Bitcoin’s price has seen notable volatility recently, driven by multiple factors ranging from the release of the US Consumer Price Index (CPI) data to the escalating conflict between Israel and Iran.

These global events have added a layer of uncertainty to the crypto market, but Bitcoin’s resilient performance suggests it will continue to find support.

Bitcoin Has Its Investors’ Support

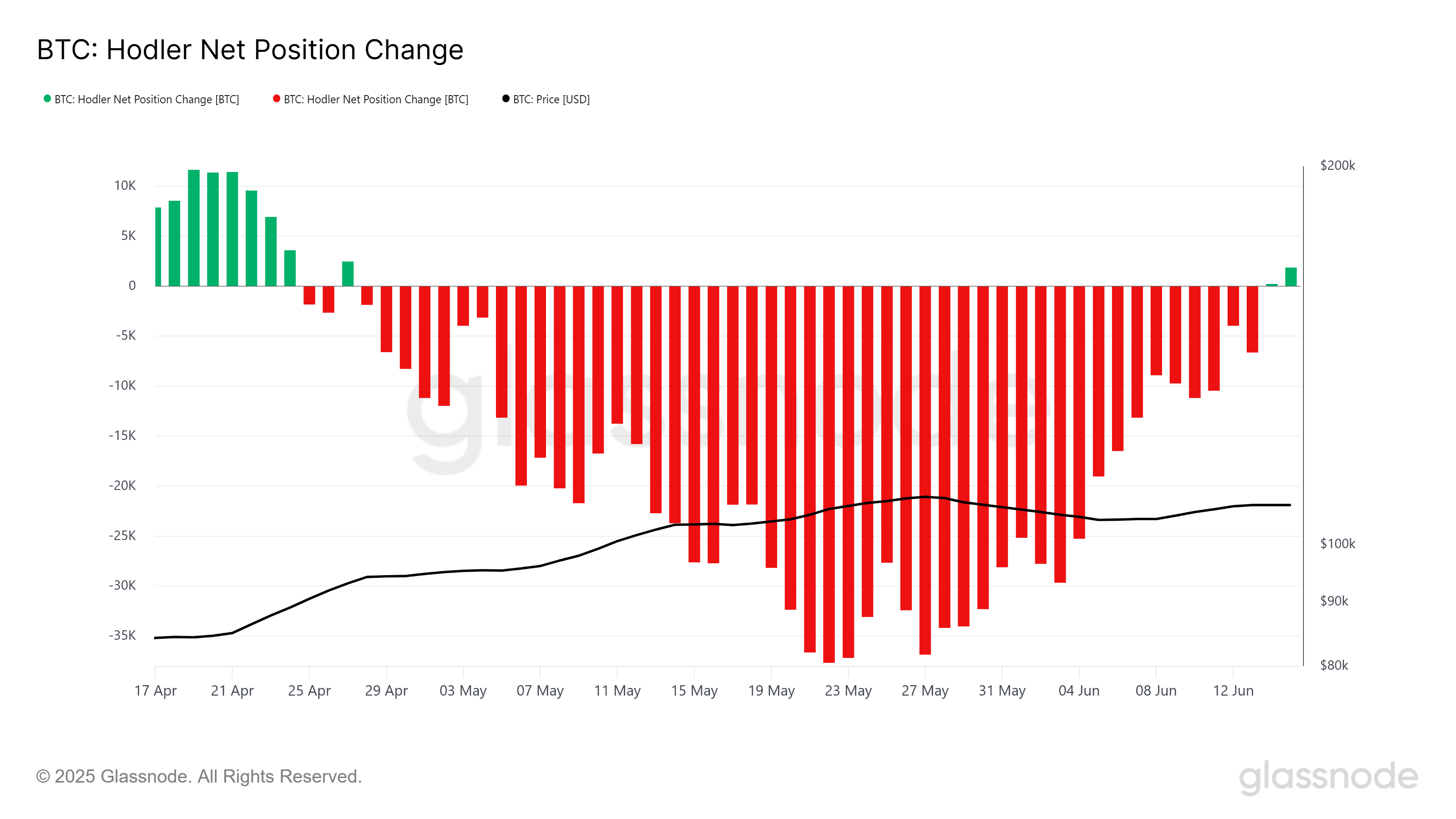

After nearly two months of limited movement, the stance of Bitcoin’s long-term holders (LTHs) has begun to change. The recent HODLer net position change data indicates that outflows have subsided, suggesting that LTHs have stopped booking profits. This shift signals growing confidence among investors.

Over the last 24 hours, minor inflows were observed, hinting that LTHs are beginning to re-enter the market. If these inflows increase, Bitcoin’s price could gain momentum and recover, reflecting renewed investor optimism.

The reversal of LTHs’ selling behavior is an encouraging sign. If the trend continues, it could support further price growth for Bitcoin.

On the macroeconomic front, Bitcoin ETFs have played a significant role in recent market developments. Last Friday, Bitcoin ETFs collectively saw inflows of $301.7 million following the Israel-Iran conflict. This marked the second-highest inflow of the week, with each day registering consistent inflows. The fact that institutional investors were undeterred by the geopolitical tensions suggests a bullish outlook from this segment of the market.

However, this positive momentum could shift depending on how institutions respond in the coming days. Should institutional inflows continue, Bitcoin could see further support, keeping its price trajectory upwards. Conversely, if institutional sentiment turns negative or inflows slow down, the price of Bitcoin could experience a reversal. Monitoring ETF inflows in the upcoming week will be crucial for gauging the market’s direction.

BTC Price Needs To Push Through Key Barriers

Bitcoin’s price recently bounced off the support level of $105,572 after holding above $105,000 for the past few days, trading at just under $107,000. This indicates that Bitcoin has found a solid support zone, and traders are targeting the next resistance at $108,000.

Breaching this level will be key for the cryptocurrency to gain further traction. If Bitcoin succeeds in surpassing the $108,000 barrier, it could push toward the next major resistance levels.

Clearing the psychological resistance at $108,000 would open the door for Bitcoin price to challenge the $109,476 level, bringing the $110,000 mark into reach. If Bitcoin can reclaim this as support, the path towards a new all-time high (ATH) of $111,980 becomes more achievable.

However, if Bitcoin struggles to breach the $108,000 resistance and sees a shift in investor sentiment, the cryptocurrency may fall back to the $105,572 support level. A drop below this support would suggest a bearish reversal, with Bitcoin potentially slipping below $105,000.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.