Korean cryptocurrency exchanges Dunamu and Bithumb shares have surged dramatically this year, contrasting sharply with Coinone’s decision to liquidate crypto holdings.

With the bull market this year, exchanges are experiencing divergent fortunes as market leaders see soaring valuations while smaller players face financial strain.

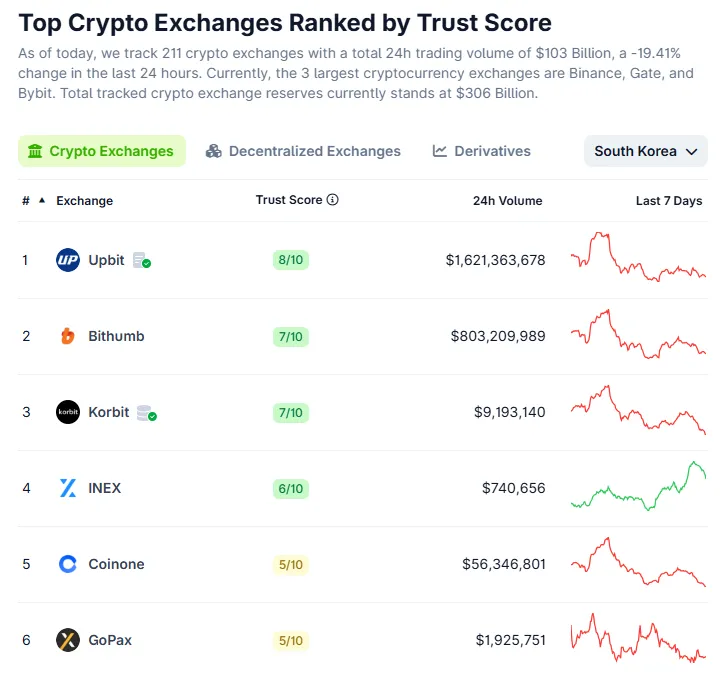

Upbit, Bithumb Drive Exchange Valuations Higher

Dunamu, which operates Upbit, has seen its private stock price climb 33% year-to-date to 240,000 won ($173). The company’s estimated market capitalization now stands at 8.26 trillion won ($5.96 billion). Bithumb has performed even more impressively with a 131% surge to 238,000 won ($172).

Both exchanges reached peak valuations on July 4th before moderating slightly. Dunamu hit 258,000 won while Bithumb touched 275,000 won during the summer rally. The gains reflect renewed optimism in cryptocurrency markets as Bitcoin repeatedly set new yearly highs.

Both companies are positioning themselves for potential public offerings in the coming months. Bithumb has specifically targeted a Kosdaq listing for late 2025. Their strong market positions support these ambitious plans as trading volumes remain robust.

Coinone Struggles Against Market Concentration

Smaller exchange Coinone faces mounting pressures with just 3% market share compared to dominant players. The company announced plans to sell $2.96 million worth of cryptocurrencies. This represents approximately 10% of Coinone’s total digital asset holdings.

The sale marks the first case under new regulatory guidelines introduced in May. Financial authorities established transparent procedures allowing exchanges to liquidate their crypto holdings for operational funding. The framework requires advance disclosure and limits sales to top-20 cryptocurrencies by market capitalization.

Coinone’s sale will fund operational expenses including personnel costs rather than expansion or infrastructure. The move signals urgent liquidity needs amid ongoing financial difficulties.

Coinone recorded $4.4 million in operating losses last year, extending deficits to three consecutive years. Co-CEO Lee Sung-hyun now reportedly manages multiple roles following workforce reductions. Industry observers suggest these measures may precede potential acquisition discussions.

The cryptocurrency exchange sector increasingly favors scale as fee-based revenue models depend heavily on trading volumes. Market concentration between Upbit’s 63% and Bithumb’s 33% share leaves little room for smaller competitors.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.