The Perlin (PERL) price has lost more than 80% of its value since its August highs. While the price has returned to an important support level, there are no definite bullish reversal signs in place yet.

After a similar decrease, Coti (COTI) also reached an important support level and has shown some bullish reversal signs.

PERL Drops Significantly

Since it reached a high of $0.098 on Aug 18, PERL has been subject to a significant drop that culminated in a low of $0.015 on Sept 21. This makes for an 83.69% decrease from the aforementioned high. Since then, the price has been trading very close to the long-term $0.018 support area, which has not been broken since May. If the price were to begin an upward move, the closest significant resistance area would be found at $0.05.

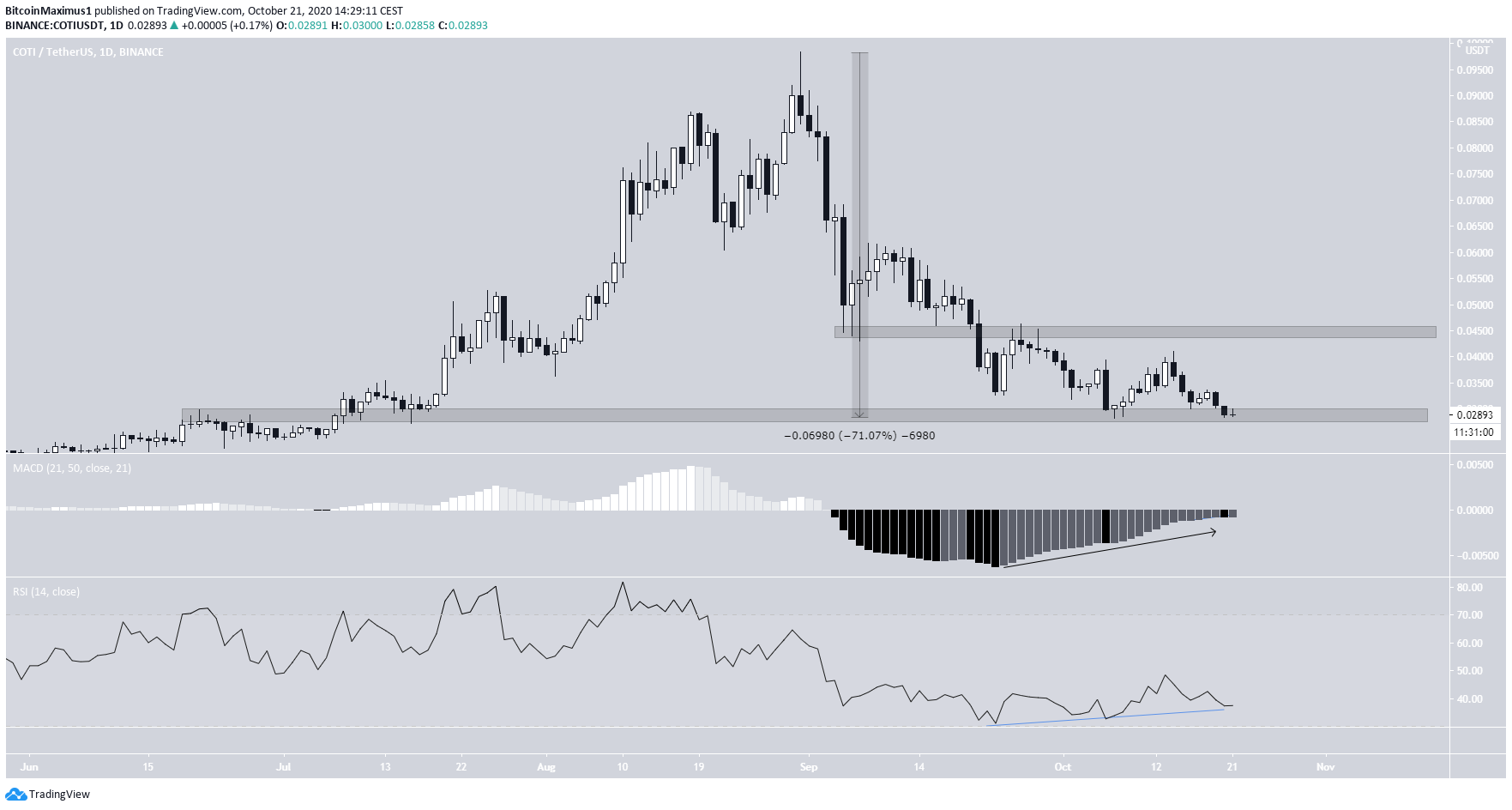

COTI Drops to Support

Similarly, the COTI price has lost over 70% of its value since it reached a high of $0.098 on Aug 21. The decrease culminated with a low of $0.028, reached on Oct 7. COTI is trading inside a significant support area at $0.0285 where it has possibly created a double-bottom. The pattern has been combined with a considerable bullish divergence in both the RSI and MACD, indicating a likely upward move. If the price begins to increase, the closest resistance area would be found at $0.045.

Top crypto platforms in the US

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Valdrin Tahiri

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

READ FULL BIO

Sponsored

Sponsored