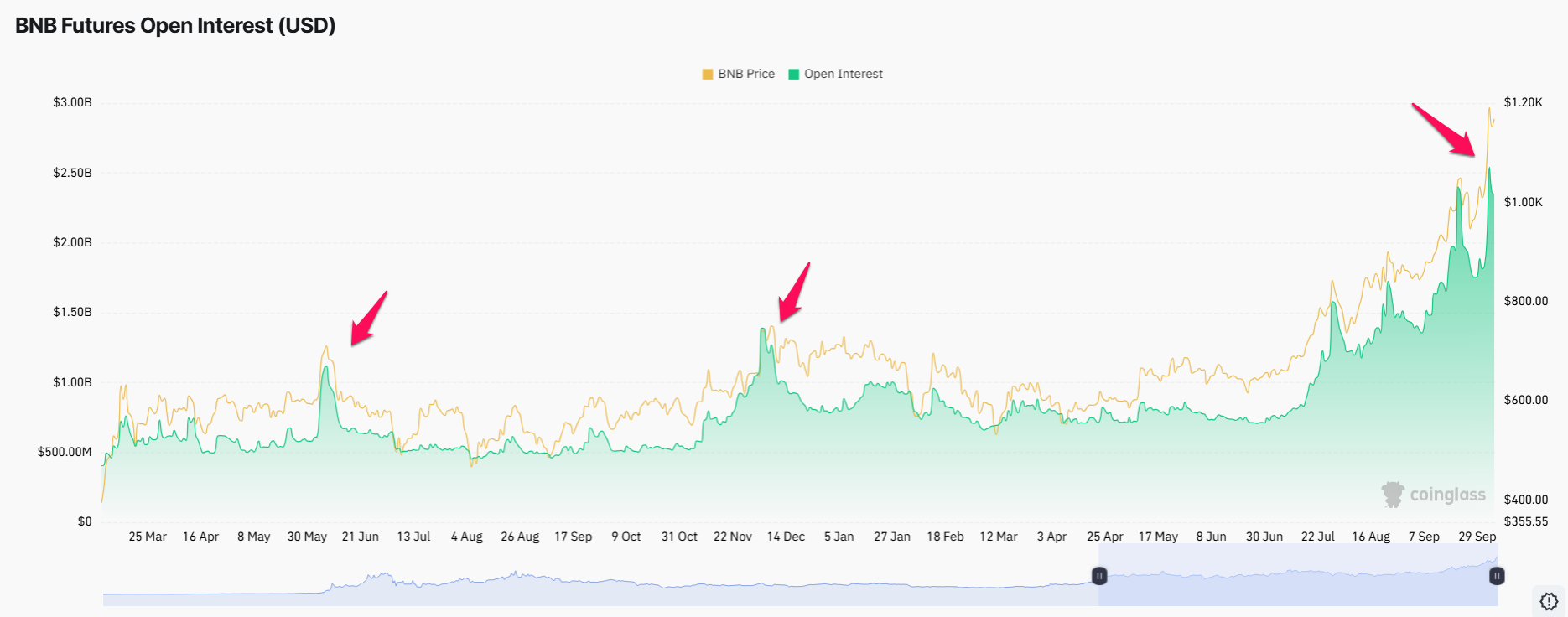

While BNB could still extend its rally, the total open interest (OI) for BNB in October has surpassed $2.5 billion — its highest level ever. Historical data shows that BNB’s OI spikes often precede sharp market corrections.

Long traders may still profit if the uptrend continues. However, without strict risk management, they face the danger of heavy liquidation losses if BNB experiences a sudden reversal.