XLM has been experiencing significant volatility and facing a drawdown as investor sentiment weakens. Despite attempts at recovery, the altcoin is struggling to reclaim its former highs.

Market conditions continue to worsen, with investors largely hesitant to re-enter the market, contributing to the ongoing decline in price.

Stellar Investors Are Uncertain

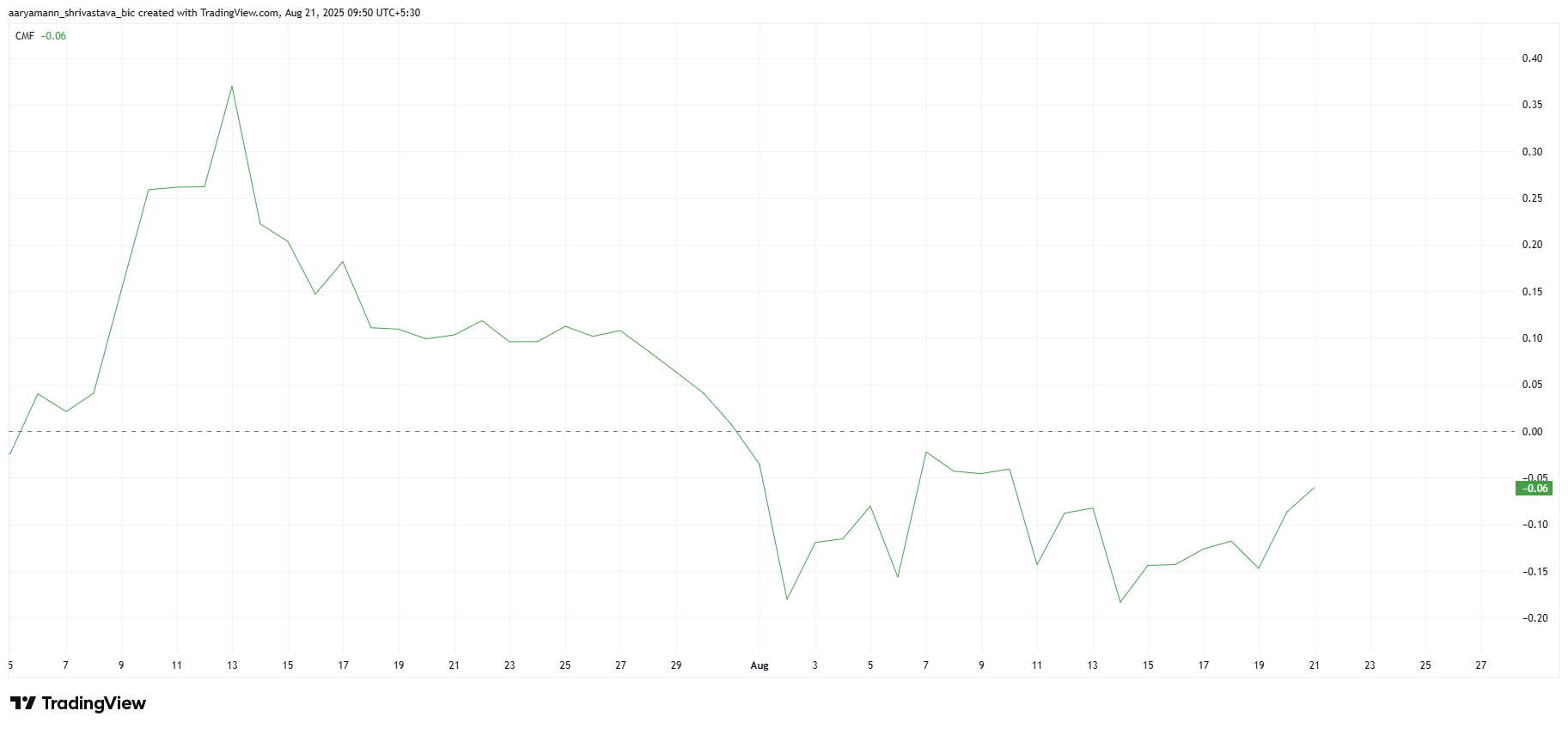

The Chaikin Money Flow (CMF) has been stuck below the zero line since the start of the month, signaling strong outflows from XLM. This indicates that investor uncertainty is hindering new inflows into the asset.

As the CMF stays negative, it reflects a lack of confidence in XLM’s short-term prospects. Investors appear to be pulling out their funds, leading to a sustained bearish sentiment in the market.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

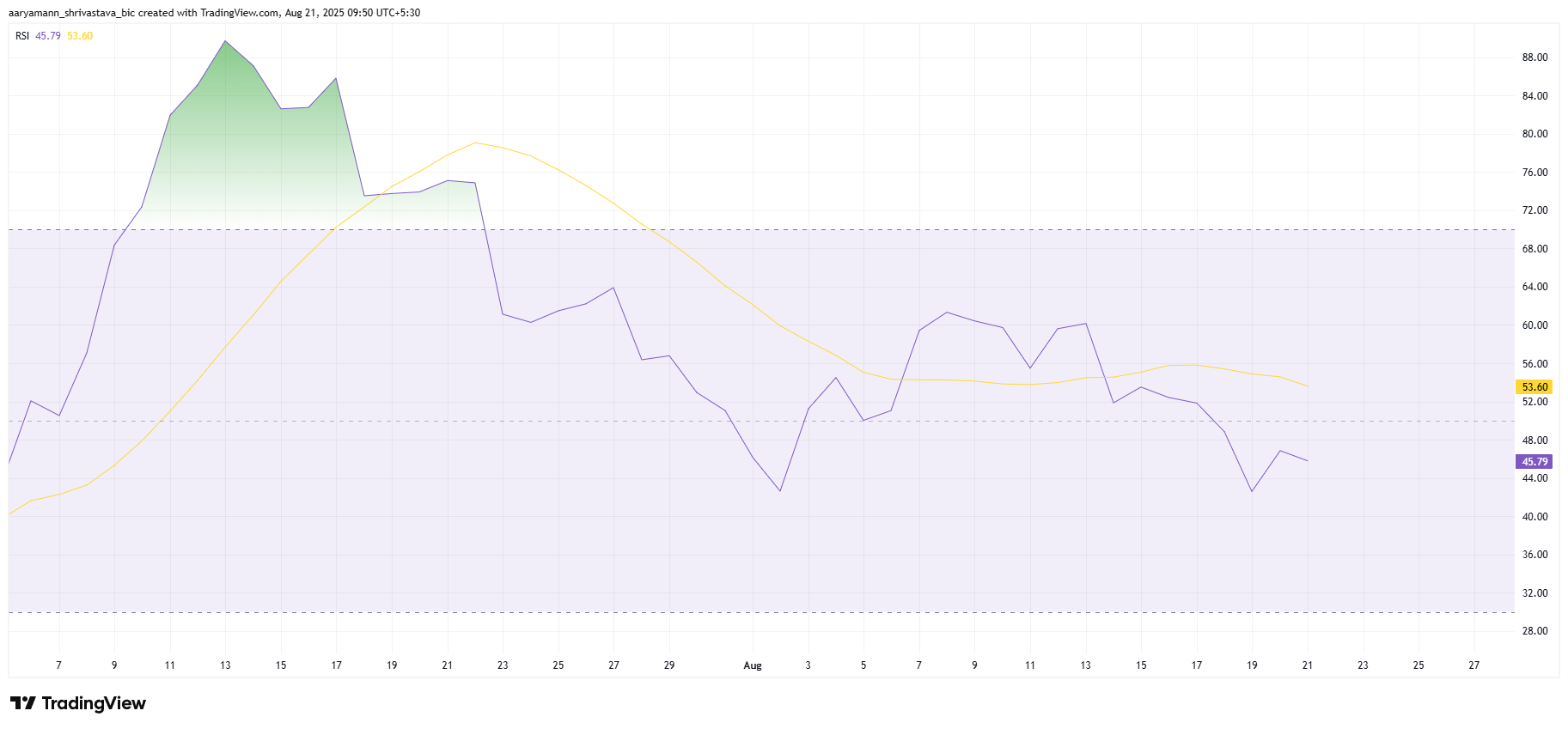

The Relative Strength Index (RSI) for XLM has also slipped below the neutral line, reinforcing the bearish outlook. The RSI is a critical indicator that tracks momentum and market conditions, and its current position shows growing weakness for XLM.

With the RSI trending downward, the broader market environment for XLM remains unfavorable. This further supports the notion that, for the time being, the altcoin is under significant selling pressure, and any potential recovery seems distant.

XLM Price Is Not Noticing A Downtrend

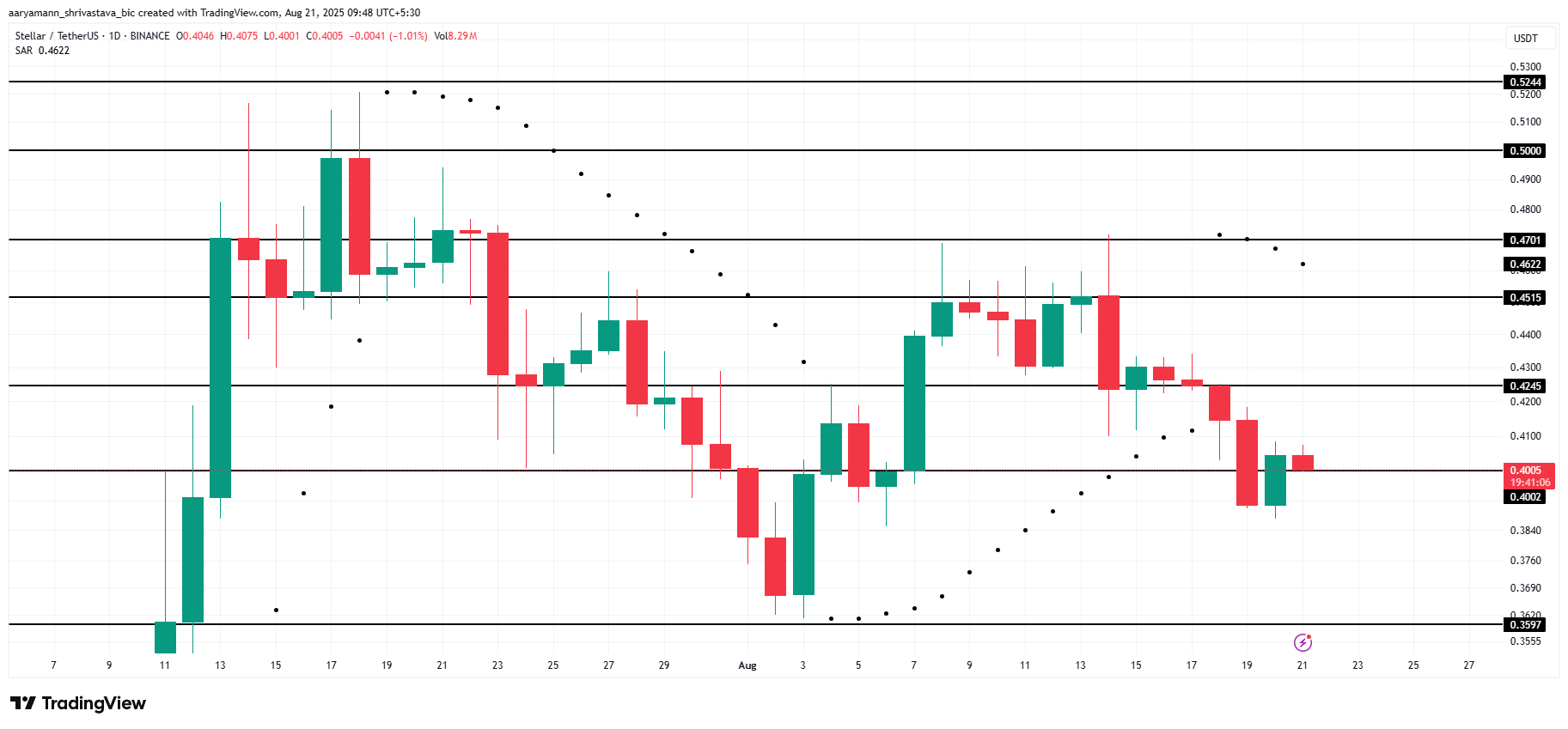

XLM’s price is currently at $0.40, and they are attempting to hold this level as support. However, given the current market conditions and the indicators mentioned above, it seems unlikely that XLM will recover its losses in the short term. The Parabolic SAR above the candlesticks confirms the ongoing downtrend, making it difficult for the altcoin to reverse its trajectory.

The next significant support level for XLM is at $0.35, which it last visited over a month ago. If the downtrend continues, the price could fall to this level, triggering further selling from investors. This would reinforce the bearish market sentiment and could prolong the period of weak price action.

However, if XLM manages to bounce off the $0.40 support level, it could see a recovery toward $0.42 or even $0.45, provided investors shift their sentiment and re-enter the market. A successful rebound would invalidate the bearish thesis.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.