Aave (AAVE) price has broken out from a descending resistance line in what is likely the first stage of a longer-term upward movement.

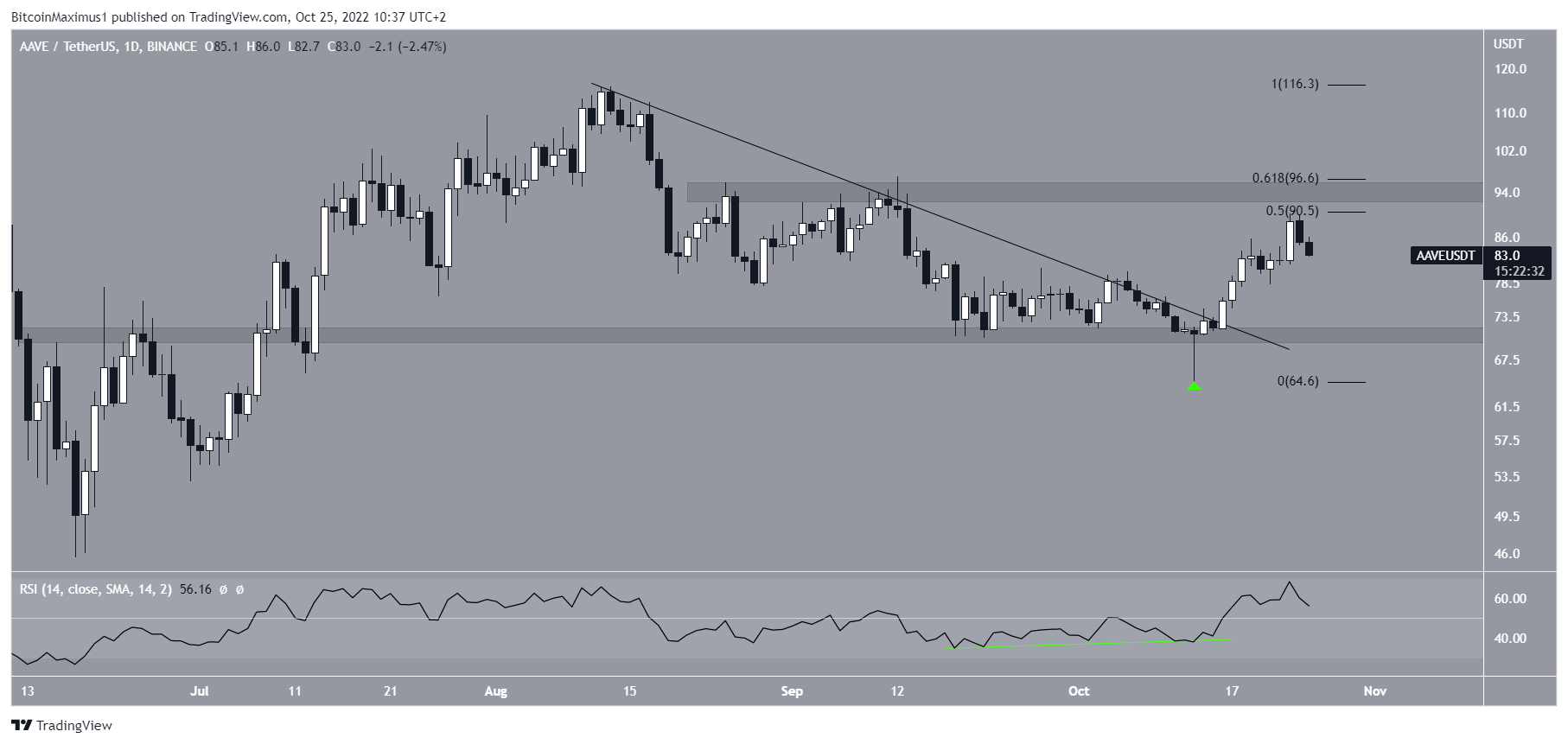

AAVE price had been falling underneath a descending resistance line since reaching a high of $115.8 on Aug. 13. The downward movement led to a minimum price of $64.7 on Oct. 13.

Initially, it seemed that the downward movement caused a breakdown from the $71 horizontal support area. However, the price reversed trend immediately, bouncing and creating a long lower wick in the process (green icon).

Shortly afterward, the AAVE price broke out from the line, indicating that the preceding correction is complete. The breakout and ensuing upward movement led to a high of $90.1 on Oct. 23 before being rejected.

The main resistance area is found between $90.50 and $96.60. This is the 0.5-0.618 Fib retracement resistance and a horizontal resistance area.

It is worth mentioning that technical indicators support the continuation of the upward movement. The breakout was preceded by bullish divergence in the daily RSI (green line).

The indicator is now above 50 and increasing. This is a sign that supports the legitimacy of the breakout and continuation of the upward movement.

AAVE Price Could Reach $135

In similar fashion to the RSI, the wave count provides a bullish outlook. It shows that the AAVE price is likely in wave C of an A-B-C corrective structure (black). If so, giving waves A:C a 1:1 ratio would lead to an AAVE future price prediction of $135.50. The sub-wave count is given in red.

At the current time, it is not certain if the movement is an A-B-C structure or a new bullish impulse. However, in both cases an increase towards at least $135.50 would be expected.

Conversely, a decrease below the wave B low (red line) of $64.70 would invalidate this bullish AAVE price prediction.

What Will Happen to Aave After Target Is Reached?

So far, both technical analysis readings and the wave count from the daily timeframe are bullish and support an upward movement towards $135.5.

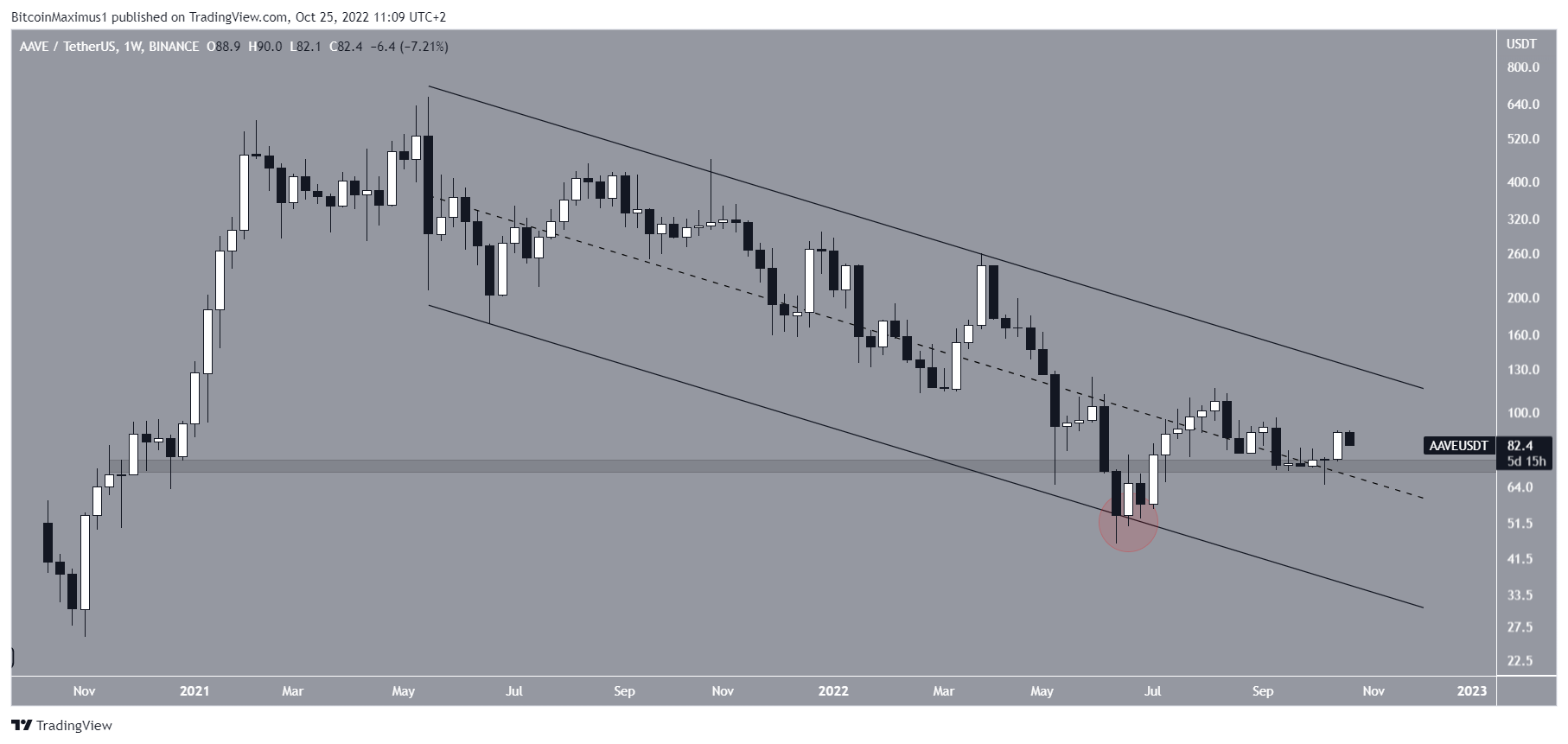

A look at the weekly time frame also gives a bullish outlook.

In June 2022, AAVE price broke down below the $71 long-term horizontal support area. It also validated the support line of a long-term descending parallel channel (red circle).

But, it reversed trend shortly afterward, reclaiming the area in the process. Such deviations followed by reclaims are considered bullish developments and usually lead to upward movements.

An interesting confluence is that the resistance line of the channel is currently at $135, aligning with the target given by the wave count.

As a result, the reaction at the $135.50 level will be crucial, since a breakout above it would also mean a breakout above the long-term channel.

For the latest BeInCrypto Bitcoin (BTC) and crypto market analysis, click here

Disclaimer: BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.