Bitcoin (BTC) has been on a steady downtrend since reaching an all-time high of $123,731 on August 14. In the weeks that followed, it shed nearly 10% of its value.

With the leading coin now trading under $110,000, and considering its historical tendency to underperform in September, the outlook for the month appears increasingly bearish.

History Points to More Downside This Month

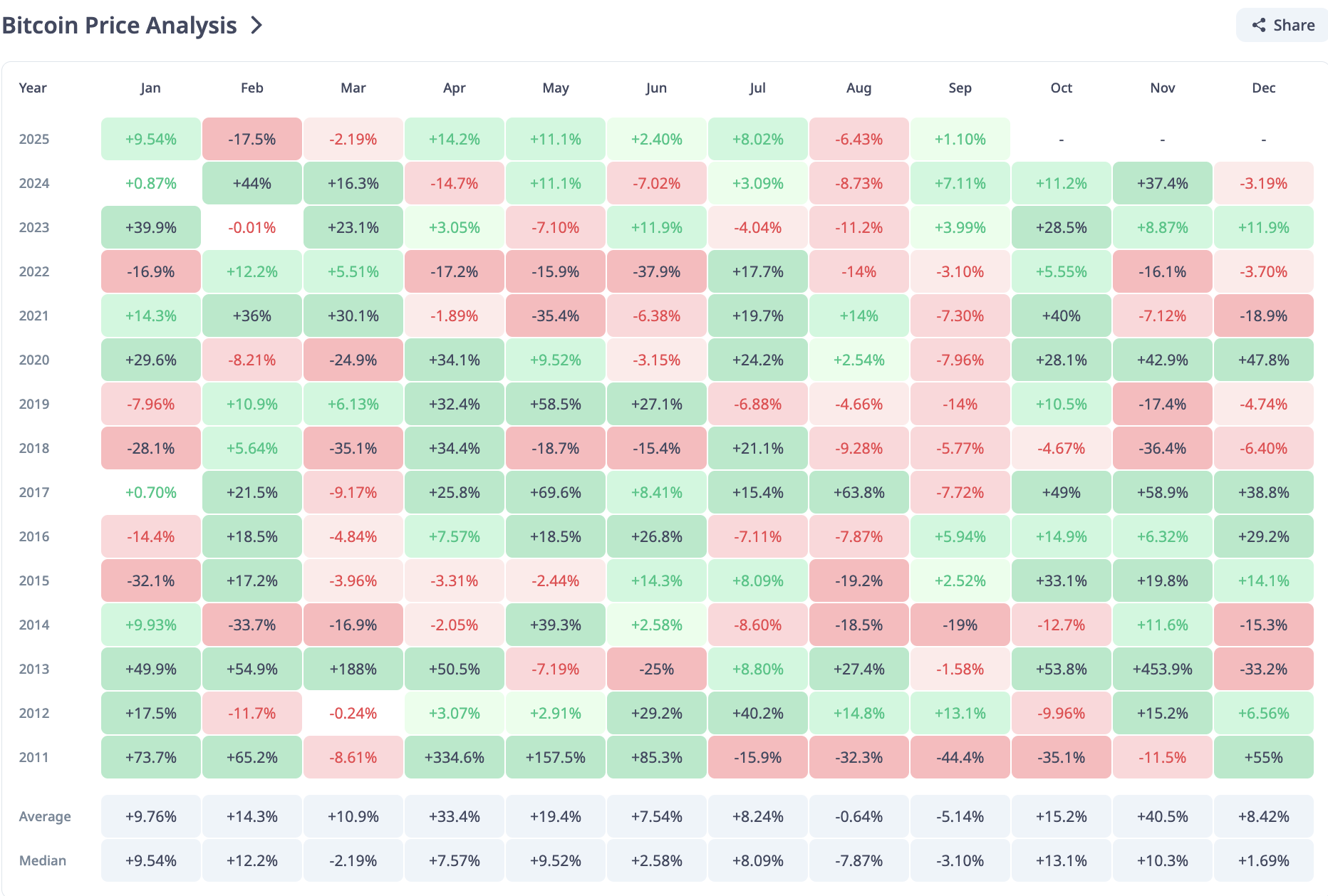

Historically, September has been one of BTC’s weakest months, often marked by negative returns and heightened volatility. Data shows that over the years, the coin has logged multiple red closes in September, including an 8% drop in 2020, a 7.3% decline in 2021, and a 3.10% price dip in 2022.

Although it recorded marginal gains of 4% and 7% in September 2023 and September 2024, respectively, this month could see the downtrend return, given the combination of waning institutional demand and growing bearish market sentiment.

ETF Exodus and Negative Sentiment Put Bitcoin at Risk of Deeper Correction

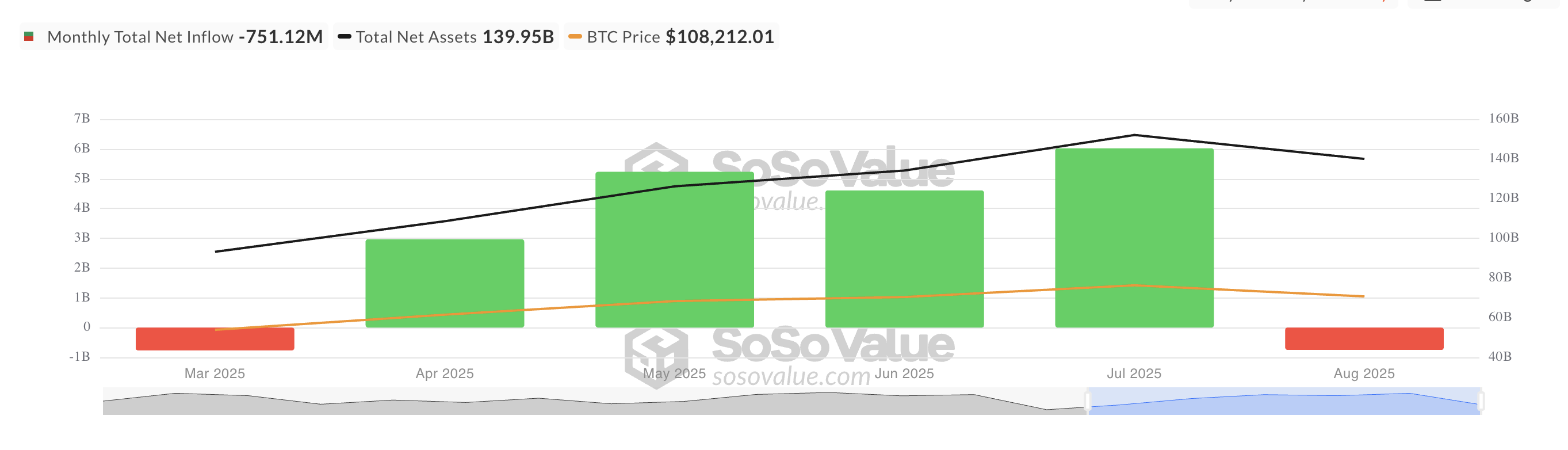

August was marked by a decline in capital inflows into BTC-backed exchange-traded funds (ETFs). According to SosoValue, during the 31-day period, outflows from these investment products totaled $751.12 million, ending the four-month streak of steady inflows that had supported BTC’s rise in the months prior.

Total Bitcoin Spot ETF Net Inflow. Source: SosoValue

This development is significant because, since the approval and launch of spot BTC ETFs, the asset’s push to new record highs has been directly tied to the volume of institutional inflows. The more capital poured into ETFs, the stronger BTC’s price momentum became.

Now, with inflows reversing and institutional interest showing signs of fatigue, the coin may face additional downside pressure in September. Without the consistent backing of large-scale ETF demand, the market could struggle to maintain its bullish momentum, leaving the asset vulnerable to sharper corrections if retail buyers fail to fill the gap.

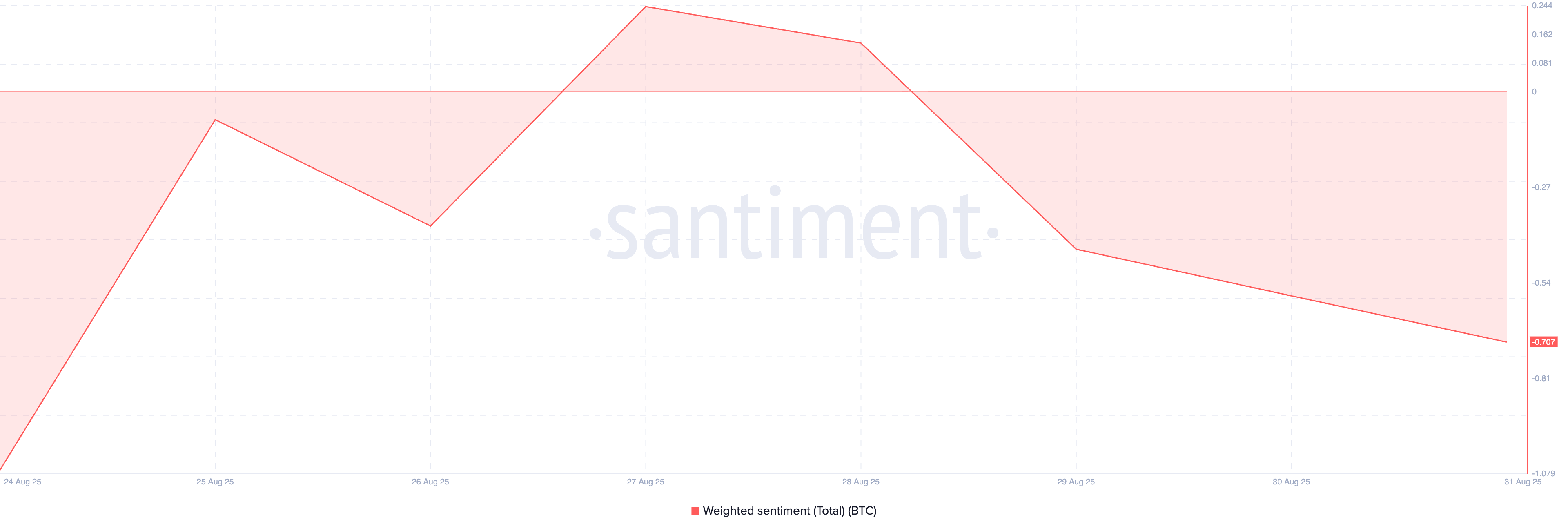

Furthermore, the coin’s negative weighted sentiment confirms the likelihood of a further price dip this month. According to Santiment, this metric currently stands at -0.707 at press time.

An asset’s weighted sentiment measures its overall positive or negative bias by combining the volume of social media mentions with the tone of those discussions.

When an asset’s weighted sentiment is positive, it signals rising confidence and renewed interest. Conversely, a negative weighted sentiment reflects bearish conditions. This means investors have become skeptical of the token’s short-term prospects, which may cause them to trade less.

Bitcoin Bears Circle $103,000

With institutional investors and spot traders growing increasingly cautious, the reduced optimism could translate into weaker demand and lower trading volumes for BTC this month.

If buying continues to fall, the coin’s price could slip toward $107,557. If the bulls fail to defend the support floor, it could trigger a deeper decline toward $103,931.

On the other hand, if demand soars, BTC could rebound and climb above $111,961.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.