XRP is up 5% over the past 24 hours, offering temporary relief from the bearish pressure that has dragged its price downward over the last week.

While the recent uptick reflects broader improvements across the crypto market, on-chain data show asset-specific trends could be fueling XRP’s rebound.

XRP Sentiment Shifts as Futures Buy Pressure Builds

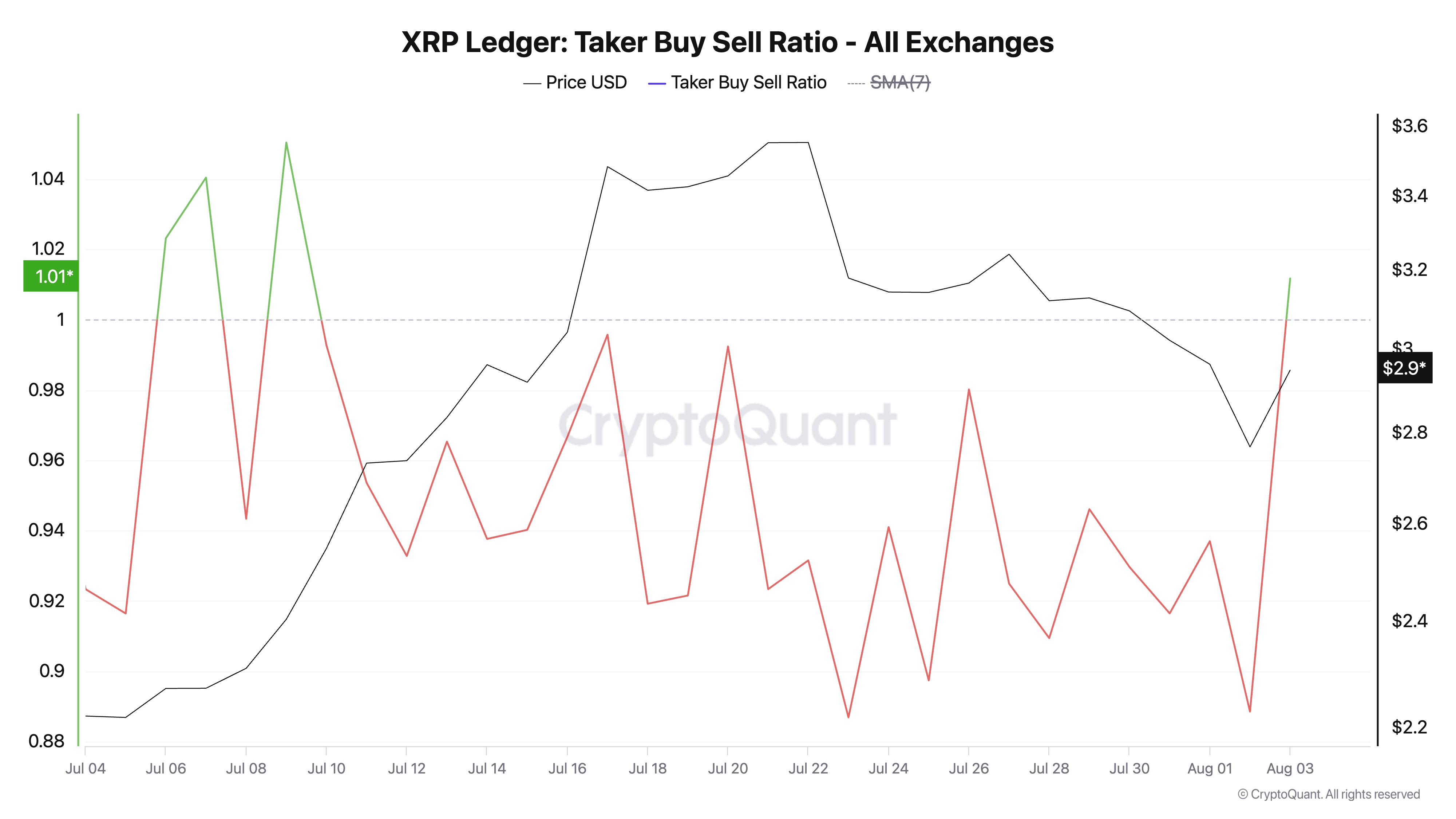

One key metric pointing to this shift is XRP’s taker buy/sell ratio, which closed in the green zone yesterday. According to CryptoQuant, this marked the first time this metric would close at a positive value since July 10, confirming the likely positive shift in the market’s sentiment.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

An asset’s taker buy-sell ratio measures the ratio between the buy and sell volumes in its futures market. Values above one indicate more buy than sell volume, while values below one suggest that more futures traders are selling their holdings.

The uptick in XRP’s taker buy/sell ratio signals a slowdown in futures market sell pressure. It highlights the weakening of bearish sentiment among futures participants — a trend that, if sustained, could further aid XRP’s upward movement.

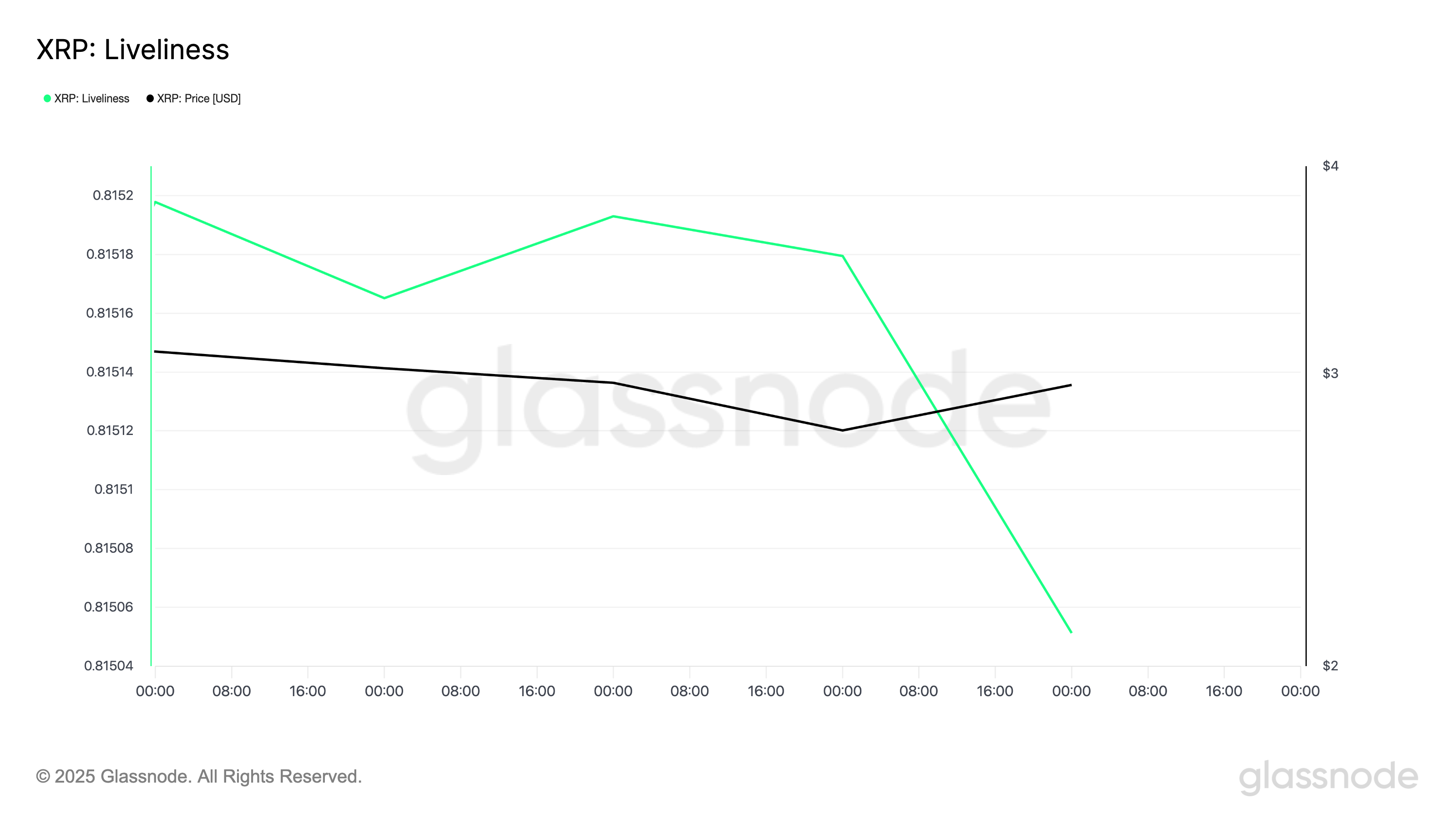

Another noteworthy trend is the steady decline in XRP’s liveliness since the beginning of August. According to Glassnode, the metric closed August 3 at 0.8150, falling from the 0.8152 recorded on August 1.

Liveliness tracks the movement of long-held/dormant tokens. It does this by measuring the ratio of an asset’s coin days destroyed to the total coin days accumulated. When the metric climbs, it means that LTHs are moving their coins or selling them.

On the other hand, when it falls like this, profit-taking may be slowing down, with key holders returning to accumulation mode after a period of sell-side pressure.

Will Resistance Halt the Climb or Trigger a Fall to $2.87?

The combination of reduced selloffs and rising futures interest could help XRP stabilize above the $3 price level in the near term. If accumulation strengthens, the altcoin could extend its gains toward $3.22. A successful breach of this barrier could open the door to a rally to $3.33.

Failure to do so could see the altcoin reverse gains and dip as low as $2.87, resuming the recent downward trend.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.