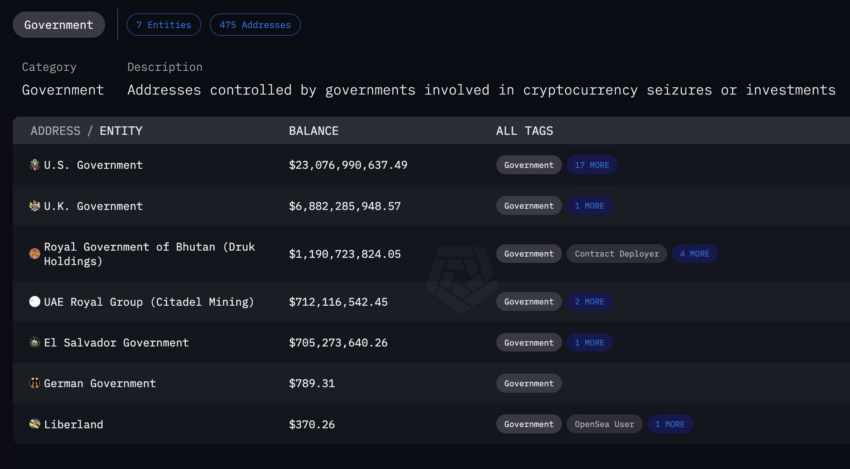

The Abu Dhabi royal family has strategically built a $700M (₩970B) Bitcoin reserve. They are among the world’s wealthiest families. Arkham Intelligence revealed this in its latest report.

The findings reveal that the United Arab Emirates (UAE) holds 6,333 BTC. The state generated these through sophisticated mining operations, not market purchases or seizures.

$700M in BTC Mined by Royal-Owned Operation

Arkham said in a Monday report on X that it identified wallets owned by the UAE government. It stated, “The UAE’s $700M BTC holdings are now labeled on Arkham. Unlike the US and UK, the UAE’s holdings do not come from police asset seizures but from mining operations with Citadel Mining.”

They came from a sophisticated, state-controlled mining operation whose intricate ownership structure underscores this venture’s sovereign nature.

Citadel Mining is the firm at the center of the operation. 2pointzero owns 85% of Citadel Mining, which is wholly owned by the International Holding Company (IHC). The Royal Group controls about 61% of IHC, which is controlled by the Abu Dhabi royal family. This structure cements the state’s control over Bitcoin production.

UAE Turns Oil Money Into Digital Money

This move signals a significant pivot for the oil-rich nation. It converts “oil money” into “digital money.” It establishes a sustainable method to accumulate Bitcoin, giving the country a continuous and expandable source of digital wealth.

“This is a unique case of a nation-state directly accumulating Bitcoin through mining,” the Arkham report noted. Other countries’ Bitcoin holdings are mostly static and depend on law enforcement. The UAE has built a mechanism to grow reserves consistently.

Citadel Mining operates a vast 80,000-square-meter Bitcoin mining facility on Al Reem Island in Abu Dhabi. The facility serves as the physical platform for the government’s crypto strategy. Arkham’s investigation suggests Citadel has mined about 9,300 BTC to date. State-controlled wallets hold at least 6,300 BTC.

Arkham corroborated its findings through on-chain data analysis and real-world verification, including comparing on-chain mining activity with satellite imagery and matching the mining timeline with facility construction time-lapse images.

The Abu Dhabi royal family extends their digital asset interest beyond Bitcoin. The Phoenix Group, another publicly traded mining firm linked to the royals, currently holds Bitcoin valued at $3.2 million. Phoenix disclosed a Solana (SOL) position in its second-quarter report this year. This indicates a broader strategy in the cryptocurrency ecosystem.

Archam added, “On-chain transactions between Phoenix and Citadel also match amounts disclosed in official reports.”

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.