In this article, we will take a look at both pairs and determine their potential for increases/decreases.$LINK analysis (BTC and USD pairs)

— il Capo Of Crypto (@CryptoCapo_) April 2, 2020

-BTC pair is in a clear uptrend (higher highs and higher lows)

-USD pair target is $0.95

Bearish short-mid term, bullish long term. https://t.co/pUytw4IOKr pic.twitter.com/IlzLoY1SuN

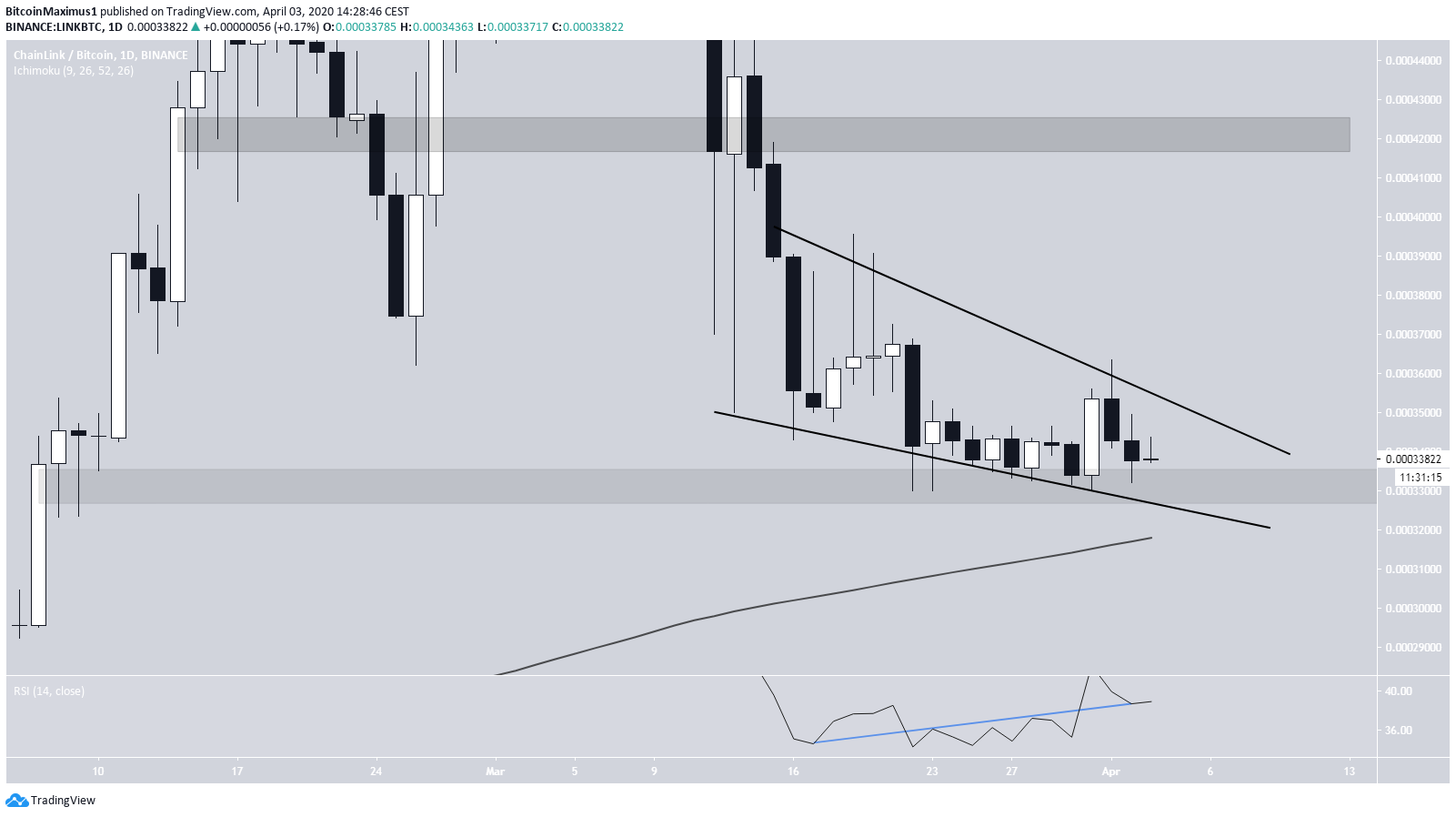

LINK/BTC

The LINK price has been following a curved ascending support line since January 2018, almost since its inception. At the time of writing, it was trading slightly below it, touching it for the fifth time. However, it has yet to reach a weekly close below it. The most interesting area is found at 35,000 satoshis. This area acted as resistance from July 2019 until March 2020, when the price was finally able to successfully break out and reached an all-time high. At the time of writing, the price was in danger of reaching a close below this area. If it does so, along with a decrease below the ascending support line could mean that the upward trend that lasted for more than two years has ended.

LINK/USD

The LINK/USD pair shows an entirely different movement. The price reached the $1.5 support area on March 13 and began the current upward move. The price has not traded below this level since May 2019. However, the price has yet to even move above the 0.382 fib level of the previous decrease, indicating that the current move is a retracement rather than the beginning of a new upward move. The closest resistance area is found at $3. At the time of writing, the most likely movement would be a price decrease towards the $1.5 area, followed by a period of range trading between $1.5-3. A breakdown below the $1.5 area would likely mean that the upward trend has ended and LINK is bearish.

A breakdown below the $1.5 area would likely mean that the upward trend has ended and LINK is bearish.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.