Algorand (ALGO) has witnessed a renewed interest in its investors amid the recent broader market rally. The past few days have been marked by a surge in the demand for the token, pushing its price upward.

By exchanging hands at $0.15, ALGO’s value has increased by 12% in the past seven days.

Algorand Sees Spike in Buying Pressure

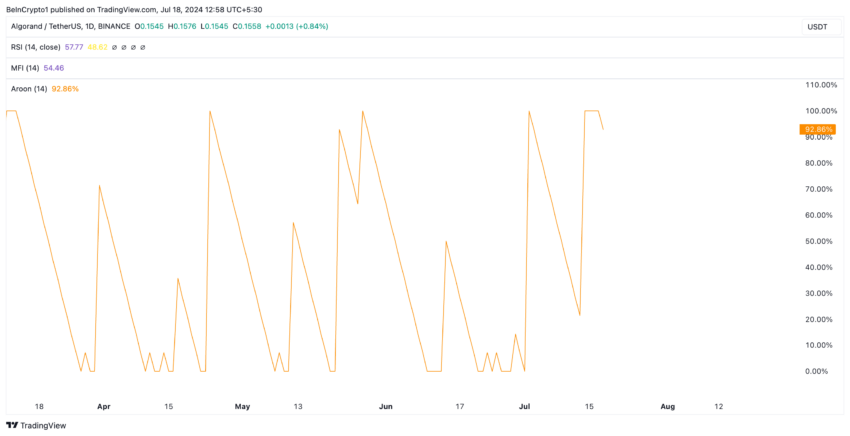

Algorand’s (ALGO) key momentum indicators observed on a daily chart confirm that buying pressure outweighs selling activity among market participants.

For example, the altcoin’s Relative Strength Index (RSI) is in an uptrend at 58.52 at press time. Likewise, its Money Flow Index (MFI) rests above the 50-neutral line at 54.50.

An asset’s RSI measures its overbought and oversold market conditions. It ranges between 0 and 100, with values above 70 indicating that the asset might be overbought and a price correction or reversal might occur. On the other hand, RSI values below 30 suggest that the asset might be oversold, and a rebound could happen.

The MFI is similar to the RSI but uses price and volume data to identify overbought or oversold conditions in an asset. An MFI above 80 typically suggests that the asset is overbought, while values below 20 indicate that the asset is oversold.

The current RSI and MFI values for ALGO indicate increasing buying pressure, which is starting to outpace selling activity. This suggests a growing demand for the altcoin.

Read more: What Is Algorand (ALGO)?

Further, ALGO’s Aroon Up Line is 92.86% at press time. This confirms the strength of its current uptrend and hints at the possibility of a further price rally.

An asset’s Aroon Indicator tracks its price and identifies potential price reversal points. When the Aroon Up line is close to 100, it indicates that the uptrend is strong and that the most recent high was reached relatively recently.

ALGO Price Prediction: There is Potential For More Growth

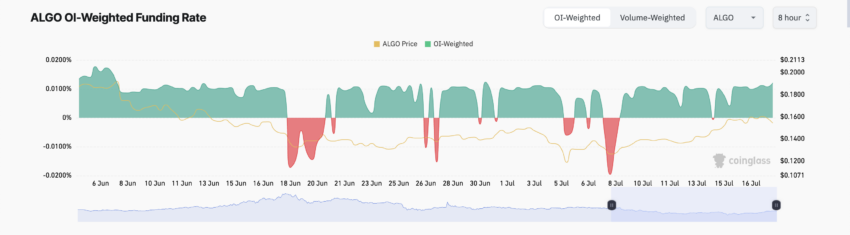

Another bullish signal that confirms the possibility of further price growth is ALGO’s positive funding rate across cryptocurrency exchanges. Since July 10, the token’s funding rate has remained above 0. According to Coinglass data, it is currently 0.01%.

When an asset’s funding rate is positive, it suggests a strong demand for long positions. It is considered a bullish signal and a precursor to an asset’s continued price growth.

A consistently positive funding rate indicates that an asset’s spot price is rising. If ALGO’s price maintains its uptrend, it may exchange hands at a monthly high of $0.16.

Read more: Algorand (ALGO) Price Prediction 2024/2025/2030

However, if market sentiment shifts from positive to negative, and downward pressure is put on its price, ALGO’s value may drop to $0.11.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.