Altcoin season is still not here, but traders are already watching for early signals. One DeFi-specific sector stands out more than others: decentralized exchanges. Whales have been buying DEX tokens during a weak market, and their price behavior shows they can move on their own when Bitcoin slows down.

If the next altcoin season arrives, this is one of the few groups that already shows early leadership traits. Let us understand why!

Reason 1: DEX Trading Share Keeps Rising Against CEX Spot and Perps

The DEX market has been gaining ground all year.

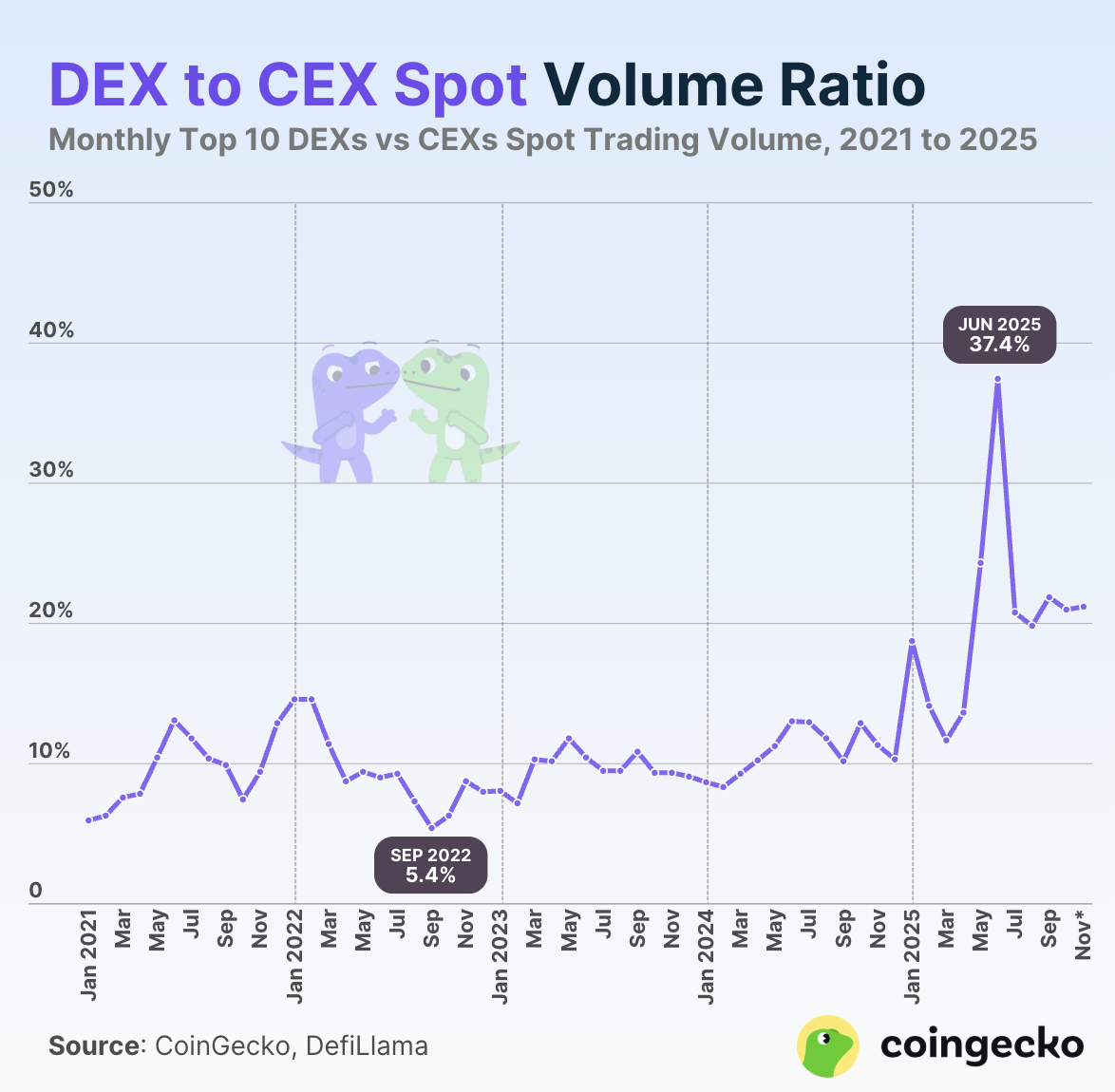

Spot DEX trading volume, measured as a share of global spot volume, has climbed from 5.4% in September 2022 to 21.19% in November 2025. June 2025 peaked at 37.4%, the highest level on record. This shows users are moving more spot activity on-chain even when the broader market is weak.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

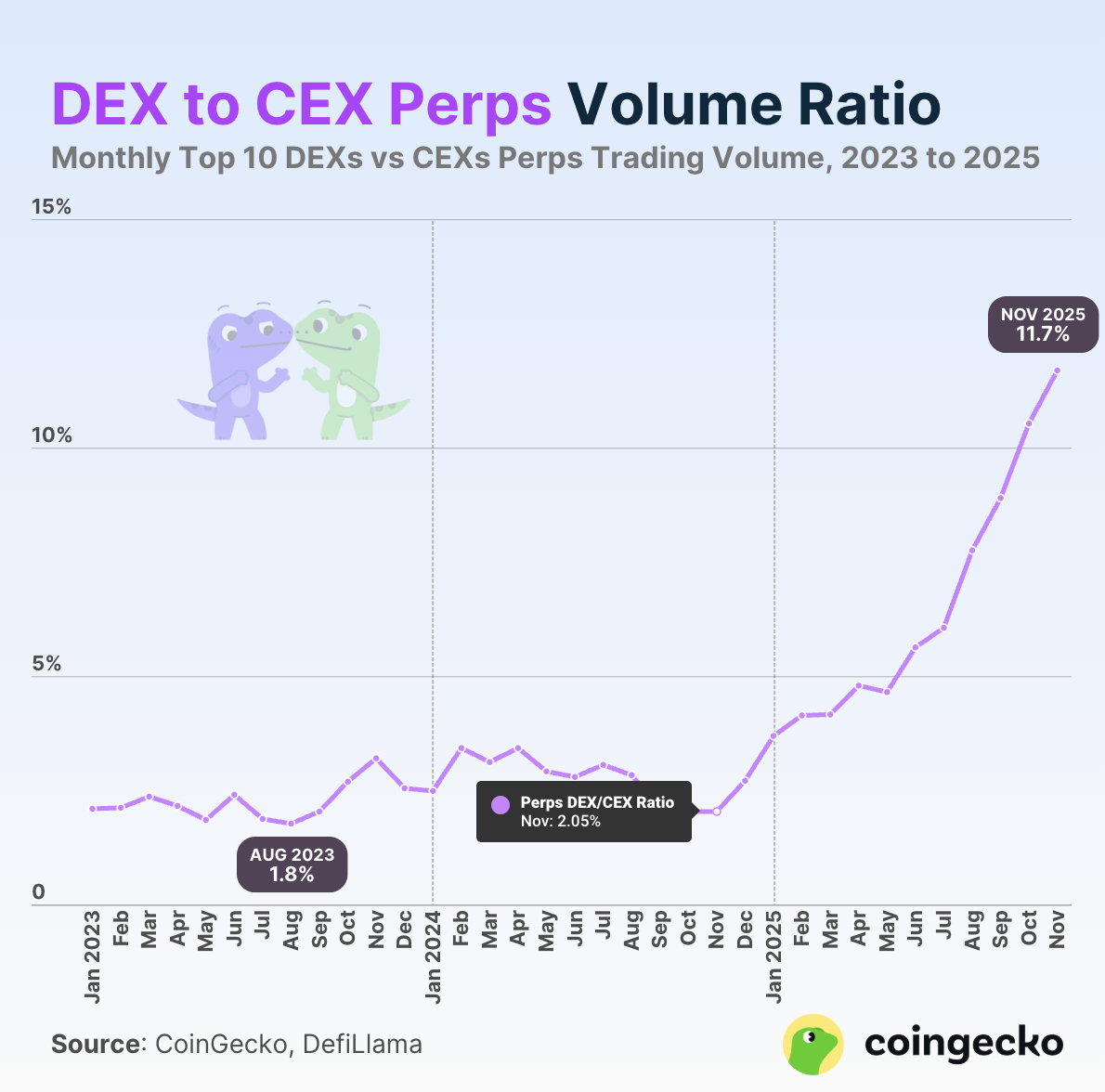

Derivatives activity tells the same story.

The DEX-to-CEX perpetuals ratio jumped from 2.05% in November 2024 to 11.7% this month, its strongest reading yet. When more traders choose on-chain perpetuals over exchange-based ones, it suggests confidence in DEX systems is rising.

Despite this strength, the DEX token category is still down 3.9% in the past week, while CEX tokens are up the same amount. This gap points to undervaluation and creates room for DEX tokens to catch up if sentiment improves.

That is why this subcategory is becoming one of the first places traders check when they rotate away from majors.

Reason 2: Whales Are Quietly Accumulating Key DEX Tokens

DEX-specific price action looks weak on the surface, but large wallets have been buying steadily. Whales and mega-whales added across the major DEX names even while prices drifted sideways to lower over the last 30 days.

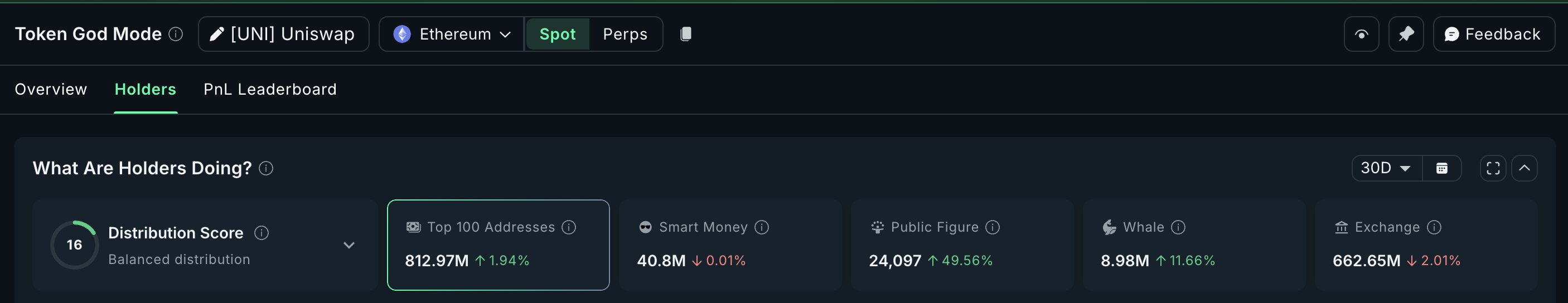

Uniswap (UNI) is down 3.4% in 30 days, but mega-whales increased holdings by 11.66%. Top 100 addresses now hold 8.98 million UNI, showing strong accumulation while exchanges continue to lose supply.

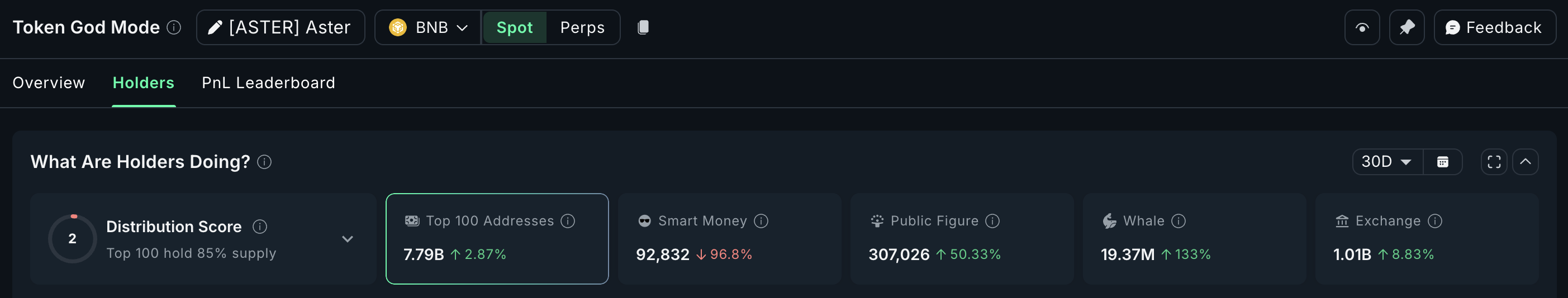

Aster (ASTER) is almost flat in 30 days, up 0.9%, but the whale signal is even stronger. Whale holdings jumped 133%, and top-tier addresses added 2.87% more supply. Retail wallets continue to sell (exchange netflows in green), but whales positioning early is usually the first sign of a sector turning before price follows.

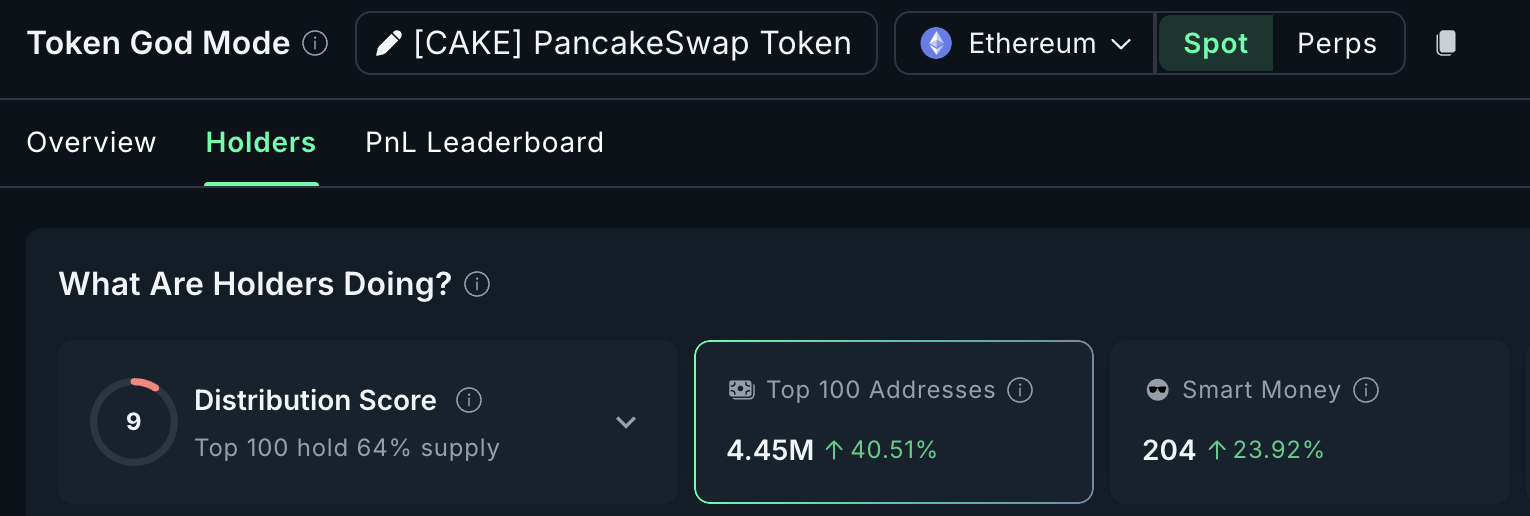

PancakeSwap (CAKE) is down 5.4% in 30 days, yet the top 100 addresses (mega whales) increased their balances by 40.51%.

This pattern across three unrelated DEX ecosystems shows one common message: large holders are building exposure during weakness, not exiting.

When a sector shows rising on-chain adoption and rising whale demand at the same time, it often becomes one of the earliest beneficiaries when risk appetite returns.

Reason 3: DEX Tokens Move Differently When Bitcoin Stalls

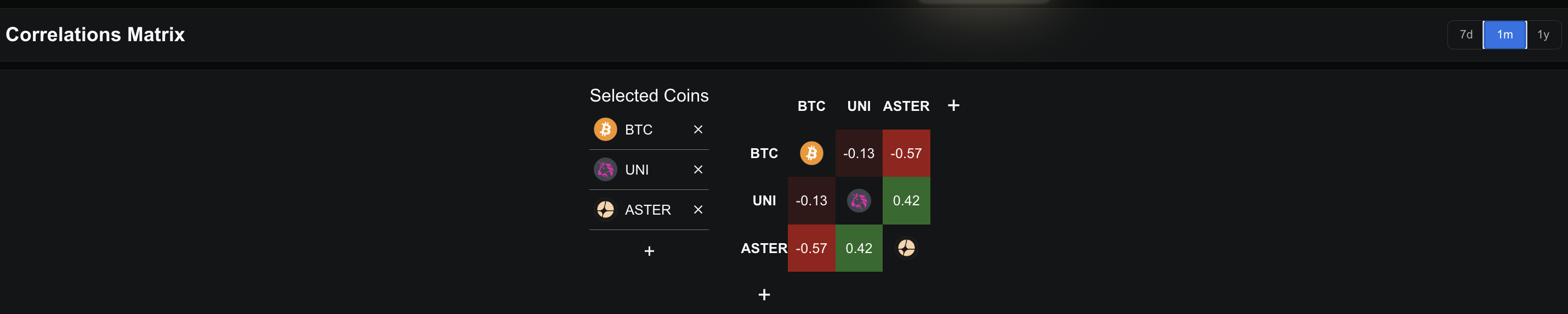

Monthly correlation trends show that key DEX tokens are no longer moving in lockstep with Bitcoin. Correlation here refers to the Pearson correlation coefficient, which measures how two prices move together. A negative value means they move in opposite directions.

UNI shows a light negative correlation with Bitcoin at –0.13. ASTER shows a much stronger negative reading at –0.57, which is rare during a Bitcoin-led market.

This means that when Bitcoin pulls back, these tokens often do not follow immediately. In some cases, they attract early speculative flows because they move independently. This independence is one of the earliest signs of altcoin rotation.

Charts support the same view.

ASTER’s 12-hour chart shows a completed bearish crossover between the 20-period and 50-period EMA (Exponential Moving Average), and the bearish power has been decreasing since. When a token with negative BTC correlation shows weakening bearish pressure post bearish crossover, it becomes one of the first candidates to rebound if market conditions flip.

An EMA is a moving average that gives more weight to recent price candles.

UNI trades inside a tight pennant with a weak upper trendline, only two touchpoints. A break above $6.91 opens $8.06 and then $10.26, but it will need confirmation from its on-balance volume (OBV). OBV measures volume flow, and without an upside shift, breakouts often fail. Still, the technical structure aligns with the whale accumulation and the negative correlation backdrop.

This combination—whales buying, bearish power fading, and price decoupling—is exactly how early altcoin leaders behave before a broader cycle starts.

But Altcoin Season Has Not Started Yet

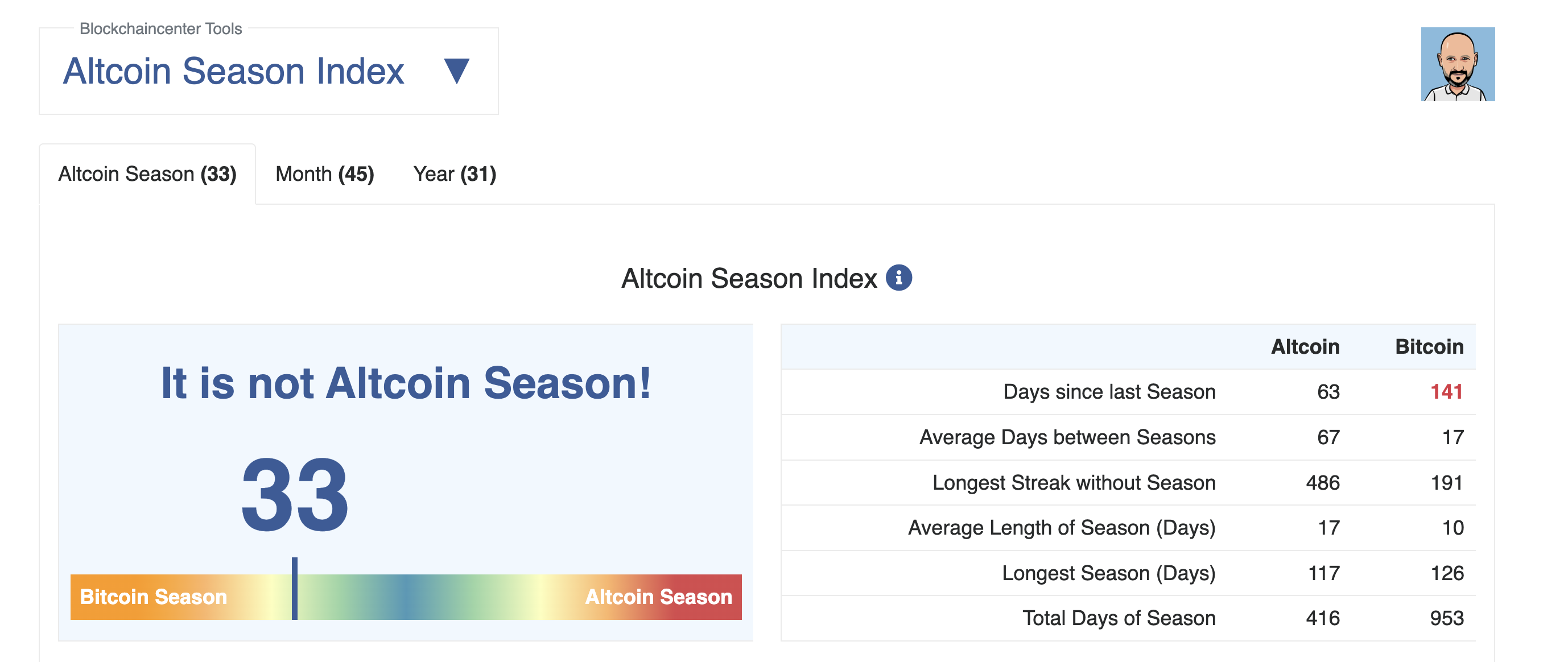

According to BlockchainCenter’s Altcoin Season Index, the current score is 33, far below the 75 threshold that signals a true altcoin season.

The index also shows that we are 63 days since the last altcoin season burst and that the average gap between seasons is 67 days. This places the market close to the window where rotations usually start, but not there yet.

Bitcoin dominance is still high, which means Bitcoin still controls most of the money flowing in and out of crypto. For an altcoin season to form, two things must happen together:

- The total crypto market cap needs to grow.

- Bitcoin dominance needs to fall at the same time.

That combination would show that traders are moving money from Bitcoin into altcoins. Only then can a sector break out in a sustainable way.

If that shift happens in this cycle, DEX tokens have one of the strongest cases to lead the early wave. They already show rising volume share, steady whale demand, and negative correlation with Bitcoin—traits that often appear in the sectors that rotate first.