PUMP has emerged as today’s top gainer, climbing 10% over the past 24 hours despite a broader pullback in crypto trading activity.

The surge comes as Pump.fun, the platform behind the token, reclaims its position as Solana’s largest memecoin launchpad, overtaking rival LetsBonk after weeks of losing dominance.

Pump.fun Reclaims Solana Memecoin Crown

Pump.fun is a memecoin launchpad built on the Solana blockchain. It enables users to create and launch tokens quickly with minimal technical know-how.

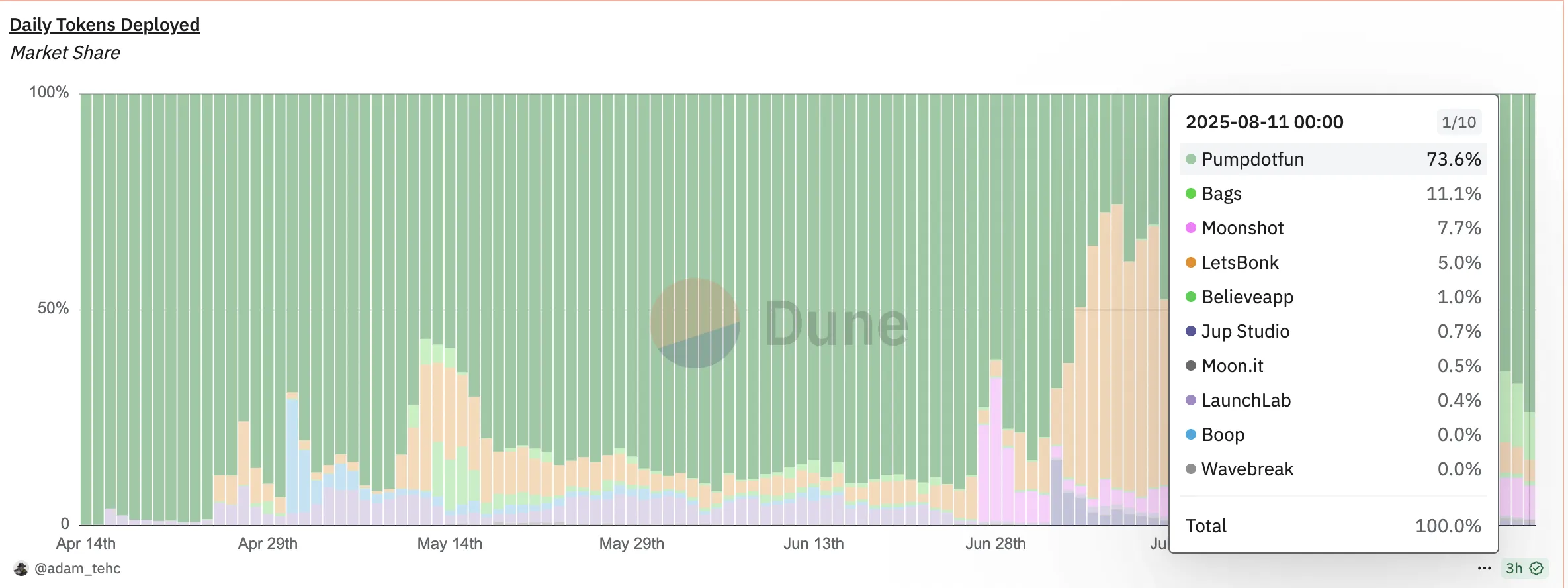

According to a Dune Analytics Dashboard, the platform dominated memecoin creation on Solana for over a year.

Pump.fun briefly lost its dominance in July as LetsBonk surged to command up to 74% of daily memecoin launches on the network. However, as the summer peak faded, LetsBonk’s dominance began to wane, opening the door for Pump.fun’s resurgence.

By Monday, Pump.fun had rebounded to claim a 73% share of 36,458 memecoins launched, while LetsBonk’s market share shrank to just 5% on the same day.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

PUMP Stages Strong Recovery With Bullish Indicators

This gradual increase in Pump.fun’s dominance has fueled renewed demand for PUMP, pushing the token to a multi-week high of $0.003616 at press time.

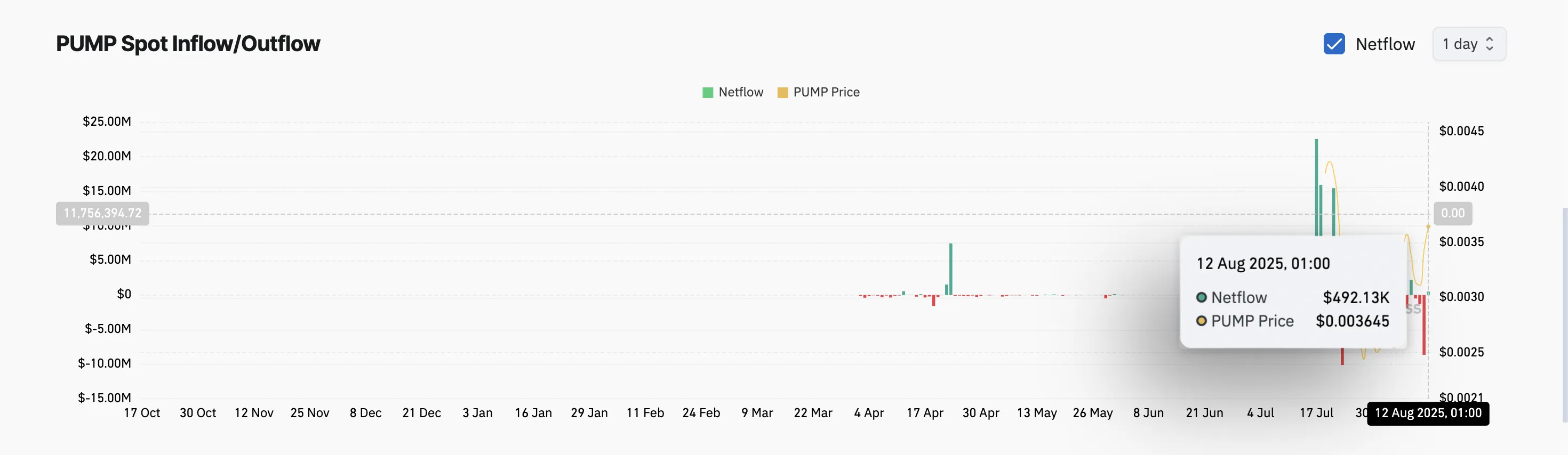

On-chain data shows a slow shift in investor behavior, with PUMP reversing a three-day streak of spot net outflows — a sign that accumulation is back in play. According to Coinglass, net outflows from the PUMP market exceeded $10 million during that period.

With capital slowly returning to the meme coin’s market, inflows into PUMP’s spot markets have totaled $492,130 today.

This steady influx of capital reflects growing confidence in PUMP’s market outlook, as more traders begin to position for further upside. If this trend holds, PUMP could maintain its upward momentum amid Pump.fun’s strengthening market position.

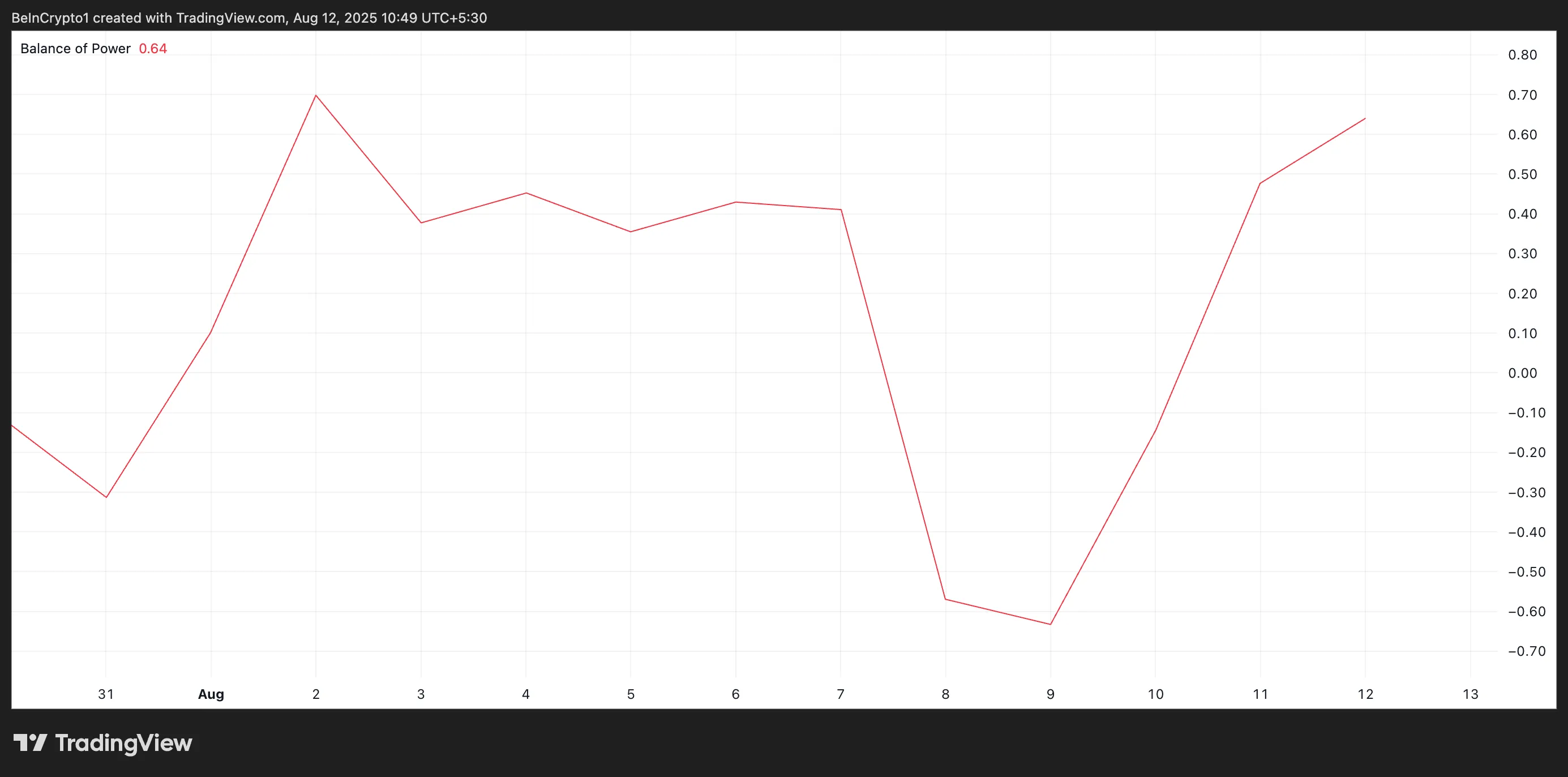

Moreover, on the technical front, PUMP’s positive Balance of Power (BoP) confirms heightened buying pressure, strengthening the bullish outlook. As of this writing, the metric stands at 0.69 and is climbing, highlighting the growing demand for the meme coin.

The BoP indicator measures the strength of buying versus selling pressure by comparing price movements within a given period. When its value is positive, buyers are in control, increasing the likelihood of further upward price momentum.

Bulls Push PUMP Toward Breakout, But Bears Lurk Below $0.00307

PUMP currently trades below the resistance formed at $0.004065. If buy-side pressure grows and the meme coin successfully flips this barrier into a support floor, it could propel its price to $0.004598.

However, a rise in the profit-taking trend could invalidate this bullish projection. If the bears regain control, they could trigger a decline below $0.00307.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.