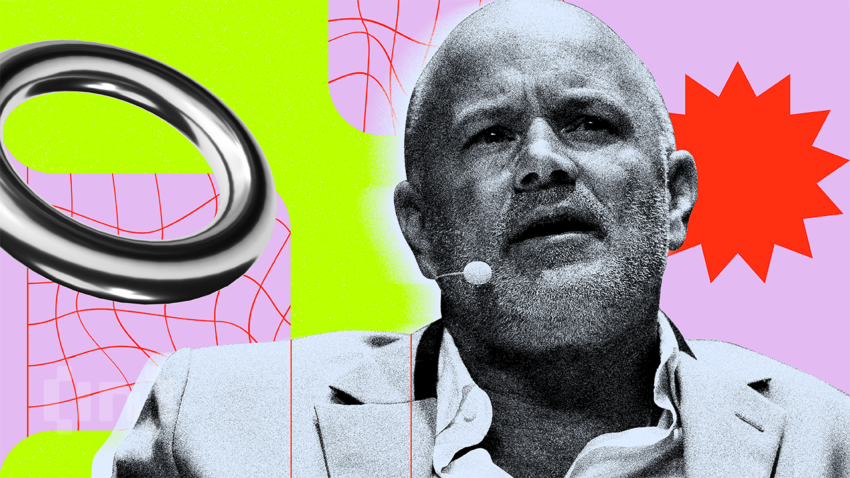

At Tokyo’s WebX conference, Galaxy Digital CEO Mike Novogratz predicted crypto applications and tokenized markets will gain real-world adoption within five years.

He said this shift would move the industry from speculation to practical use.

Ethereum’s Rally and the Coming IPO Wave

Novogratz said Ethereum’s sharp price surge has been fueled by digital asset treasury firms (DATs) that purchased around $11 billion in tokens, creating powerful buying pressure. He expects $5,000 to serve as a near-term resistance level.

He also expects a surge in crypto-related IPOs in 2025. Improved regulatory clarity after former SEC Chair Gary Gensler’s exit and wider Nasdaq access could attract more investors. That, he argued, will allow conventional equity investors to channel funds into digital asset companies.

Galaxy Digital Shares to Be Tokenized

Novogratz called tokenization the next major frontier. He revealed Galaxy Digital will announce plans to tokenize its own shares. He expects tokenized equities and other assets to see faster adoption, opening a new era in capital markets.

“Success in crypto will depend on moving from speculation to practical applications,” he said. He expects consumers to use blockchain-based products daily within four to five years.

Regarding regulation, Novogratz predicted the US would set global standards after years of uncertainty. Other nations are likely to adjust their frameworks to follow, he said. Novogratz described past regulatory turbulence as a necessary phase but argued that recent policy shifts now signal a more constructive direction.

He characterized former SEC Chair Gary Gensler as highly capable yet too political, a factor that slowed industry progress. With a friendlier regulatory climate emerging, Novogratz expects capital inflows and broader investor participation.

While Novogratz positioned the US as the global regulatory leader, Finance Minister Katsunobu Kato said early frameworks boosted trust and helped crypto exchange accounts in Japan grow to 12 million. Monex Chairman Oki Matsumoto said most financial transactions will eventually move to blockchain. He echoed the broader vision of a tokenized future.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.