MARA Holdings, Strategy Incorporated (MSTR), and Galaxy Digital (GLXY) are three of the most closely watched Crypto US stocks for today. MARA is expanding aggressively in both Bitcoin mining and AI infrastructure, while Strategy just added 4,020 BTC to its treasury, bringing its total to over 580,000 Bitcoin.

Galaxy Digital is facing early volatility after its Nasdaq debut but holds a unanimous “Strong Buy” rating from analysts. All three stocks are trading near key technical levels that could determine their short-term direction.

MARA Holdings (MARA)

MARA Holdings continues to draw attention as a high-risk, high-reward stock, driven by its aggressive expansion into Bitcoin mining and artificial intelligence infrastructure.

Despite delivering mixed Q1 2025 results, the company has increased its Bitcoin holdings by more than 170% over the past year and nearly doubled its mining capacity.

MARA is also making a strategic push into AI, developing a major data center in Ohio to support AI applications and broaden its revenue potential.

While analysts remain cautiously optimistic, they highlight the importance of monitoring Bitcoin price trends and regulatory developments, as both could significantly influence the company’s performance.

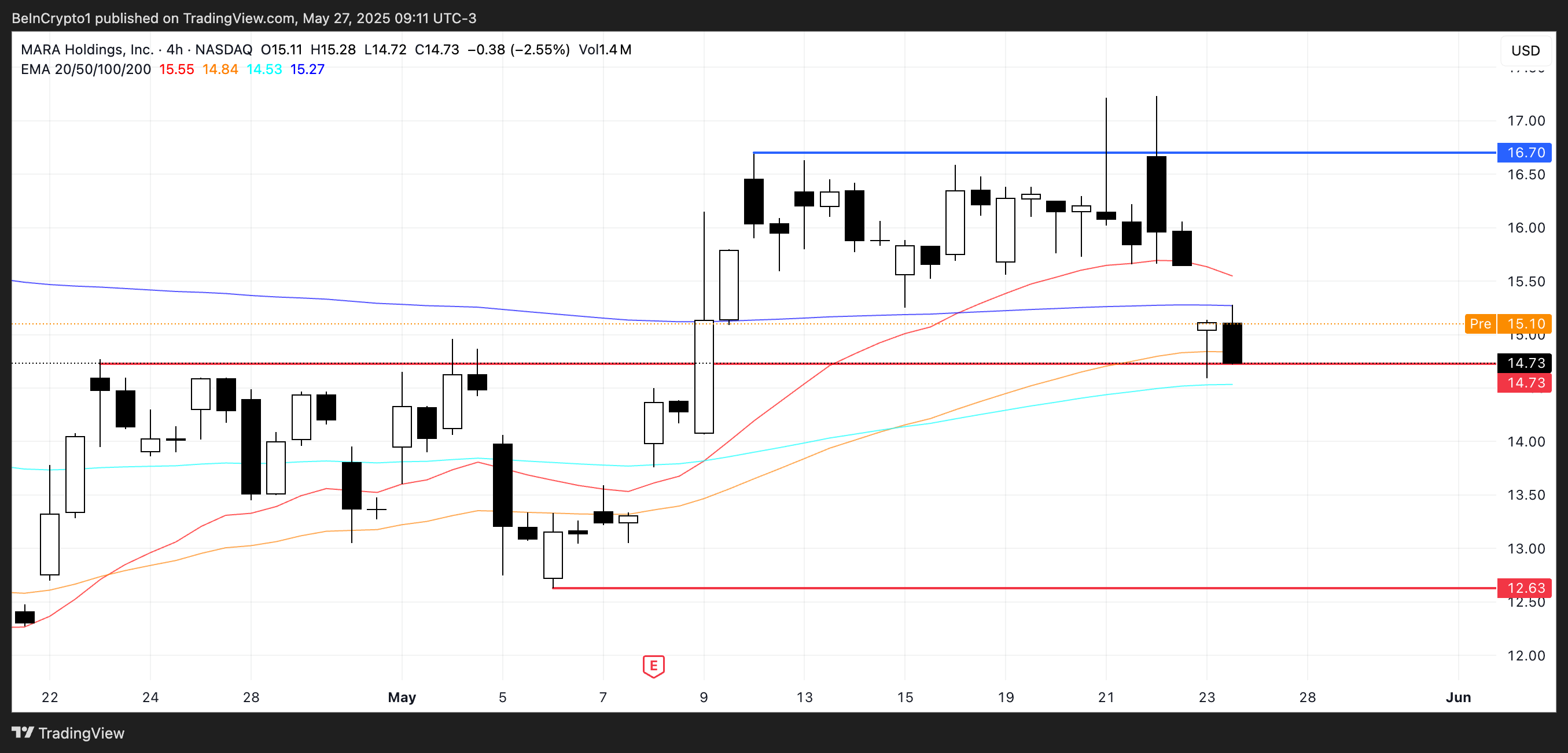

MARA closed last Friday down 5.88%, finishing at $14.73, but saw a 2.38% recovery in pre-market trading. The stock currently sits near a critical support level—if that level breaks, the next downside target could be $12.63.

However, if the trend reverses, MARA could potentially rally toward $16.70. Among 17 analysts covering the stock, 7 rate it a strong buy, 9 suggest holding, and only 1 recommends a strong sell.

With an average one-year price target of $20.27, indicating a 37.61% upside, MARA remains a speculative but compelling choice for investors with a high risk tolerance.

Strategy Incorporated (MSTR)

Strategy, formerly known as MicroStrategy, has once again made headlines with a bold move in the crypto space—purchasing 4,020 Bitcoin worth $427 million between May 19 and May 25, 2025.

This brings the company’s total holdings to a staggering 580,250 BTC, now valued at $40.6 billion, solidifying its position as the largest publicly traded Bitcoin holder globally.

With nearly 3% of all Bitcoin now under its control, Strategy holds immense influence over market sentiment and remains a key driver of corporate adoption in the digital asset space.

MSTR, the company’s stock, closed last Friday down 7.5%, but has rebounded 2.71% in pre-market trading, now showing a year-to-date gain of 27.58%.

The $362 level stands as crucial support—if lost, a move toward $343 becomes likely. However, a bullish reversal that pushes MSTR above its current $383 resistance could open the path to retesting the $404 zone and reclaiming the $400 mark.

Galaxy Digital (GLXY)

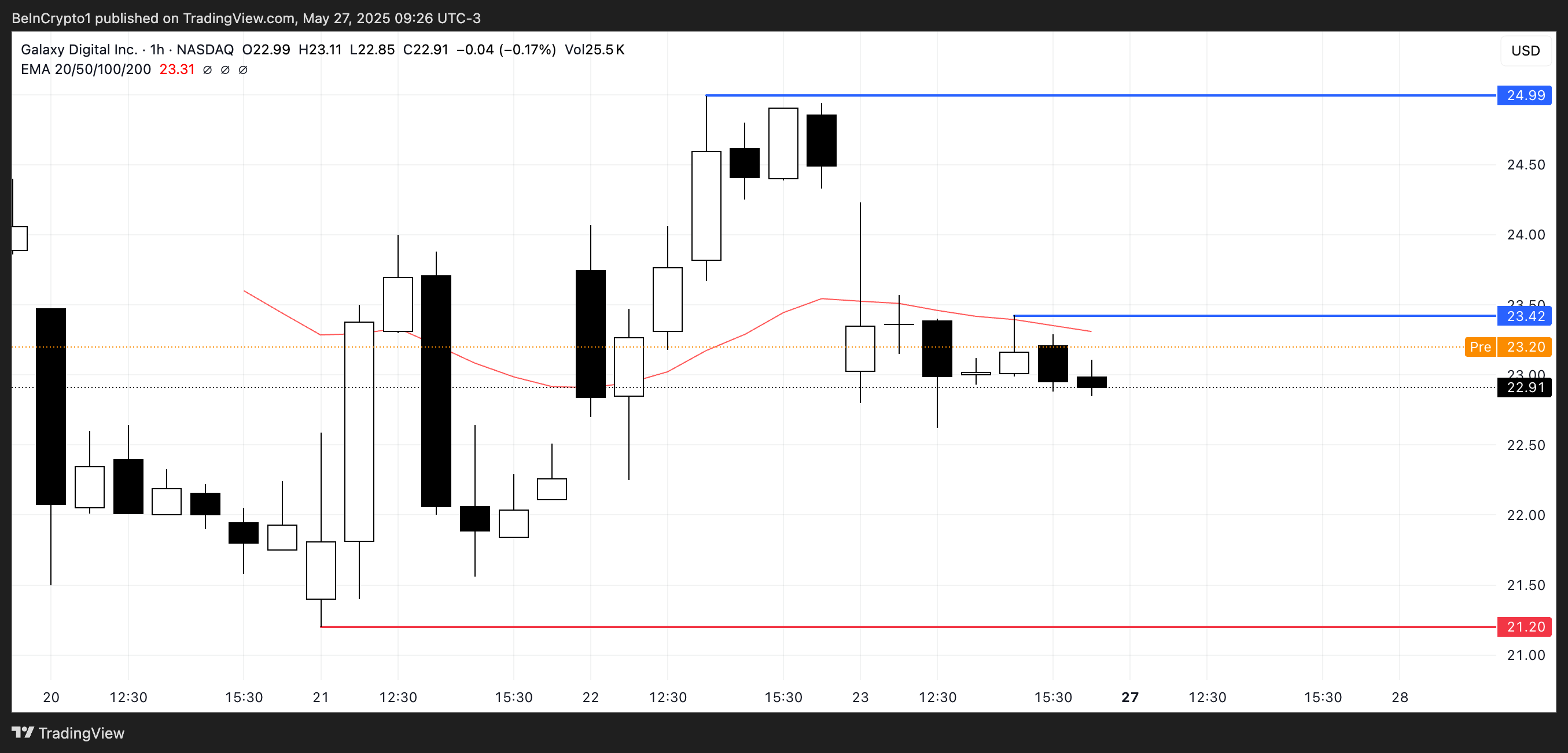

Galaxy Digital (GLXY) has had a mixed start since debuting on Nasdaq. It is down 2.34% overall and closed last Friday with a sharp 6.17% drop. However, early signs of stabilization are emerging, with the stock up 1.09% in pre-market trading.

Despite the volatility, analyst sentiment remains overwhelmingly bullish—GLXY has a unanimous “Strong Buy” rating from all nine analysts covering it.

From a technical standpoint, GLXY is approaching an important moment. If the recent correction deepens, the stock could fall to test the $21.20 support level. Conversely, if buyers step in and the uptrend resumes, GLXY could first test resistance at $23.42.

A break above that would open the door for a move toward $24.99. Nine analysts give GLXY a one-year price target of $27.71 and an expected upside of 20.73%.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.