Bitcoin (BTC) recently reached a new all-time high. However, based on few on-chain indicators, this is not yet the peak of the current bullish cycle.

Drawing from four on-chain indicators provided by Lookonchain, BTC is expected to hit the $200,000 mark in this cycle.

$200,000 Could Be BTC’s Peak This Season

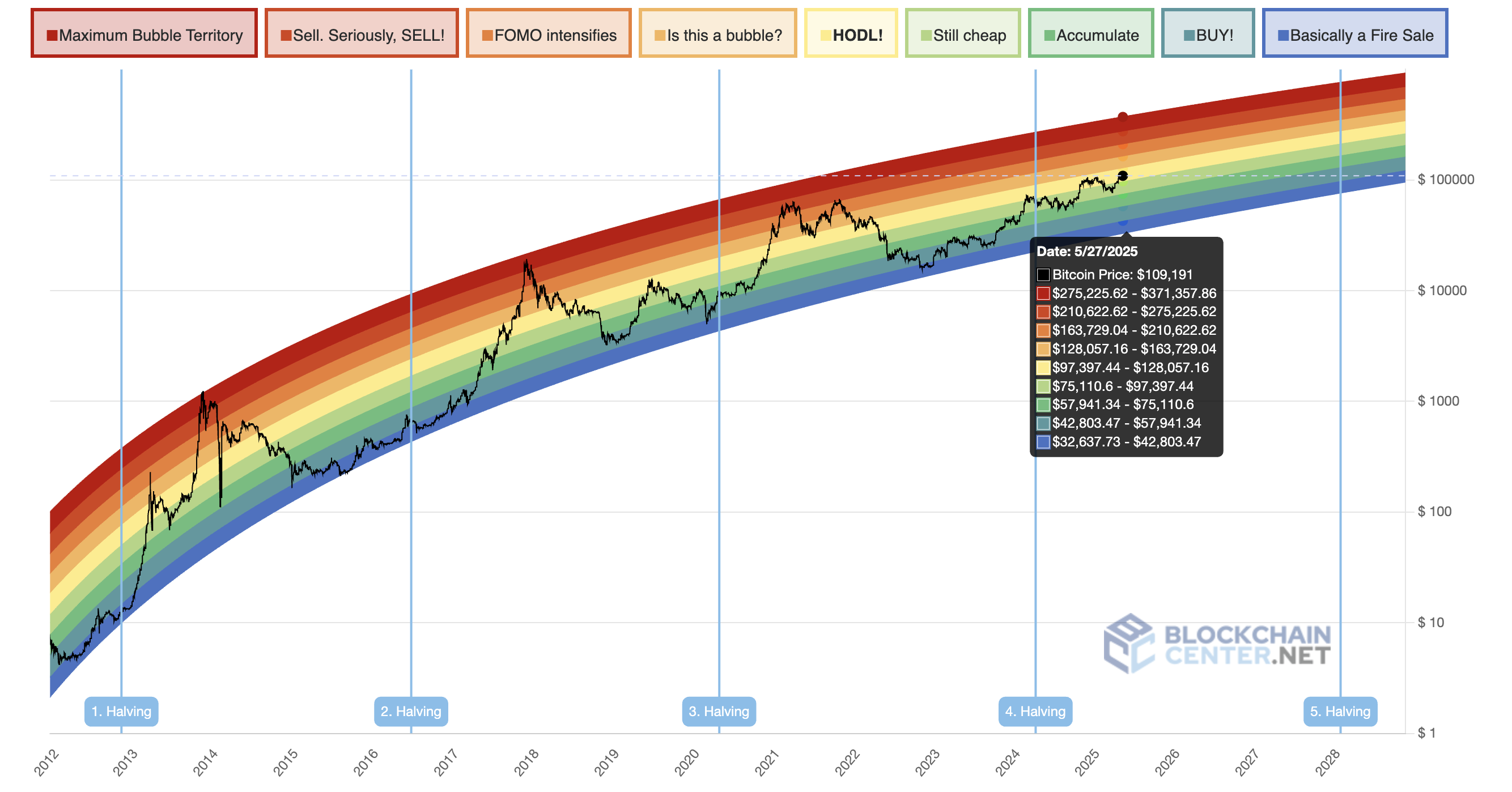

First, the $200,000 target is predicted using the 2023 version of the Rainbow Chart. This long-term valuation tool employs a logarithmic growth curve to forecast BTC’s potential future price direction. If this prediction is true, Bitcoin has only reached halfway through its journey in this cycle.

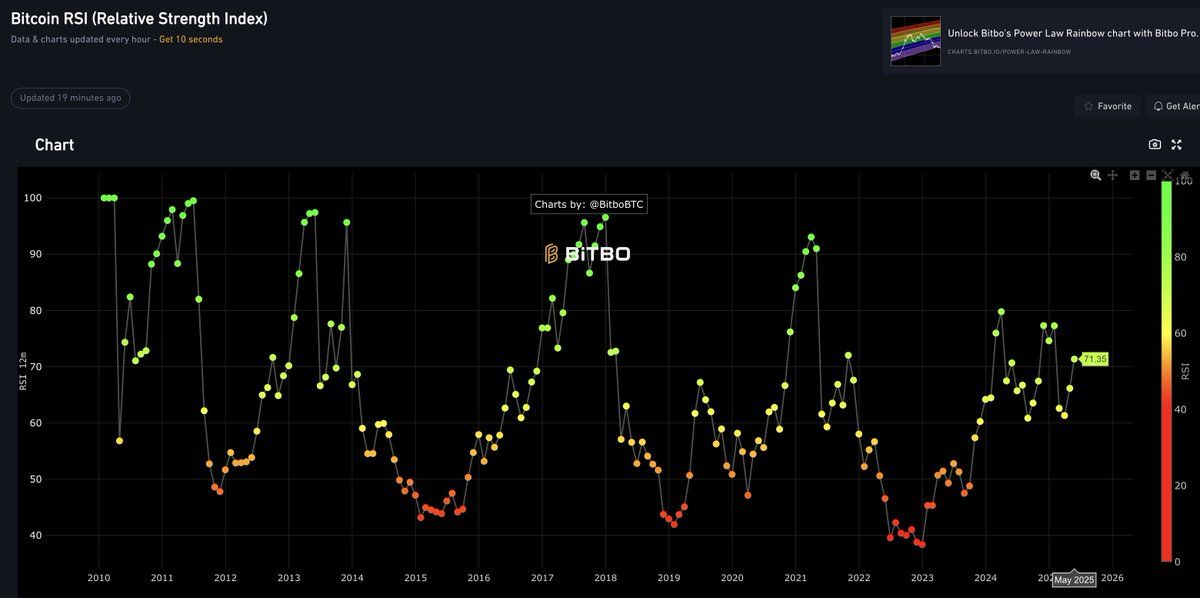

Second, Bitcoin’s Relative Strength Index (RSI) stands at 71.35. BTC is considered overbought when this indicator is above 70 and may soon decline. Conversely, if it is below 30, BTC is oversold and may soon rise.

At its current level, Bitcoin is in a mildly “overbought” zone but still has room to grow compared to historical peaks. BTC typically reaches its peak when the RSI surpasses the 90 threshold.

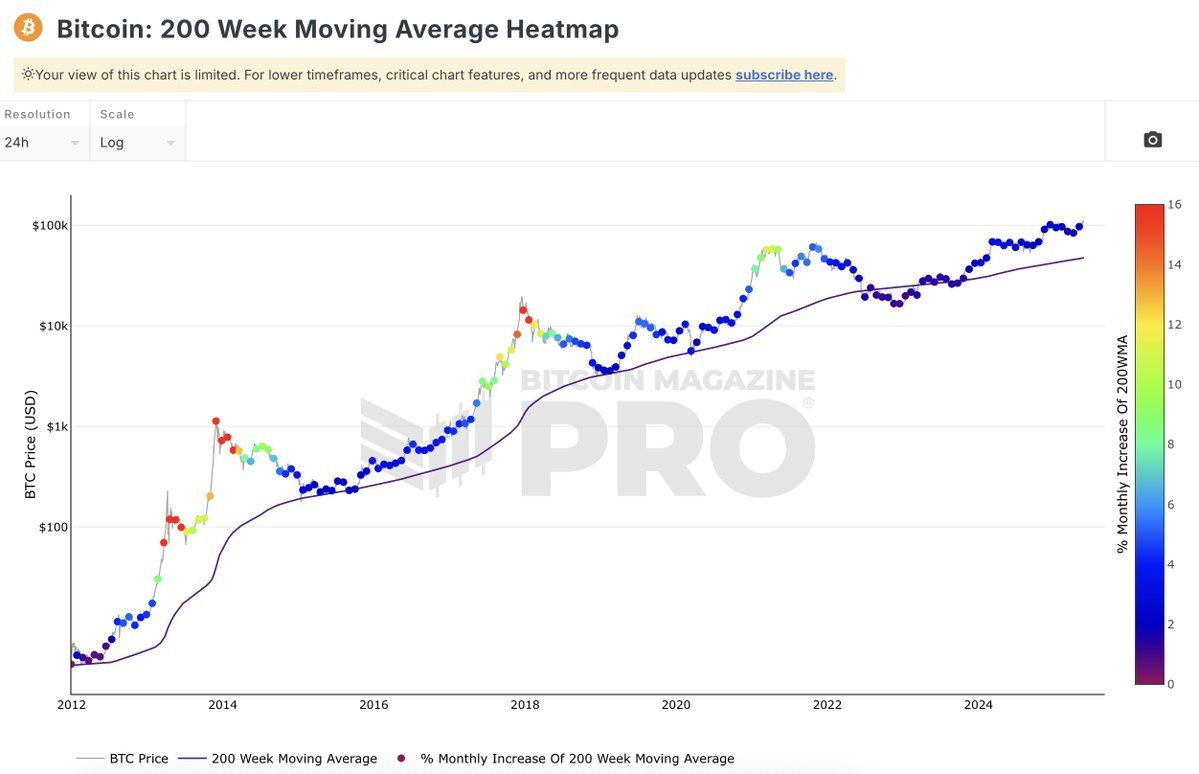

Third, the 200-week Moving Average (MA) Heatmap is in the blue zone. This suggests that the price has not yet peaked, making it an opportune time to hold or buy in.

Finally, the 2-Year MA Multiplier shows the current price between the red and green lines. As the price has not yet touched the red line, the market has not reached its peak.

Bitcoin Still Has Growth Potential

Beyond the technical indicators mentioned above, several other on-chain data points support the view that Bitcoin still has growth potential.

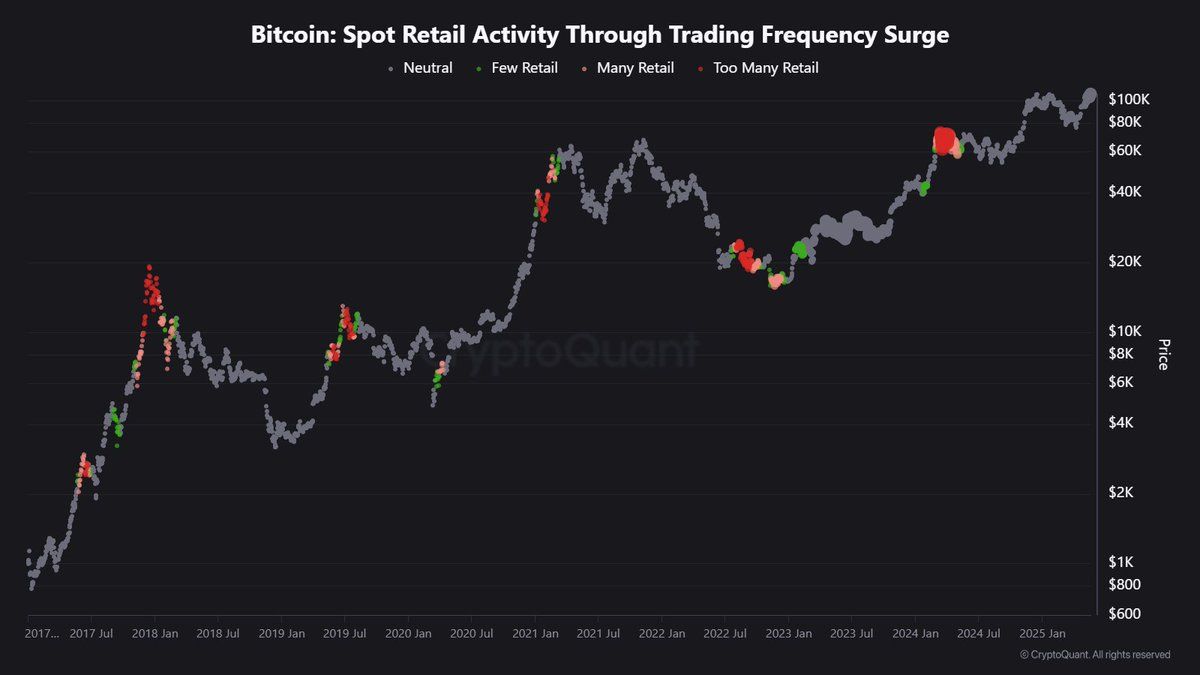

According to CryptoQuant, retail investors are still largely on the sidelines, with current Bitcoin trading volumes lower than the one-year average. This indicates that the market has not yet entered a “FOMO” (Fear of Missing Out) state—a signal often seen when prices peak.

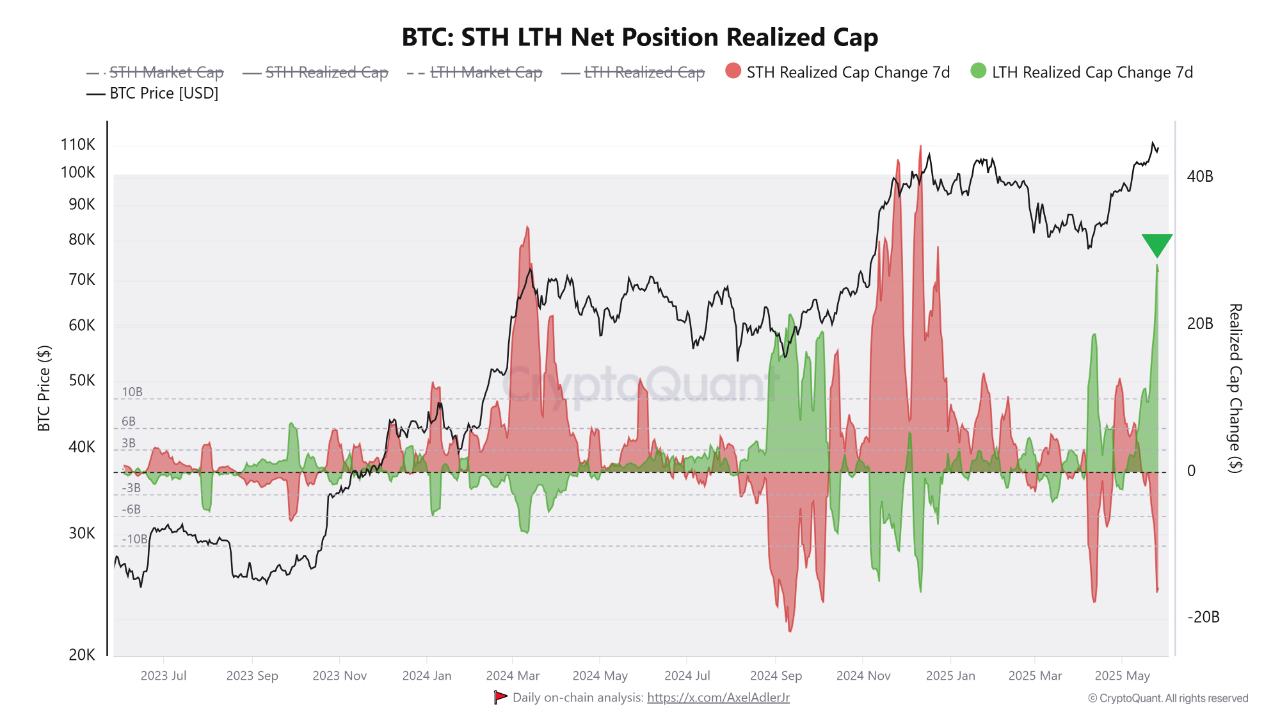

Additionally, a Bitcoin on-chain analyst at CryptoQuant noted that when BTC corrected below $111,000 and $109,000, short-term holders using excessive leverage were wiped out. Meanwhile, BTC long-term holders (LTHs) have capitalized on these price dips to increase their Bitcoin holdings.

This caused the long-term holder realized capitalization to surge past $28 billion, a level not seen since April. Realized cap measures the value of each Bitcoin based on the last time it was moved, rather than the current market price.

“Long-term investors are using this period of forced selling to increase their exposure and accumulate more Bitcoin for the long run. This strategic accumulation during moments of market stress reflects the deep conviction of LTHs,” a CryptoQuant analyst noted.

Based on technical analysis and market data, Bitcoin has not reached its peak in the current cycle. Nevertheless, investors should remain cautious of short-term fluctuations and macroeconomic factors that could impact the market.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.