The broader crypto market ended last week on a lackluster note. This weakness extended into crypto-related equities, many of which saw sideways or downward pressure.

However, some crypto stocks bucked the trend, closing the week with notable gains.

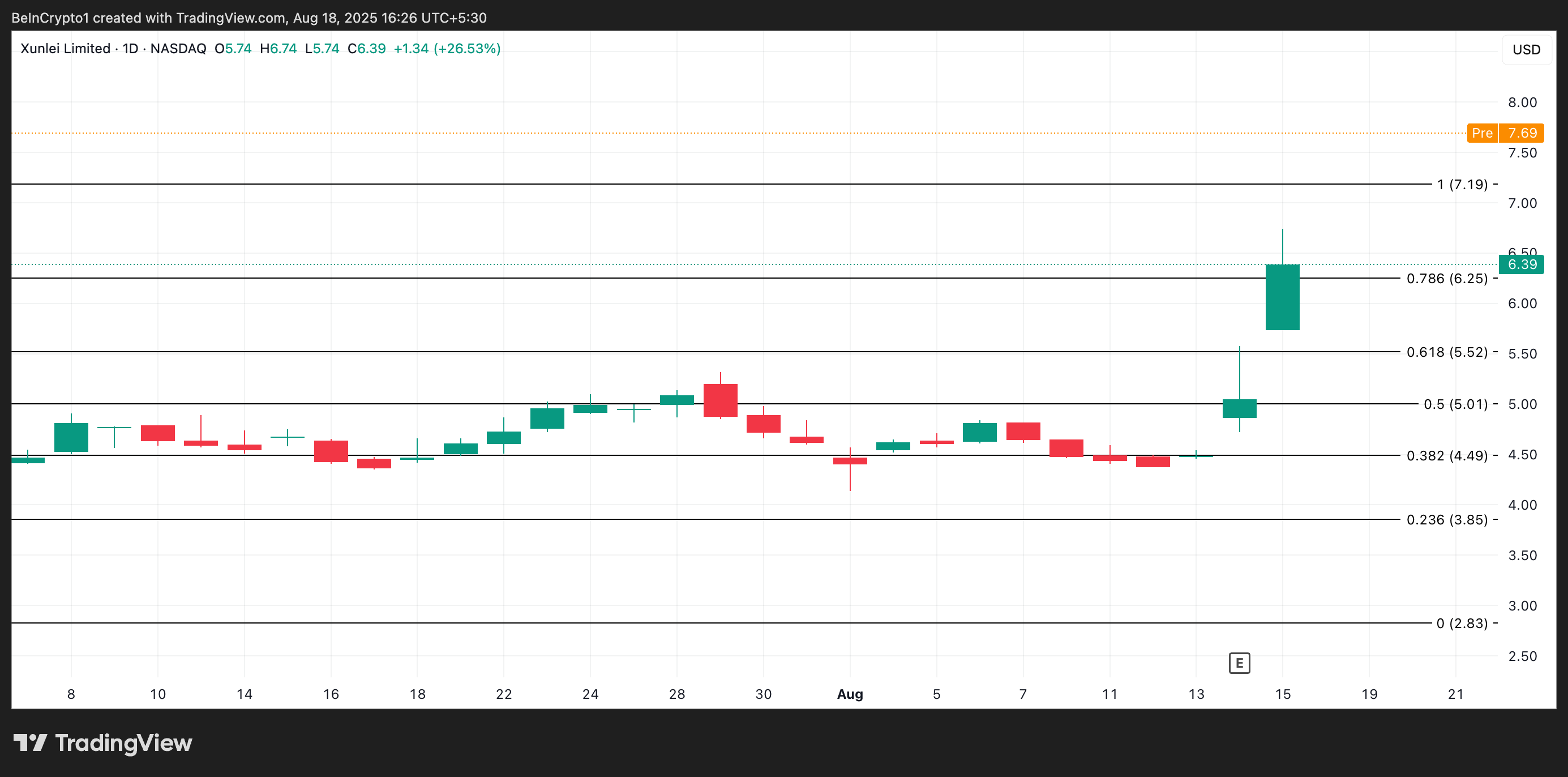

Xunlei Limited (XNET)

Xunlei Limited’s shares closed Friday’s session at $6.39. This was a 26.53% gain, which came after the company released its second-quarter 2025 financial results. The strong earnings report was the key driver behind the rally, drawing traders’ attention to the stock heading into this week.

The company reported total revenues of $104 million, up 30.6% year-over-year. Subscription revenues rose to $36.4 million while live-streaming and other services revenues surged to $37.6 million, an 85.5% increase. Cloud computing revenues also grew, reaching $30 million. This massive turnaround helped XNET close the week at fresh highs.

During today’s pre-market session, the stock already trades higher at $7.69. If buying pressure grows as the week progresses, XNET’s price could rally toward $8.77.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

On the other hand, failure to hold momentum could cause it to fall back below $6.00.

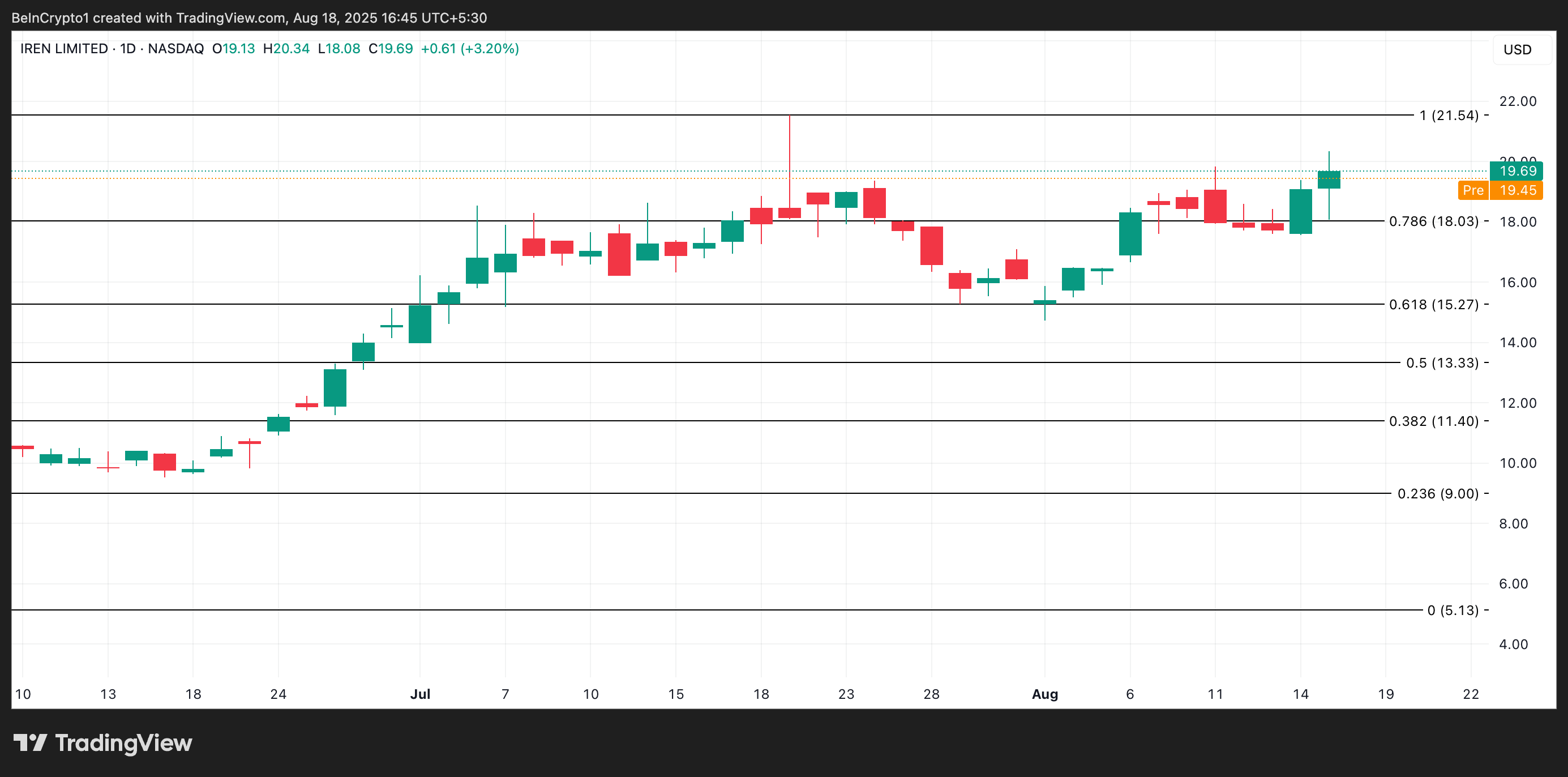

IREN Limited (IREN)

On Friday, IREN closed the week strong at $19.69, up 3.20%, marking one of its best weekly performances since July 21. This makes it one of the crypto stocks to watch this week.

Adding to the buzz, IREN announced it will release its fiscal year 2025 results on August 28. This upcoming earnings event has the potential to fuel volatility and attract fresh buying interest.

In the pre-market session today, IREN trades at $19.45. If buying interest climbs through the week, the stock could rally toward $21.54.

However, a dip in demand could cause its price to retreat below $18.03.

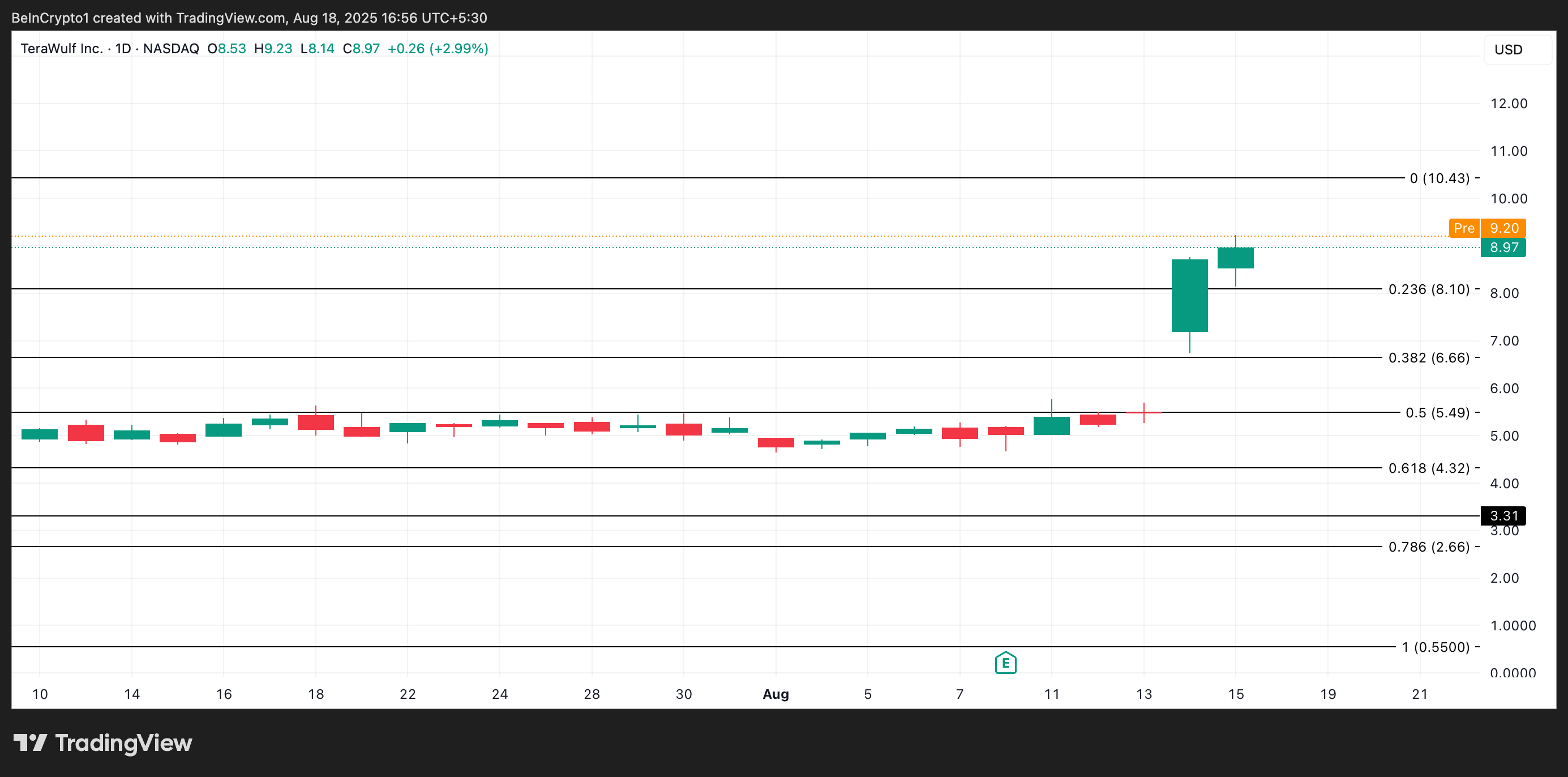

TeraWulf Inc (WULF)

WULF closed Friday’s session at $8.97, up 2.99%. The rally was fueled by the company’s announcement of an 80-year ground lease at the Cayuga site in New York, securing exclusive rights to develop up to 400 MW of HPC and AI data center capacity.

In today’s pre-market session, WULF trades at $9.20. If buy-side pressure increases this week, the stock could rally toward $10.43.

Conversely, a reversal in sentiment could see it slip below $8.10

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.