XRP has shown signs of recovery, rising from $1.94 to its current price of $2.24. Despite this positive momentum, the altcoin faces significant resistance around the $2.27 mark.

As it approaches this target, bearish signals from large holders could potentially halt its recovery beyond this level.

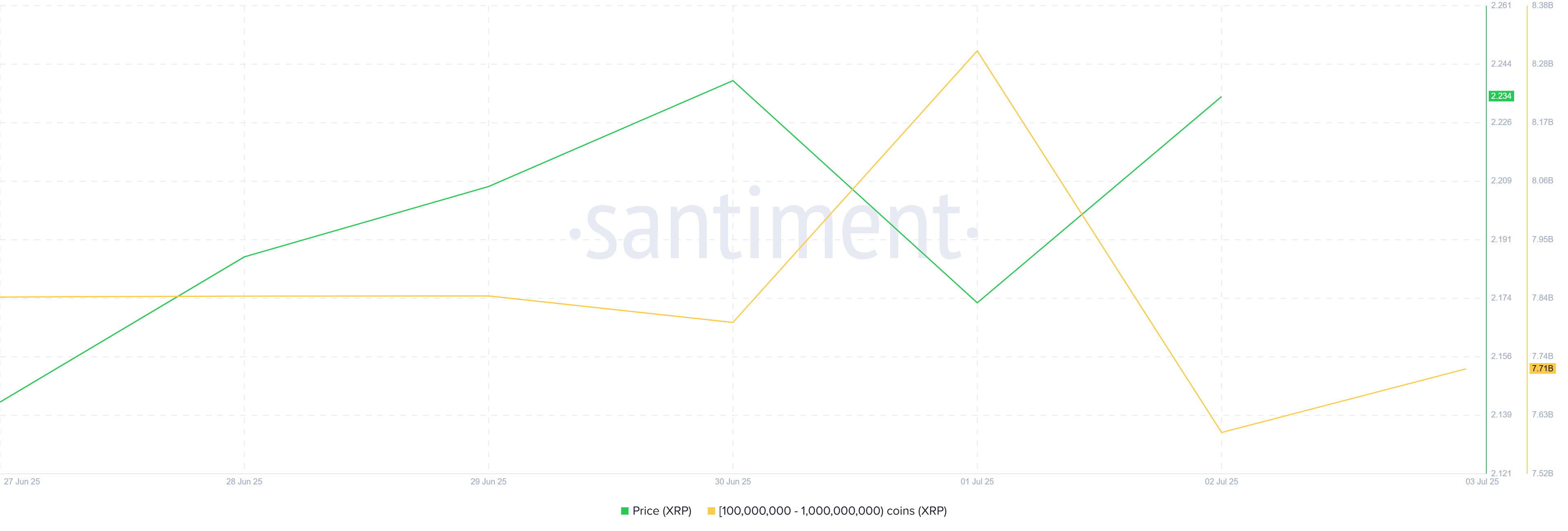

XRP Whales Are Losing Conviction

This week, addresses holding between 100 million and 1 billion XRP sold over 600 million XRP in just 24 hours, reducing their holdings to 7.7 billion XRP. The total worth of the XRP sold is over $1.2 billion, indicating increasing uncertainty and a lack of belief among these whales that XRP will rise further.

The selling activity from these major holders points to a shift in sentiment. With such a large amount of XRP leaving the hands of long-term holders, the market may struggle to sustain its upward movement.

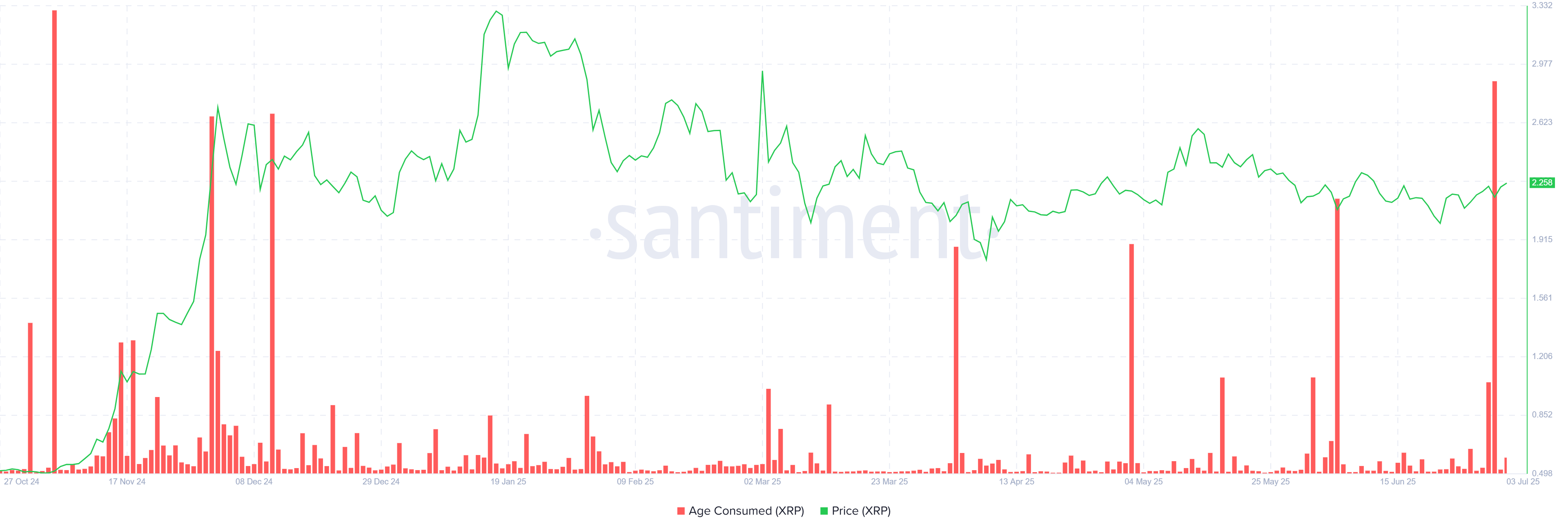

The age consumed metric, which tracks the selling activity of long-term holders (LTHs), recently hit a 7-month high. This spike indicates that LTHs are increasingly willing to sell their holdings, suggesting a negative shift in their sentiment towards XRP. LTHs are considered to be the backbone of an asset’s stability, so their decision to sell could signal weakening confidence in XRP’s future price prospects.

With LTHs contributing to the selling pressure, the potential for further price gains diminishes. This shift in behavior from these crucial holders could signal an impending decline in XRP’s price stability.

XRP Price Needs A Push

At $2.24, XRP is just under the resistance level of $2.27. This resistance has held strong for over a month, making it the key barrier between XRP and the next significant resistance at $2.32. If XRP fails to breach this level, the altcoin may struggle to continue its recovery and could face a retracement.

Breaching $2.27 is crucial for continuing the recovery, but with the selling activity from large holders and bearish signals in the market, it seems unlikely that XRP will reach $2.32. Instead, a failure to break past $2.27 could send XRP back down to $2.13, testing lower support levels.

However, if bullish cues dominate the market, XRP could manage to breach $2.32, potentially establishing it as support. In this scenario, XRP could rise towards $2.45, as the market sentiment shifts and large buyers step in to push the price higher.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.