Algorand (ALGO) price is showing bearish signs and is expected to break down below the $0.29 range. This would take its price to a new yearly low and potentially accelerate the rate of decrease.

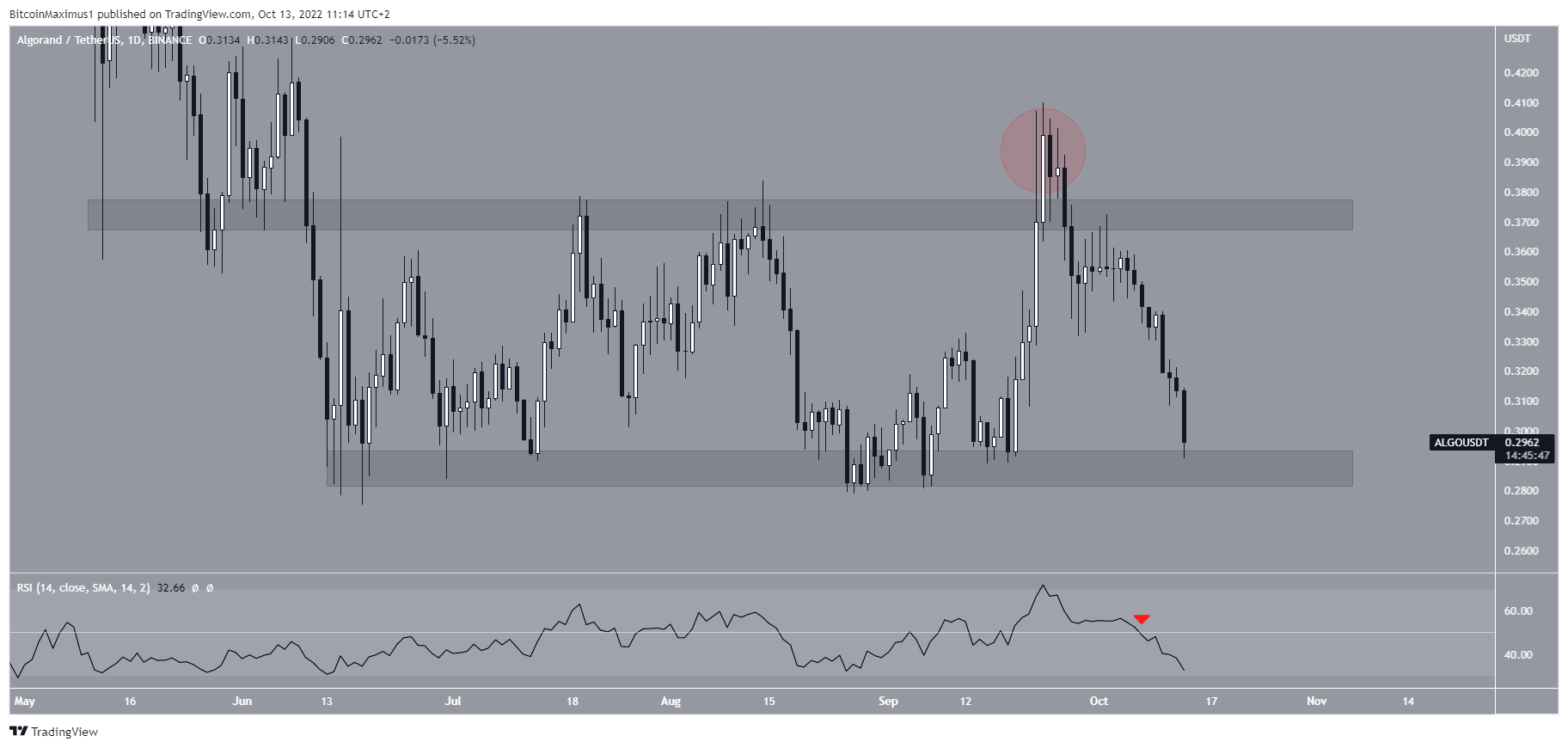

Since May 12, ALGO has been trading in a range between $0.29 and $0.37. On Sept. 23, the price reached a high of $0.41.

This seemed like a breakout above the top of the range. However, it has been falling since, rendering the supposed breakout (red circle) as only a deviation.

This downward price movement was also combined with an RSI drop below 50 (red icon), which is considered a sign of a bearish trend.

On Oct. 13, the ALGO price reached a low of $0.29, just above the bottom of the range.

Due to the deviation above the range high and bearish RSI readings, an eventual breakdown from this range is expected.

Can ALGO Bounce Before Breaking Down?

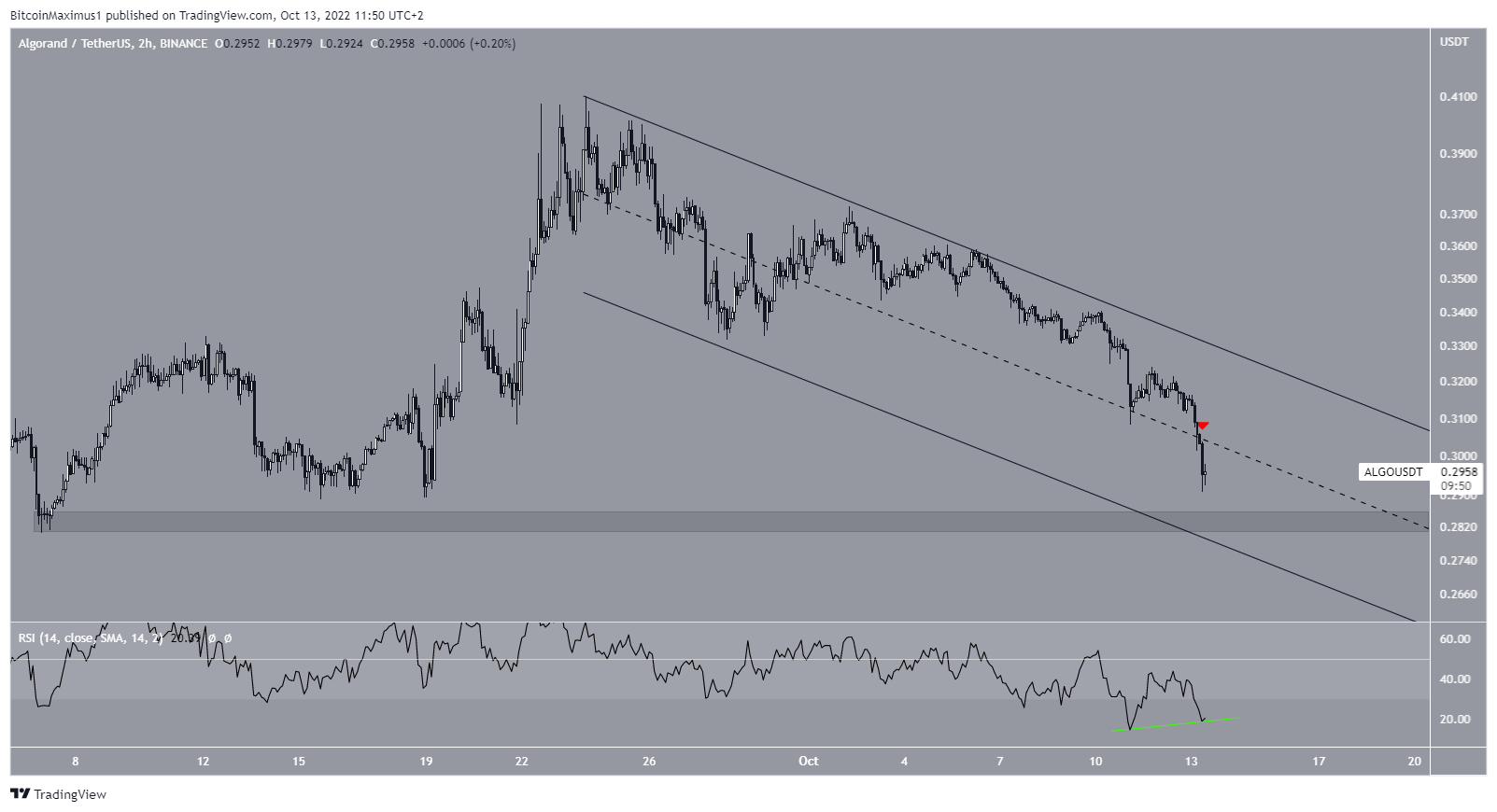

The ongoing decrease since Sept. 24 has so far been contained inside a descending parallel channel. The price held above the middle of the channel since Sept. 30, but then Algorand finally broke down (red icon) on Oct 13. This is a sign that lower prices are in store.

If the downward price movement continues as expected, there would be support at $0.28. The support is created by the confluence between the support line of the channel and the $0.28 horizontal support area.

Unlike the daily time frame, the two-hour RSI is showing bullish signs, since it has generated bullish divergence inside its oversold territory. As a result, a considerable bounce could occur once the price reaches this area.

Direction of the Future Trend

Despite these bearish signs in the weekly and daily time frames, the weekly ALGO chart shows potential for an upward movement in price.

The two main reasons for this are the bullish divergence in the weekly RSI and the fact that there is a strong horizontal support at $0.24.

However, there is still time until the price falls to the support line of the weekly RSI. Since the line also coincides with the $0.24 support area, it would make sense for Algorand to initiate a reversal once it gets there.

There is also positive news on the fundamental side. AnChain.Ai, a platform for Web3 risk prevention and security said that it has partnered with Algorand.

As a result, all those that build on ALGO will have access to their tools. Additionally, the 26 million wallets on the Algorand blockchain will be now monitored for fraudulent and suspicious activity.

Currently, the AML engine for AnChain.ai is responsible for screening more than $1 billion in daily transactions.

ALGO Short-Term Price Drop Expected

To conclude, the daily time frame for ALGO suggests that another downward movement is expected. If one occurs, it will cause a breakdown below the yearly lows and take the price to the $0.24 horizontal support area. Afterward, a considerable bullish reversal seems likely due to the bullish regains from the weekly time frame.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer: BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.