Data shows that two major mining pools currently control over 51% of Bitcoin’s total mining power.

Bitcoin has long been considered a symbol of decentralization and financial independence. However, the latest development reveals the downside of concentration within the PoW mechanism.

Could Bitcoin face a 51% attack?

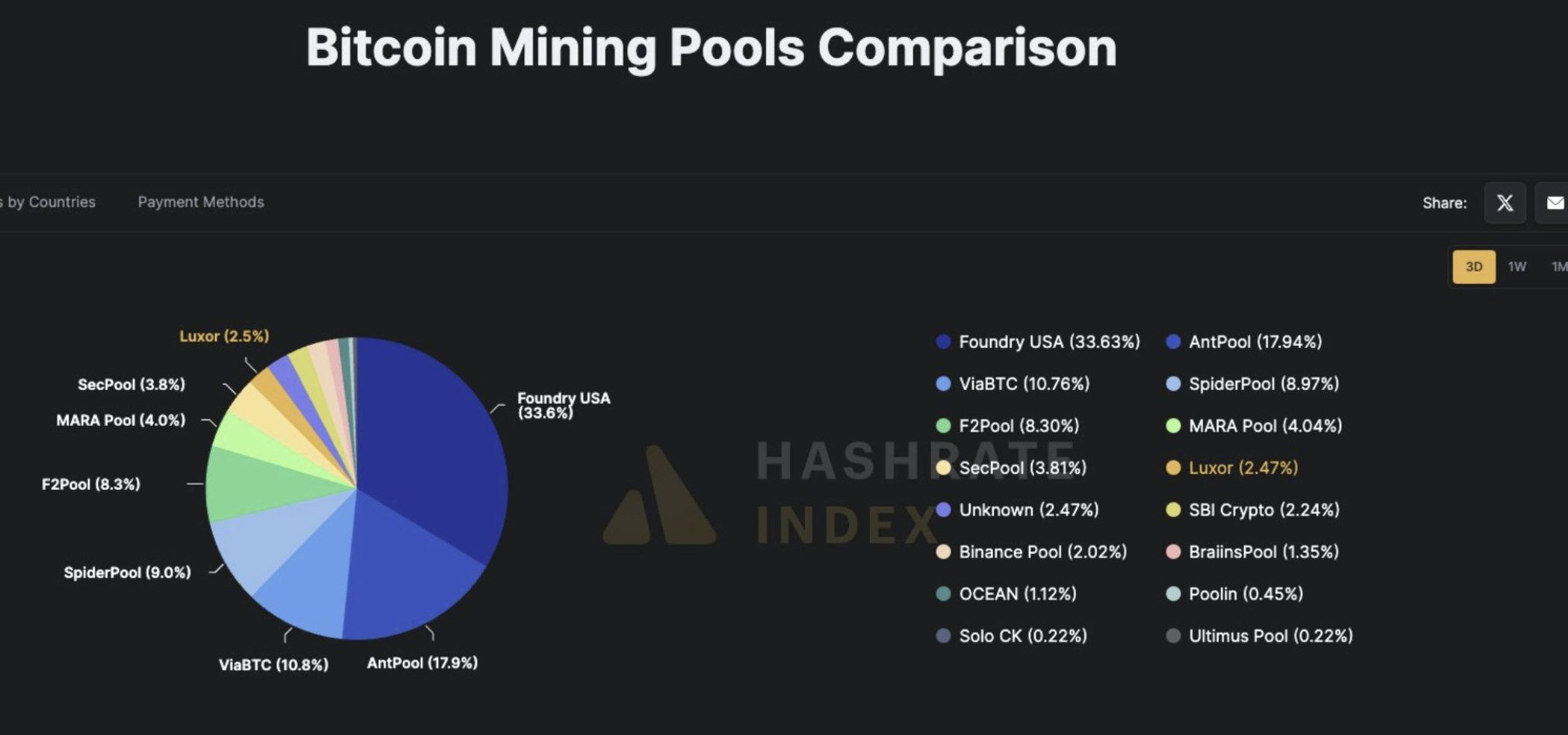

According to analyst Jacob King, Foundry currently holds a 33.63% market share of Bitcoin’s mining hashrate, while AntPool accounts for 17.94%. Together, these two pools dominate over 50% of the network’s hashrate, raising concerns about centralization in Bitcoin mining.

This means that if these two Bitcoin mining pools were to combine, they would surpass the 51% threshold of hashrate control. In theory, this would open the possibility for an attack aimed at manipulating the network.

“Once reality sets in about how centralized, manipulated, and useless Bitcoin truly is, everything will collapse faster than ever. It’s essentially a giant game of musical chairs!” Jacob shared.

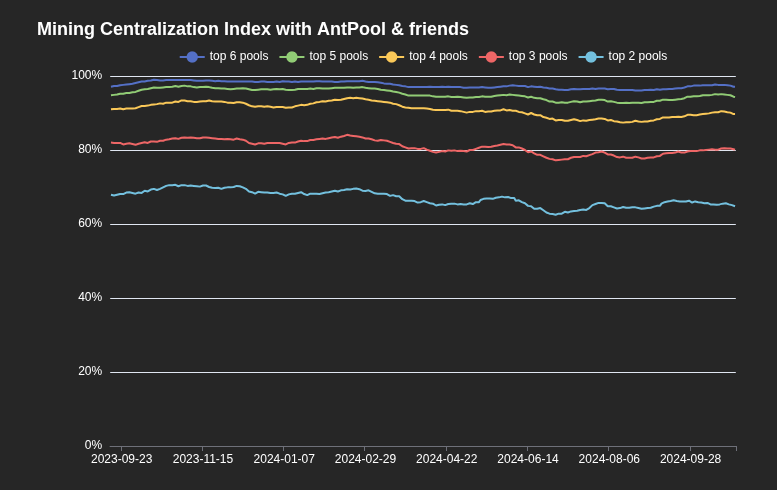

Some community members have also openly acknowledged that Bitcoin mining has become “extremely centralized.” Statistics from Evan Van Ness show that three mining pools frequently hold over 80% of the global hashrate.

This is the first time mining concentration has reached such a dangerous threshold in more than a decade. It has shaken the community’s confidence in decentralization, Bitcoin’s foundation. Many experts are questioning whether the Proof-of-Work (PoW) mechanism remains suitable to serve as the backbone of the global financial system. Its vulnerabilities, such as the risk of a 51% attack, raise concerns about its long-term viability.

Some analysts warn that this situation could transform Bitcoin from a decentralized asset into a perceived “risk and burden” for institutional investors. This shift could also impact the broader financial system.

If a 51% attack were to occur, the controlling mining pools could manipulate transaction validation and block or reverse confirmed transactions. This could also enable double-spending, compromising the Bitcoin network’s integrity. Such a scenario would cause financial losses and destroy confidence in Bitcoin as a safe-haven asset.

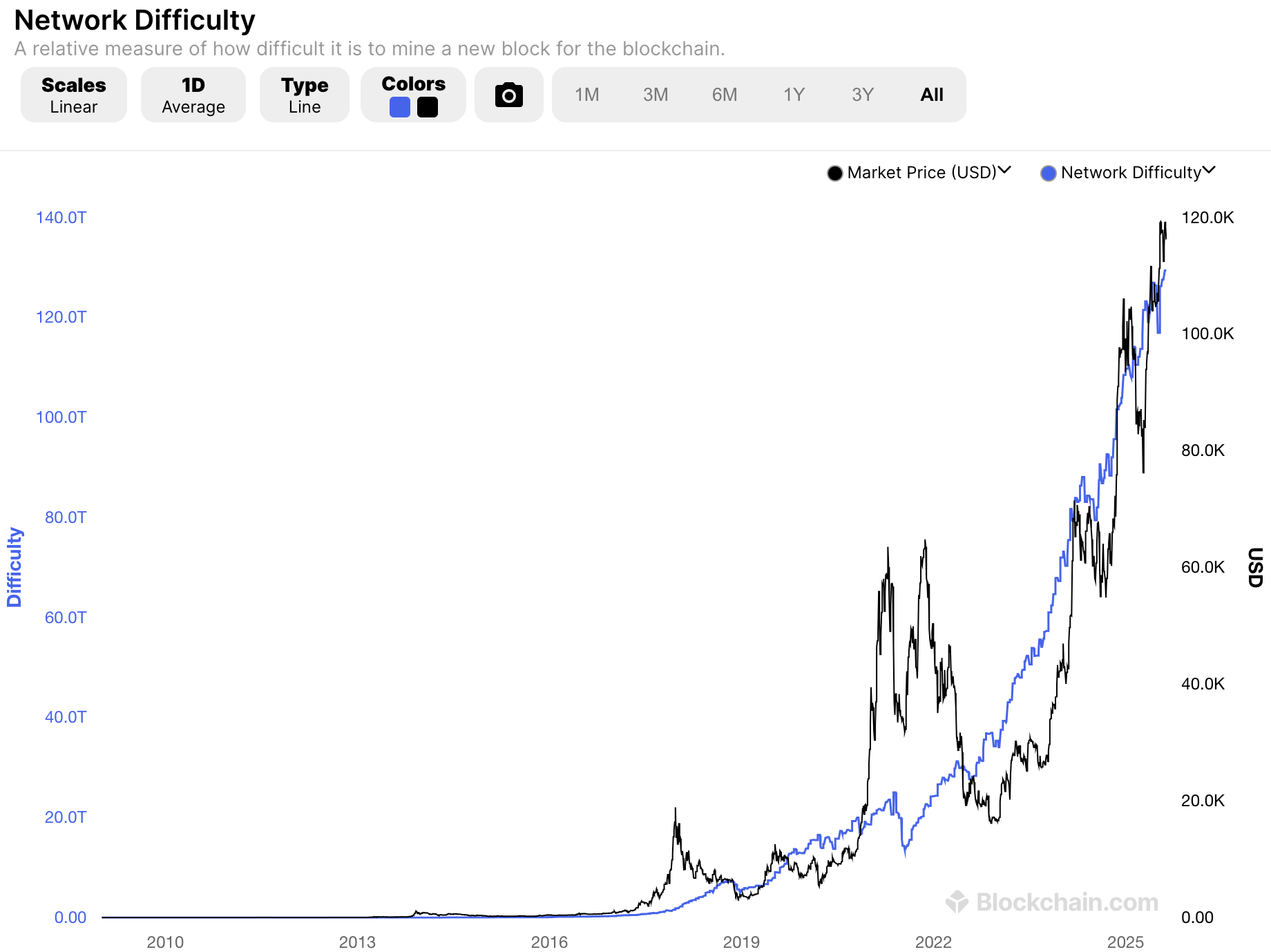

Although hashrate and difficulty are currently at a record high, concerns over a potential 51% attack have added psychological pressure to the market.

Experts note that executing a 51% attack on Bitcoin is extremely costly, requiring substantial infrastructure and energy resources. This high barrier makes such an attack logistically challenging despite the concentration of mining power.

Moreover, the economic incentives of mining pools may limit the likelihood of a 51% attack, as it could cause Bitcoin’s price to collapse. Such a collapse would directly harm those who control the hashrate themselves.

Nevertheless, the perception that Bitcoin is vulnerable to a 51% attack can generate significant concern among investors. This fear alone is sufficient to raise worries about systemic risk.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.