A community proposal on Aave wants to freeze the True USD (TUSD) reserve on the Aave V2 Ethereum pool. The stablecoin has recently faced increased issues over its ownership structure.

The Aave proposal will prevent new users from depositing or borrowing TUSD on the Aave V2 Ethereum pool.

The AAVE Proposal

However, the proposal would not affect Aave users with current positions on the pool. This means those who borrowed from the pool can repay their loans while those who deposited TUSD can withdraw.

Part of the proposal reads:

“This AIP is designed to take a conservative approach to the TUSD situation. It will allow the community to take a step back and assess the situation before making any further decisions.”

Remarkably, 83.76% of the over 600,000 votes cast support the move. This groundswell backing demonstrates the significance and urgency attached to the concerns raised by the proposal.

Read More: Best Crypto Sign-Up Bonuses in 2023

TUSD Issues

In 2023, TUSD’s market cap has grown from $755.42 million market cap in January to over $3 billion as of press time. The struggles of rival stablecoins like Binance USD (BUSD) and Circle’s USD Coin (USDC), which have faced different issues impacting confidence in them, may have contributed to its meteoric rise.

However, TUSD has become embroiled in controversy of its own after regulators claimed its custodian Prime Trust was insolvent. While its issuer has denied exposure to the embattled crypto firm, TUSD deviated from its US dollar peg twice in June.

Despite these issues, Kaiko data pointed out that the BTC-TUSD pair on Binance is the most traded BTC market in crypto and currently holds 61% of all BTC volume on the exchange.

Read More: Best Upcoming Airdrops in 2023

Link to Justin Sun

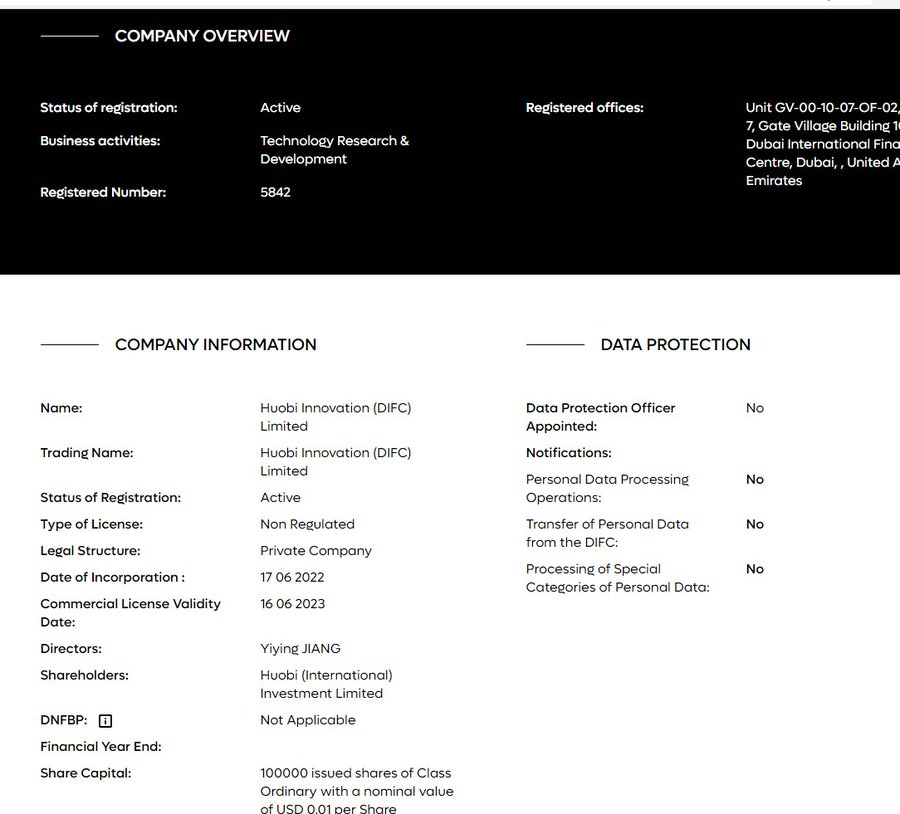

Adam Cochran, the managing partner at Cinneamhain Ventures, alleged that crypto entrepreneur Justin Sun was behind TrueUSD.

In a June 30 Twitter thread, Cochrantied several members of Sun’s immediate family, including his father, stepmother, uncle, and half-sister, to the company behind TUSD.

Cochran observed that other companies associated with Sun, including Poloniex, BitTorrent, and Huobi, have also linked these individuals’ names.

Cochran stated that the setup obscured Sun’s ownership, suggesting that the stablecoin “likely doesn’t comply with financial regulations.”

Previously, TUSD had denied being owned by Justin Sun. The firm had also threatened to pursue legal remedies against the allegations.

Read More: 9 Best Crypto Demo Accounts For Trading

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.