Layer-1 coin Cardano (ADA) has consolidated within a price range since the start of December. However, its price has trended downward over the past week, dropping by 17% in the last seven days.

This decline is attributed to a combination of factors, including sell-offs by large holders and profit-taking by many of its holders. This puts the altcoin at risk of remaining below the $1 price level in the short term, and this analysis details how.

Cardano Sees Spike in Profit-Taking Activity

The decline in Cardano’s large holders’ netflow, a metric tracking the buying and selling activity of large investors or whales, confirms a reduction in ADA accumulation by this cohort of coin holders. IntoTheBlock’s data shows ADA’s large holders’ netflow has plunged by 139% over the past seven days.

Large holders refer to whale addresses that hold over 0.1% of an asset’s circulating supply. When their netflow drops, it indicates that whales are selling their holdings of an asset. This is a bearish signal, suggesting that these large investors may be losing confidence in the asset’s future price.

The recent increase in profit-taking within the ADA market is not limited to large-scale investors. This trend has extended to a majority of coin holders, reflecting a broad loss of confidence in the asset’s future price potential.

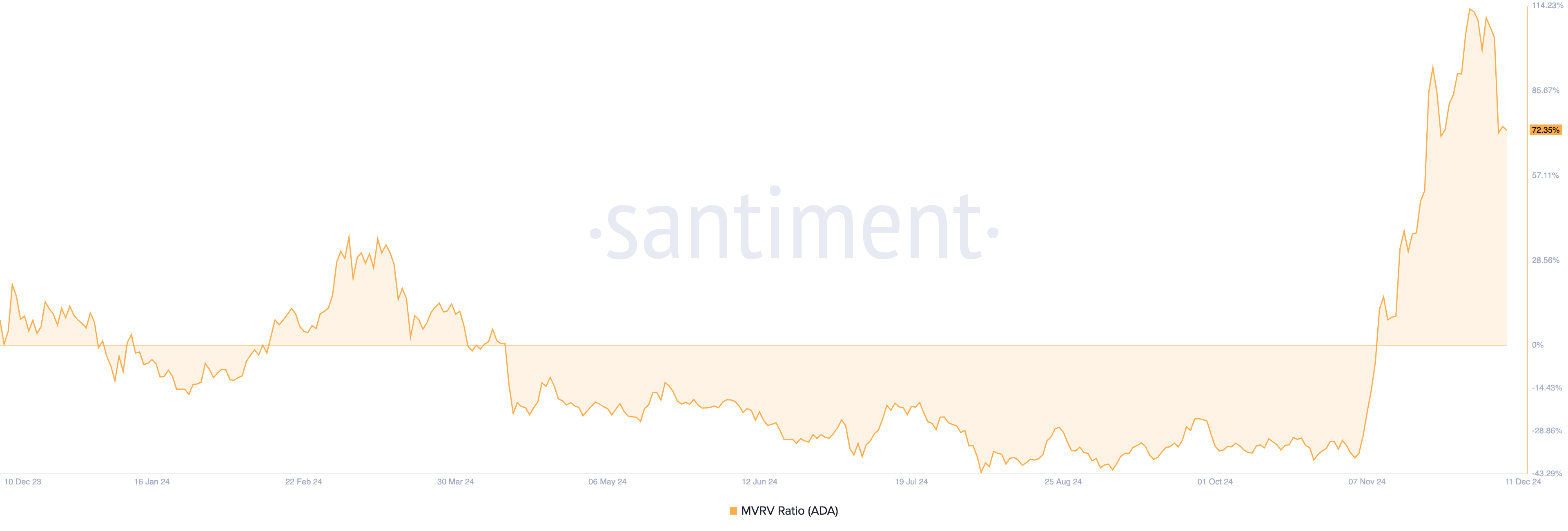

Supporting this sentiment, the altcoin’s Market Value to Realized Value (MVRV) ratio has shown a consistent decline. Data from Santiment indicates the MVRV ratio peaked at 113% on December 2 before starting its downward trajectory. As of the latest update, it stands at 72.35%.

This metric tracks whether an asset is overvalued or undervalued relative to its holders’ average cost basis. When it declines, it signals that the gap between an asset’s market value and its realized value is narrowing.

In ADA’s case, despite remaining positive, the MVRV decline suggests that holders are taking profits, reducing the extent of unrealized gains. This indicates waning bullish sentiment and increasing selling pressure in the market.

ADA Price Prediction: A Decline Toward $0.77 Is Possible

From a technical perspective, the daily chart shows that ADA’s next major support lies at $0.90. While it trades at $1.01 at press time, an increased profit-taking activity will cause it to test this support level. If it fails to hold, the coin’s price will plummet to $0.77.

On the other hand, if buying activity resurges, the ADA coin price may rebound to $1.06 and climb toward its two-year high of $1.32.