Ripple’s XRP has defied the broader crypto market’s muted performance over the past week, surging nearly 15% in the past seven days.

The token’s price has climbed to a 17-day high of $3.35 at press time, with a combination of on-chain and technical indicators suggesting the rally may have more fuel left in the tank.

XRP Social Metrics Heat Up, Hinting at Short-Term Price Growth

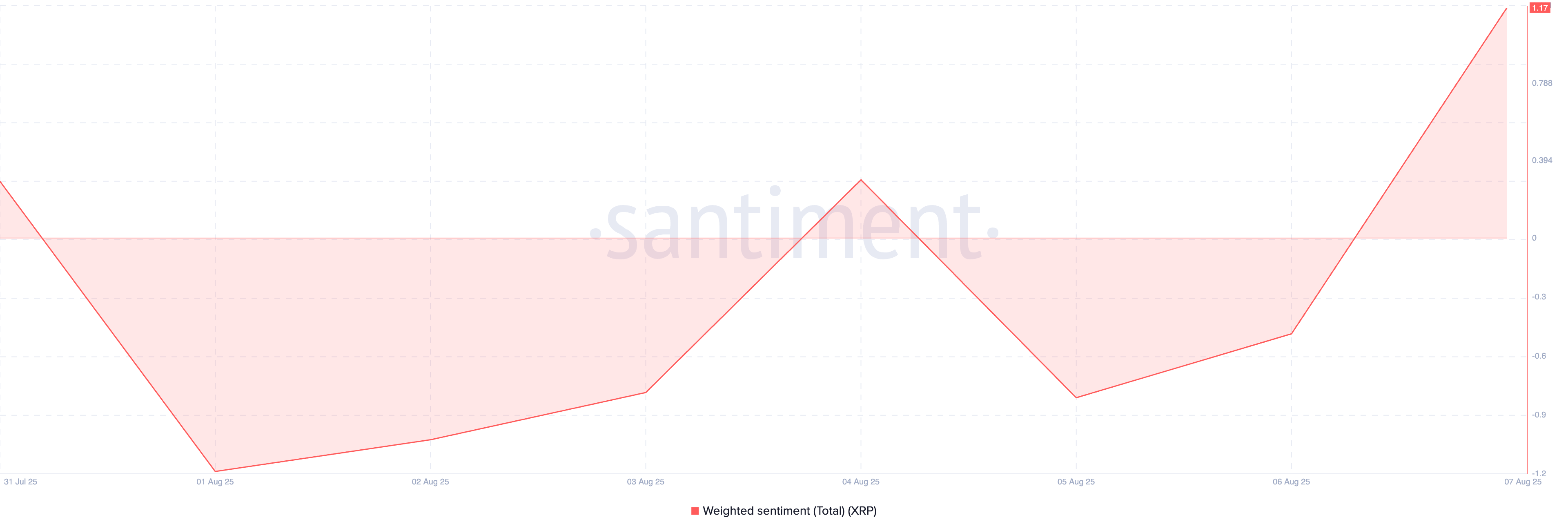

Market sentiment toward XRP has shifted sharply bullish, as reflected in its rising weighted sentiment score, which measures traders’ overall outlook. At press time, this metric stands at a two-week high of 1.17.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

An asset’s weighted sentiment measures its overall positive or negative bias, considering both the volume of social media mentions and the feelings expressed in those mentions.

When it is negative, it is a bearish signal, as investors are increasingly skeptical about the token’s near-term outlook. This prompts them to trade less, exacerbating the downward pressure on price.

Conversely, as with XRP, when an asset’s weighted sentiment is positive, it highlights growing market confidence and a willingness among traders to buy into rallies. If this sentiment-driven momentum persists, it can amplify XRP’s price gains in the short term.

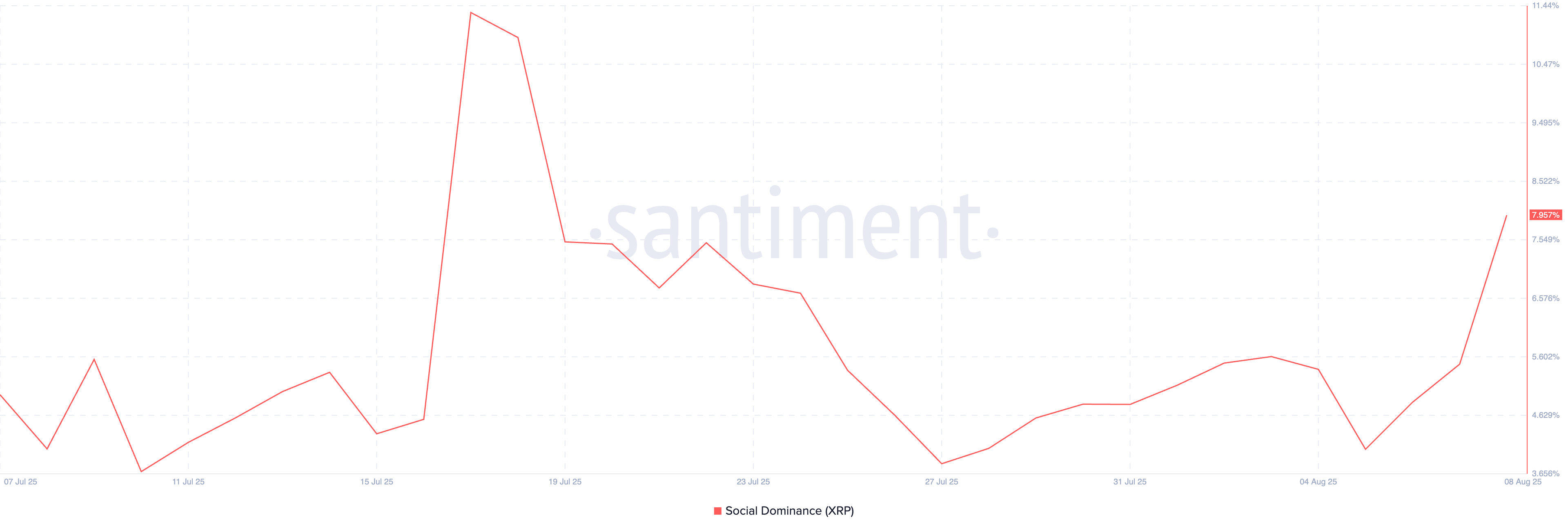

Furthermore, santiment data shows XRP’s social dominance has climbed to a 19-day high of 7.95%, meaning the altcoin continues to capture a larger share of all crypto-related social discussions.

Social dominance measures how much of the total online conversation within the cryptocurrency sector focuses on a particular asset. When this metric spikes, as it has for XRP, it signals heightened retail interest and engagement.

This visibility could draw more speculative capital in the short term, driving more gains for the token.

XRP Gears for Breakout as Buy-Side Pressure Hits Peak

On the daily chart, XRP’s Aroon Up Line supports this bullish outlook. This is 100% at press time, indicating that the token’s rally is strong and backed by significant buy-side pressure.

The Aroon indicator measures the strength and timing of a trend by tracking the time since the asset reached its most recent high (Aroon Up) or low (Aroon Down).

When an asset’s Aroon Up line is at or close to 100%, its price has hit a new high recently and is targeting more gains. This is true of XRP, which currently trades at a two-week high. It means the market has strong bullish momentum and hints at a potential sustained rally.

If this continues, the token’s price could break above $3.39 and reclaim its cycle peak of $3.66.

On the other hand, if buying wanes, the price could fall to $3.01.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.