Cryptocurrency markets never sleep, and neither does artificial intelligence (AI). Traders have started leveraging AI crypto trading to make better decisions and predict market trends, transforming the trading landscape.

But with great potential comes potential pitfalls. In this article, we’ll explore how AI is shaping cryptocurrency trading, its benefits, drawbacks, and the implications of adding complexity to an already controversial industry.

Where AI and Crypto Trading Intersect

As we examine the intricate relationship between AI and cryptocurrency trading, it’s essential to grasp the diverse ways this powerful technology influences the industry. From enhanced decision-making to continuous learning and adaptation, AI is reshaping how traders approach their strategies.

However, it’s crucial to recognize the potential drawbacks and challenges associated with incorporating AI into the trading process. To gain a comprehensive understanding of this evolving landscape, let’s explore the pros and cons of AI in cryptocurrency trading.

The Pros

Efficiency and Speed

AI’s ability to analyze vast amounts of data at lightning speed is a game-changer for traders. Market data, trends, and news can be processed faster than any human could manage, allowing traders to make informed decisions and identify profitable trades.

For example, AI-driven platforms like TradeSanta provide automated trading strategies that leverage real-time data analysis to execute buy or sell orders more efficiently.

Moreover, AI can also identify correlations and patterns that might be overlooked by human traders. By analyzing historical data, AI systems can uncover hidden relationships between various market factors, enabling more accurate predictions and insights.

Continuous Learning and Adaptation

AI’s machine-learning capabilities enable it to learn from market data and adjust AI crypto trading strategies accordingly. This iterative process could lead to better performance and more profitable trades over time. As AI models are exposed to new data, they adapt their predictions and decision-making processes.

Companies like Kryll.io offer AI-powered tools that generate and refine trading algorithms based on historical and real-time market data.

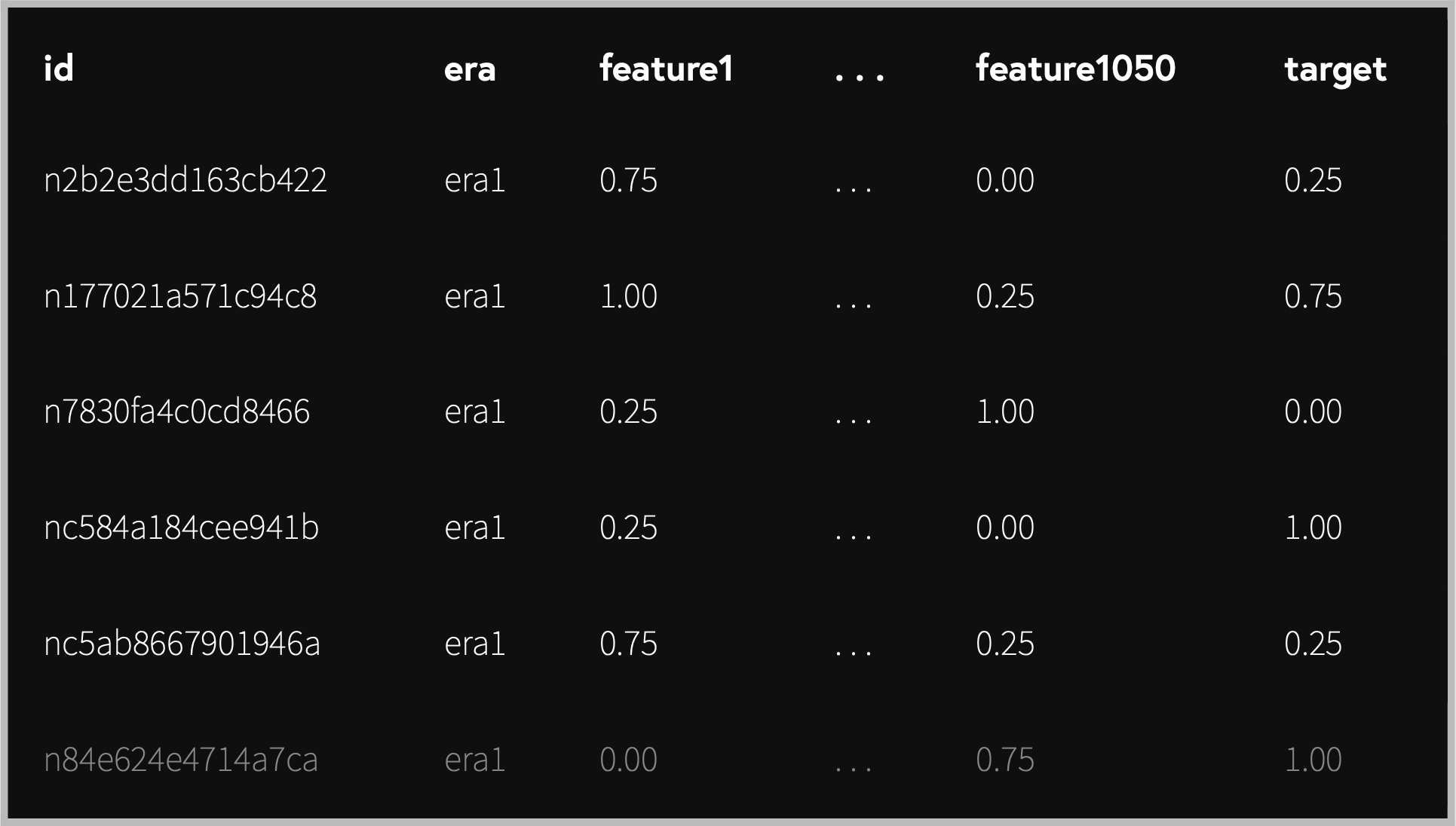

The use of deep-learning techniques, such as neural networks, allows AI systems to recognize complex patterns and make more accurate predictions. For instance, Numerai, a hedge fund, crowdsources encrypted trading algorithms from data scientists, using AI to combine these strategies for optimal performance.

Objective Decision-Making

Incorporating AI into trading strategies can help remove human bias and emotion, leading to more objective and data-driven decision-making.

With AI, traders can avoid being swayed by celebrity endorsements or unfounded opinions. AI systems like IBM’s Watson can help traders analyze news, social media sentiment, and other data sources to make unbiased trading decisions.

In addition, AI-powered risk management tools can help traders assess and mitigate potential losses. By calculating the probability of different market scenarios, AI can assist traders in making more informed decisions on when to enter or exit trades.

The Cons

Complexity and Comprehension

AI trading strategies can be complex and difficult to understand. This opacity can make it challenging to identify potential issues, risks, or even to trust AI’s decisions.

Traders need to grasp AI-platform intricacies for effective use. AI developers should focus on user-friendly interfaces and offer extensive educational resources for better user understanding.

Risk of Over-Reliance on AI

Over-reliance on AI could lead to complacency, with traders potentially neglecting their oversight responsibilities. This lack of human intervention may result in unmonitored trades and unchecked risks. To mitigate this risk, it’s crucial for traders to maintain active involvement in their strategies and stay informed about market conditions.

Hybrid approaches that combine AI-driven insights with human expertise can help strike the right balance between automation and oversight.

Infallibility and Unforeseen Risks

AI, like any technology, is not perfect. Programming errors or unforeseen market events could lead to unexpected losses, highlighting the importance of human involvement in trading decisions.

For instance, the 2010 “Flash Crash” was partly the fault of algorithmic trading, demonstrating that even sophisticated AI systems can contribute to market instability under certain conditions.

To minimize such risks, developers should prioritize rigorous testing and validation of AI models, while traders should maintain a robust risk management strategy and be ready to intervene when necessary.

Cryptocurrency’s PR Problem

Cryptocurrency already faces high levels of fear, uncertainty, and doubt (FUD), as well as government regulation and interference. Introducing AI into the mix adds another layer of complexity to an industry that struggles with public perception.

Addressing the PR Issue

To overcome this hurdle, the cryptocurrency industry needs to focus on educating the public about AI’s role in trading and its potential benefits. Transparency and effective communication are key to mitigating potential concerns. Industry leaders and AI developers should collaborate on educational initiatives, workshops, and seminars to build public trust and understanding.

Moreover, the industry should promote success stories and case studies demonstrating how AI has benefited traders and improved market efficiency. By showcasing tangible examples, the public can better grasp the value of AI in cryptocurrency trading.

Regulatory and Ethical Considerations

As AI becomes more prevalent in cryptocurrency trading, new regulatory and ethical challenges may arise. Ensuring that AI-driven trading practices adhere to existing regulations and do not contribute to market manipulation or other unethical behavior will be crucial.

Cooperation among AI developers, traders, and regulators will be necessary to establish guidelines that promote responsible AI use in cryptocurrency trading.

Striking the Balance

AI has the potential to revolutionize cryptocurrency trading, offering numerous benefits such as speed, continuous learning, and objective decision-making. However, it also introduces new risks, including complexity, over-reliance, and fallibility.

The key lies in striking a balance between leveraging AI’s advantages and maintaining human oversight to minimize risks. By addressing the PR challenges head-on, fostering a better understanding of AI’s role in trading, and considering regulatory and ethical implications, the cryptocurrency industry can continue to evolve and thrive in the age of artificial intelligence.