The non-fungible token (NFT) market seems to be in a bit of a lull, as several metrics show that interest in the space has dropped since the peak a few months ago.

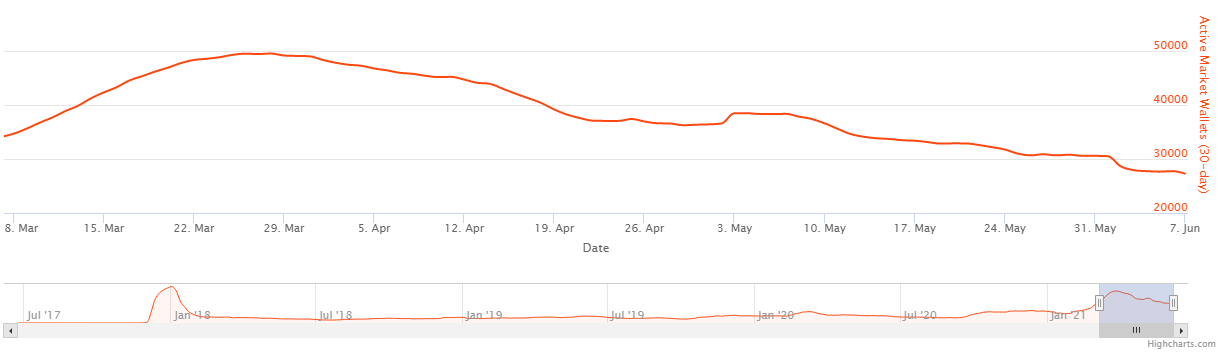

Activity in the NFT market has dropped significantly since May, according to data from Nonfungible. The number of active wallets has dropped by 40% while daily sales fell by 60%.

This is a sharp turnaround for the niche, which has been extremely popular in recent months. As measured by nearly every metric, activity peaked in the months of April and May. It now appears to be on the same kind of decline that followed the early months of 2018.

The dollar value of sales has also plummeted, peaking at roughly $322 million in April and now standing at $88 million. The actual number of sales, meanwhile, stands at just under 15,000. This is perhaps a better indication of the activity in the space, which is also down from a peak of roughly 25,000 in early May.

CryptoPunks, Sorare, and Meebits are the most popular NFTs in the market, raking in roughly $5 million in the past week. Sorare’s NFTs are currently the standout assets in the space and is the only one to hit a seven-day sales number figure of nearly 10,000. The closest competitor is Ethereum Name Service.

The largest sales that occurred in the past week have to do with Meebits, the voxel art-inspired NFTs built by the well-known Larva Labs. The top-selling NFT sold for a whopping $153 million, while the second-highest sold for $142 million.

Just a blip for the NFT market?

Since the start of 2021, the NFT market has taken the world by storm, fuelled by celebrity involvement and an appeal to the mainstream. While DeFi and the general crypto market also caught the attention of the mainstream, the difference in interest was significant.

The drop in activity could be linked to the market’s recent crash, or perhaps it’s that the novelty of NFTs has worn off. However, during the crash itself, the NFT trading market continued showing heavy activity. It will never fully be clear why the dip is occurring, but it’s likely a combination of multiple factors.

Still, major entities in the crypto space continue to plow on, with several launching NFT-related initiatives. Perhaps most significantly, Sotheby’s and Christie’s auction houses have also gotten involved.

Outside of the digital art space, sports teams have enthusiastically begun to use the unique asset for tickets, merchandising, and other exclusive features. Major League Baseball announced a licensing deal for NFTs, and Ukrainian football team Dynamo Kyiv announced that it would sell NFT tickets for the 2021 season.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.