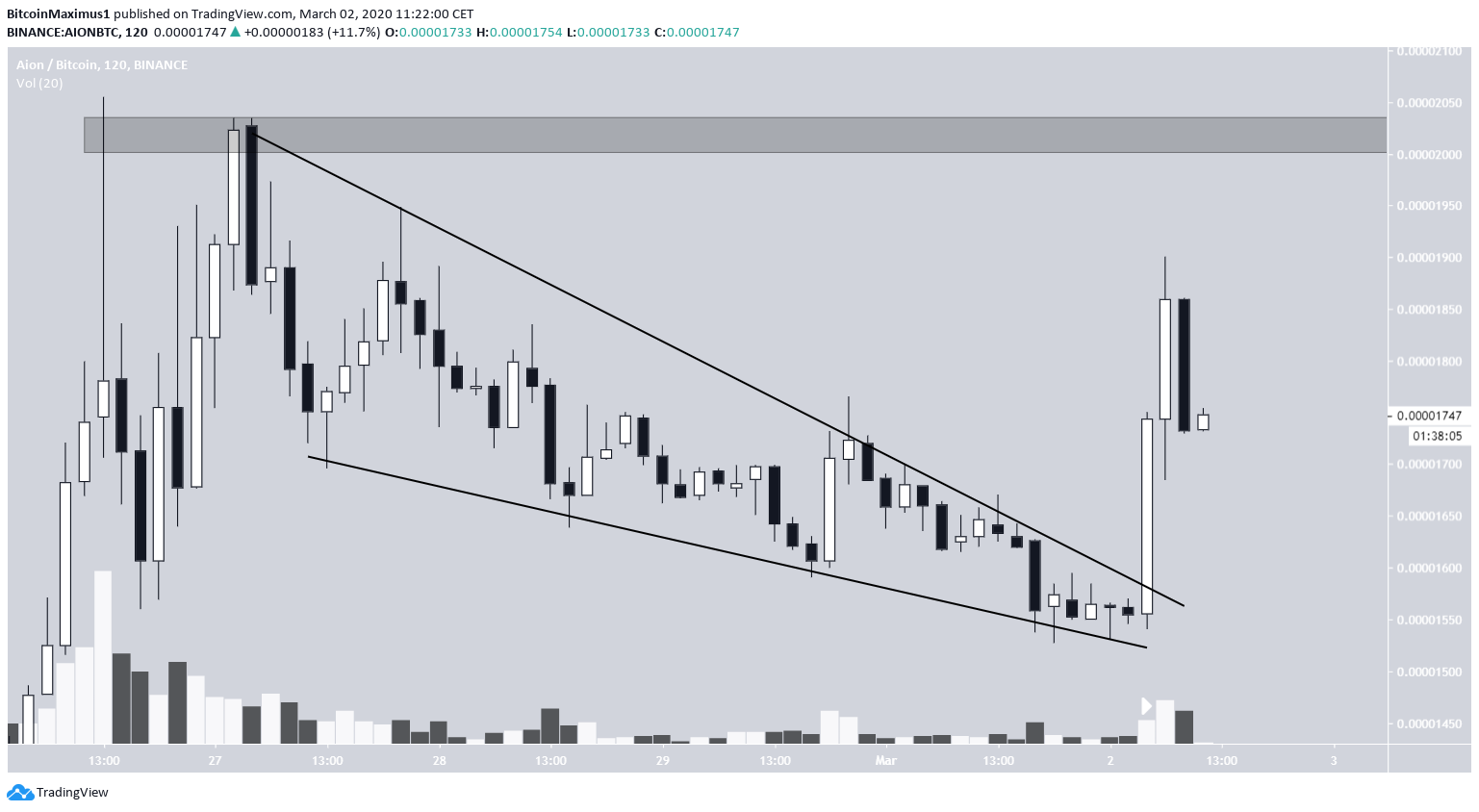

The AION price increased by 65% in the month of February. However, the final five days marked a sharp decline that began on Feb 26 with a high of 2,055 satoshis. AION began the new month with a breakout on March 2.

Aion (AION) Price Highlights

- AION has completed a double-bottom.

- There is support and resistance at 1,100 and 2,800 satoshis.

- The weekly RSI is bullish.

- The price is trading inside an ascending channel.

- AION has broken out from a short-term descending wedge.

$AION update: 1st target hit https://t.co/rnD5oENWrh pic.twitter.com/QZ6YXXj1P1

— Shelby (@CryptoNewton) March 2, 2020

AION Makes a Double-Bottom

In July 2019, the AION price declined below the 1,100 satoshi area. Once there, it made a double-bottom at 650 satoshis in September 2019 and January 2020, prior to the breakout of Feb 4, 2020. The breakout seems legitimate. Besides the bullish reversal pattern, the weekly RSI generated bullish divergence for the entire duration of the pattern and moved above 50 after the breakout, a sign indicating that the price is in a bullish trend. The price has created two long upper-wicks on the weekly candlesticks, showing that is some weakness developing in the current rally. The next resistance area is found at 2,800 satoshis.

Ascending Channel

Since Jan 15, the AION price has been trading inside an ascending channel, currently being very close to its resistance line. In fact, the price reached it today only to create a long upper wick. A bullish cross between the 50 and 200-day moving averages (MA) has transpired on Feb 5. The former is currently very close to the support line of the channel. If the price were to decrease all the way to this line, it would validate both the support and the MA. The daily RSI and current wick suggest that this decrease will occur.

There are two cases of bearish divergence developing, one for the entire duration of the channel and a second with the recent highs.

If the daily price fails to close above 2,000 satoshis, it would create a lower-high, a sign that the bullish trend is near a reversal.

The daily RSI and current wick suggest that this decrease will occur.

There are two cases of bearish divergence developing, one for the entire duration of the channel and a second with the recent highs.

If the daily price fails to close above 2,000 satoshis, it would create a lower-high, a sign that the bullish trend is near a reversal.

Future Movement

In the short-term, the price has just broken out from a descending wedge. Even though it was swift, the breakout did not have an extreme volume. Combining this with the longer-term analysis, one can presume that while the price could increase all the way to the top of the wedge at 2,050 satoshis, a decline is expected afterward. In the month of February, AION increased by 65%. The same percentage increase from the price on March 1 would take AION to 2,700 satoshis. This target is very close to the long-term resistance area at 2,800 satoshis. In addition, a breakout from the channel would be required for the target to be reached.

Integrating this with an analysis of the daily time frame suggests a decrease will occur. The best-case scenario for March seems to be an increase equal to that which happened in February.

In the month of February, AION increased by 65%. The same percentage increase from the price on March 1 would take AION to 2,700 satoshis. This target is very close to the long-term resistance area at 2,800 satoshis. In addition, a breakout from the channel would be required for the target to be reached.

Integrating this with an analysis of the daily time frame suggests a decrease will occur. The best-case scenario for March seems to be an increase equal to that which happened in February.

To conclude, the AION price has reached the resistance line of its ascending channel and has generated some weakness. A decrease toward the support line of the channel is expected.

To conclude, the AION price has reached the resistance line of its ascending channel and has generated some weakness. A decrease toward the support line of the channel is expected.

Top crypto platforms in the US

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Valdrin Tahiri

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

READ FULL BIO

Sponsored

Sponsored