While Binance is pushing for higher adoption and dominance of its stablecoin, it will be crucial to see how the exchange addresses hyper-centralization issues.

The last few months saw several stablecoins become unstable amid high market volatility and the larger market’s bearish blues. However, Binance’s stablecoin, Binance USD (BUSD), has remained afloat, keeping its $1 peg alive, despite market pressure.

A few days ago, the world’s largest crypto exchange by market volumes, Binance, made an announcement about releasing an auto-convert feature for USD Coin (USDC) and other stablecoins with Binance USD (BUSD).

On one hand, the auto-convert feature could drastically increase BUSD’s market dominance; however, on the other hand, the move received considerable backlash from market participants.

So, amid fears of centralization of stablecoins, can Binance’s move to strengthen BUSD’s position play in the favor of the stablecoin?

Binance BUSD Monopoly game

Stablecoins form an indispensable part of the cryptocurrency ecosystem mostly due to their ability to provide traders and investors with a safety net during times of high volatility.

A variety of stablecoins help the larger ecosystem maintain its decentralized nature. However, recent strides made by the top retail exchange Binance to strengthen their stablecoin BUSD’s position have been viewed with skepticism.

Following in Binance’s footsteps, Indian crypto exchange WazirX also announced the delisting of major stablecoins Tether (USDT), Pax Dollar (USDP), and True USD (TUSD), and subsequent conversion to BUSD.

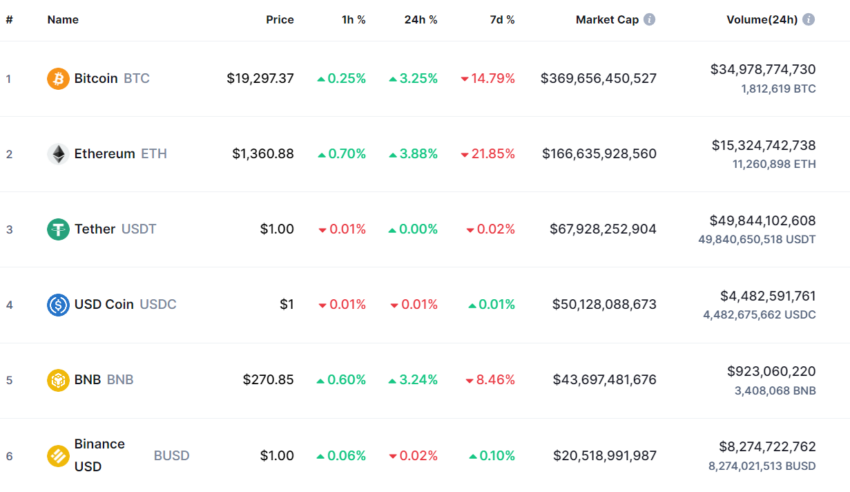

At press time, BUSD was the third largest stablecoin by market capitalization, preceded by USDT in first place and USDC in second.

Binance’s auto-convert announcement managed to pump BUSD’s trade volumes by close to 70% around Sept. 6.

Eliminating stablecoins like USDT and USDC from the ecosystem, Binance paves the way for higher BUSD usage, but that doesn’t leave concerns of centralization out of the picture for BUSD.

Will centralization concerns bite Binance?

While on the outside, the idea of dominating the stablecoins seems plausible, on-chain data paints a different picture for BUSD.

Data from Into The Block presents high centralization levels for BUSD at around 94% of all the BUSD supply is controlled by four addresses. Around 19.31 billion BUSD, equivalent to $18.98 billion, making 93.46% of the total coins was controlled by four addresses, as seen in the table below.

The holdings distribution matrix indicator shows a breakdown of different groups of addresses according to the balance that they hold. Notably, for USDC and USDT, addresses with over 1 billion held a mere 14.74% and 16.09% of the total coins which was drastically low in comparison to BUSD.

Highly centralized stablecoins have become a matter of concern in the crypto ecosystem. While Binance aims to work on increasing BUSD’s dominance, it will be crucial to see how the firm will deal with centralization concerns.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.