The Ethereum (ETH) price has been consolidating inside both a long and short-term range since the beginning of September. Until the price moves outside of this, the direction of the trend remains unclear.

Long-Term Levels

The Ethereum price is currently trading between two important support and resistance levels, found at $370 and $455, respectively. The levels are also the 0.382 – 0.5 Fib levels of the previous downward move. At the beginning of July, the price broke out from the $370 area and proceeded to reach a high of $489.57 on Sept 1. The price dropped sharply afterward and has now validated the $370 area once more.

Short-Term Movement

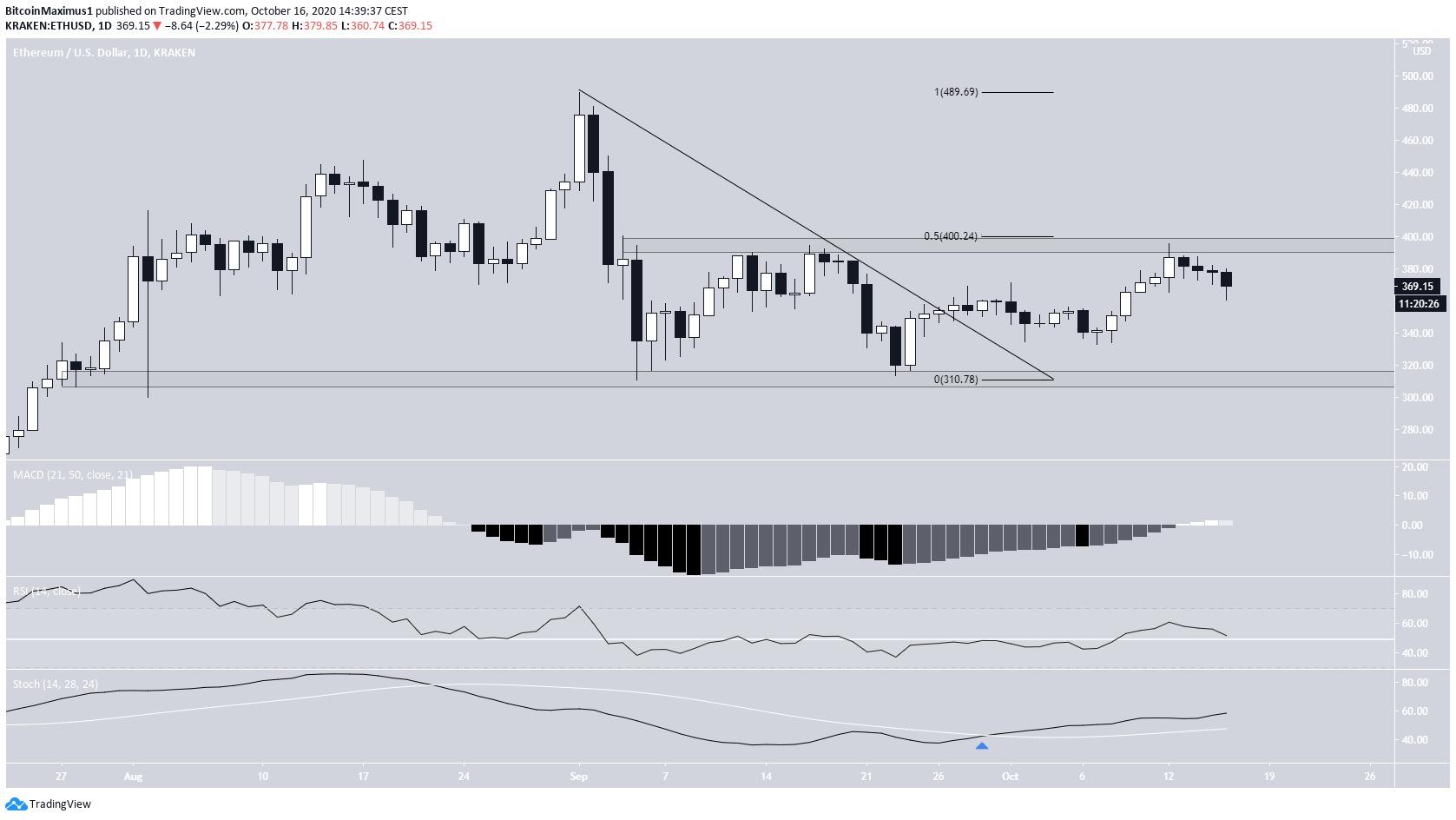

Cryptocurrency trader @TradingTank stated that Ethereum is likely to break out from the current descending wedge and head towards $400 and $420.

ETH Wave Counts

The wave count for Ethereum is not entirely clear. As it stands, it looks as if the move since the Sept 4 low is corrective, possibly being a W-X-Y structure (blue). If so, the price is nearing the end of the C sub-wave (orange) inside the Y wave. There is strong Fib confluence since both the W:Y and A:C waves have a 1:1 ratio, making this likely the top. However, sub-wave C can extend all the way to 1.61, the length of A, making a high near $420 possible, which would also fit better with other readings. On the other hand, a decline below the $323 w2 low would invalidate most bullish formations.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Valdrin Tahiri

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

READ FULL BIO

Sponsored

Sponsored