Let’s take a closer look at the BTC price movement and determine where the price will head to from here.$BTC Update

— Cred (@CryptoCred) March 20, 2020

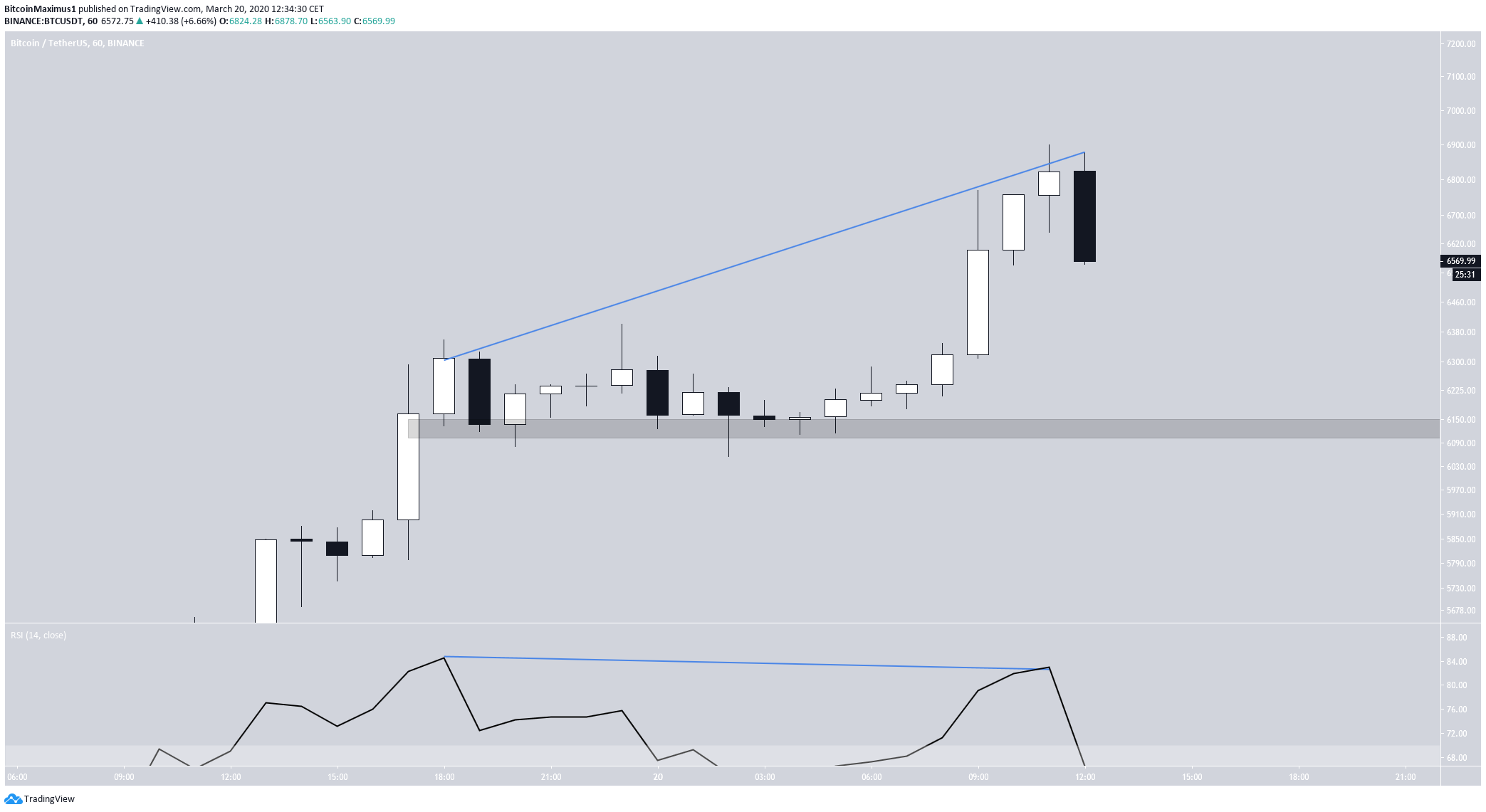

Reached range high ($6700).

Weekly close above = bullish bias.

Weekly close below = neutral bias, will look for pullbacks to range low ($6100).

Intraday will be looking to sell weakness below $6700 if I get something. No leverage longs for me at these levels. pic.twitter.com/Q8bUmCo7V3

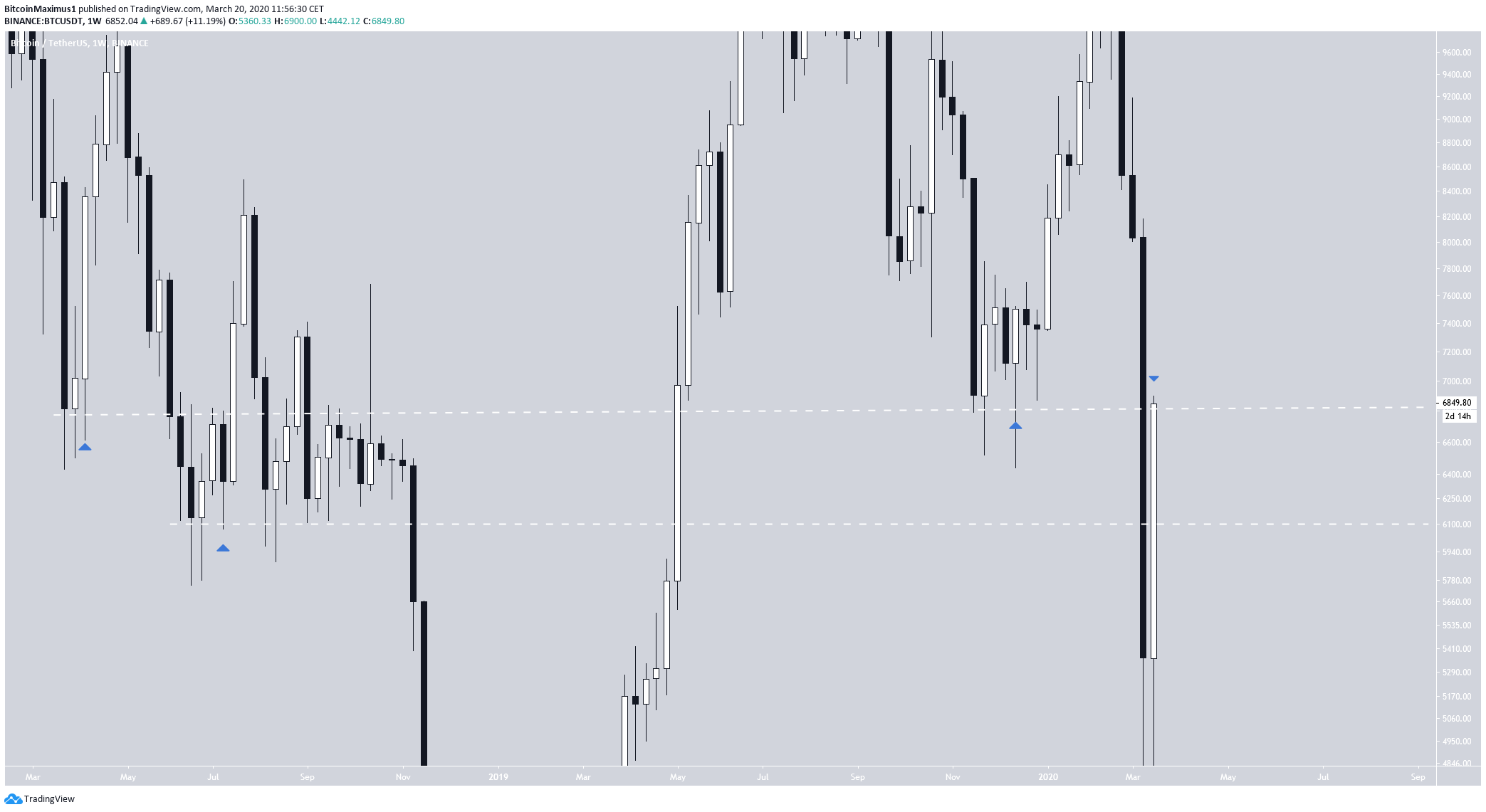

Trading Range

The price is currently trading right at the resistance line of the $6,100-$6,800 trading range. The price first reached the $6,800 area in April 2018 and bounced upward. Afterwards, the price fell to the $6,100 support in July 2018 and began consolidating within these two levels. The most recent touch came in December 2019, when the price bounced on the $6,800 area. After last week’s decrease, the price has returned and reached the $6,800 area once more, which is now likely to act as support.

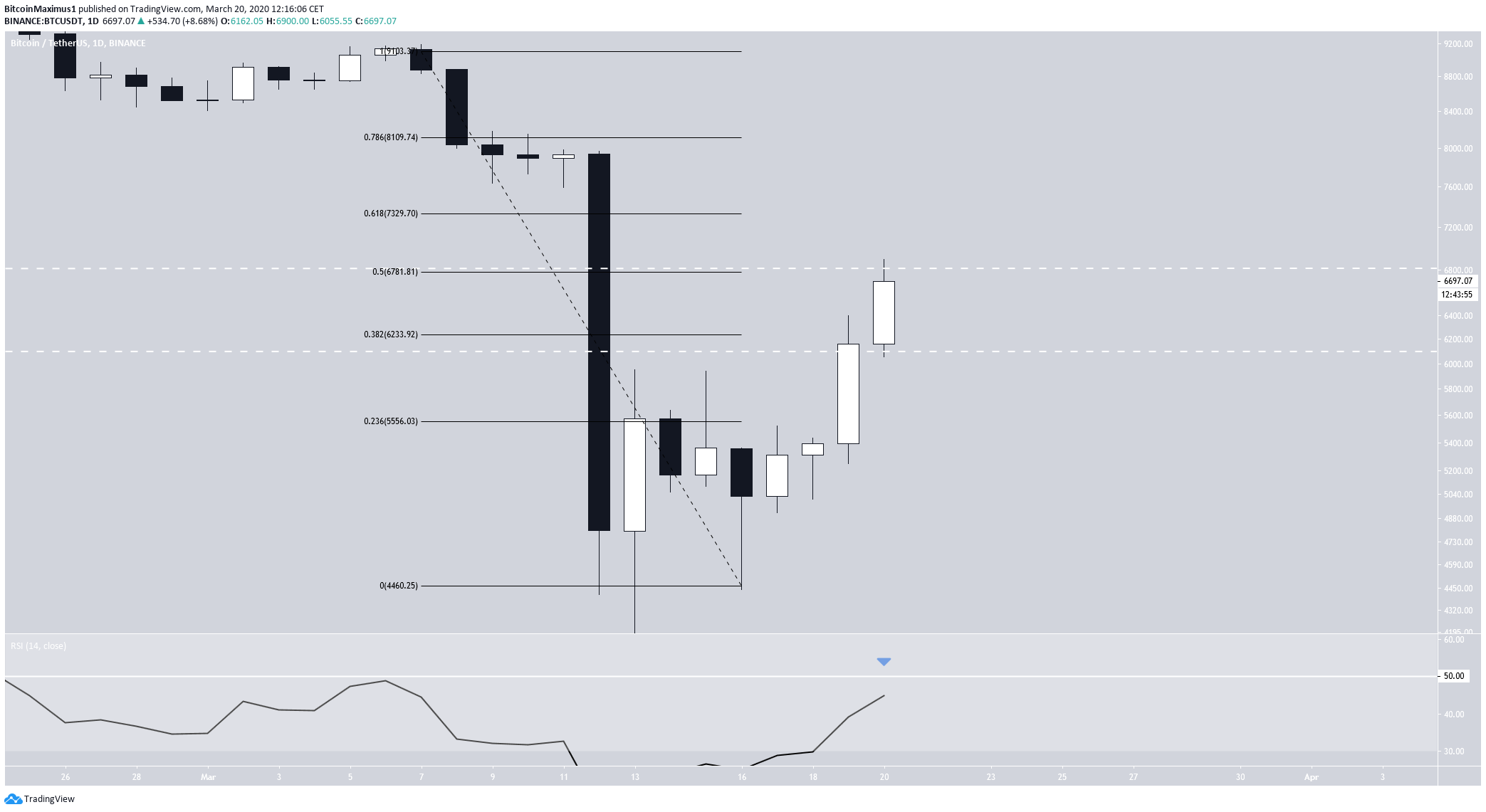

Current Resistance

A look at the daily chart shows the current bullish engulfing candlestick that is in the process of being created. This is the fourth candlestick in a row that is bullish. In addition, there are two other signs that solidify the current resistance. The price has reached the 0.618 Fib level of the previous downward move and the daily RSI is quickly approaching the 50 line from below. Therefore, there is a confluence of resistance levels that could cause the price to move downward.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.