In a shocking turn of events, an Ethereum wallet belonging to the bankrupt trading firm Alameda Research has reportedly received $6 million worth of Tether (USDT) from Bitfinex’s hot wallet.

The news comes as a surprise to many in the crypto community, as the firm has been struggling with bankruptcy proceedings. Still, the real shocker came when it was revealed that the same wallet received another $4.5 million worth of USD Coin (USDC) from an unknown entity, bringing the total to a staggering $10.5 million in the last 24 hours.

Where Is the Money?

Alameda Research has been a prominent name in the crypto world, known for its advanced trading strategies and cutting-edge technology. The firm’s collapse came as a surprise to many in the crypto community, and the sudden influx of funds into the Ethereum wallet has only added to the mystery.

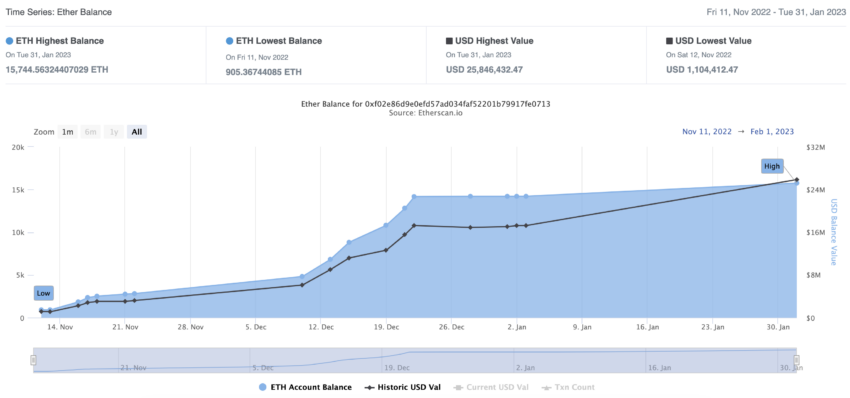

The wallet, which was created 31 days ago, has received several transactions from another Alameda Research address. It now holds a total of $183 million in various altcoins and $26 million in ETH. The largest holding in the wallet is $54 million worth of BitDAO tokens (BIT). This token which has a thin liquidity with only 2% market depth of $15,000 on Coinbase, according to CoinMarketCap.

The crypto market has been in turmoil since the collapse of Alameda Research and FTX last year. However, in a positive turn of events, FTX has reportedly recovered over $5 billion in assets.

While the recovery of assets is a positive sign, the sudden influx of funds into Alameda Research’s Ethereum wallet raises questions about the fate of the company and the future of the crypto market.

The lack of regulation in the crypto market has led to many concerning practices, including the exploitation of innocent investors. Industry leaders need to come together to find a solution that protects the interests of all parties involved.

The mystery surrounding Alameda Research’s Ethereum wallet is a stark reminder of the need for increased transparency and regulation. As the crypto market continues to grow and evolve, it’s crucial that the industry takes a step back and reevaluates its practices to ensure the safety and security of all investors.

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

This article was initially compiled by an advanced AI, engineered to extract, analyze, and organize information from a broad array of sources. It operates devoid of personal beliefs, emotions, or biases, providing data-centric content. To ensure its relevance, accuracy, and adherence to BeInCrypto’s editorial standards, a human editor meticulously reviewed, edited, and approved the article for publication.